In a raw display of the high-stakes financial maneuvers driving the global Artificial Intelligence race, SoftBank Group founder Masayoshi Son on Monday addressed the controversial decision to sell the conglomerate’s entire stake in Nvidia, confirming the necessity of the move to fund his massive, integrated AI ecosystem.

Speaking at the FII Priority Asia forum in Tokyo, Son admitted the decision was deeply personal: “I don’t want to sell a single share. I just had more need for money to invest in OpenAI and other projects,” he stated.

He added, vividly summarizing the emotional conflict, “I was crying to sell Nvidia shares.”

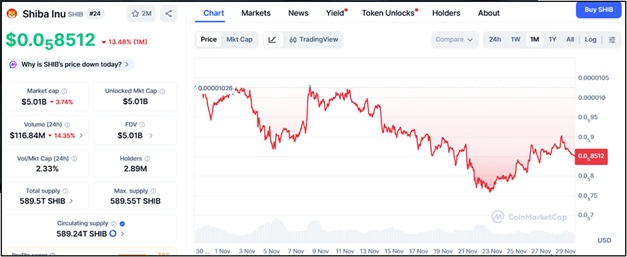

The November disclosure revealed that SoftBank had completely offloaded its shares in the chip darling for $5.83 billion. Son’s comments reinforce the consensus among analysts and executives that the sale was a deliberate move to bolster the SoftBank Vision Fund’s AI war chest, rather than a lack of confidence in the world’s most valuable chipmaker.

SoftBank is strategically shifting from being a major passive technology investor (holding Nvidia stock) to being an active shaper of the AI value chain. The capital gained from the divestiture is immediately being funneled into projects designed to build what Son describes as “his own sphere of influence supporting artificial intelligence”—a vertical integration strategy covering AI development, specialized chips, and foundational infrastructure.

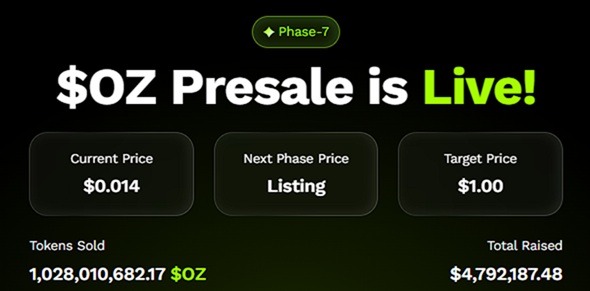

The sale directly bankrolls an increased commitment to OpenAI, the maker of ChatGPT. Son has made a substantial bet on the company’s future, having stated earlier this year that SoftBank was “all in” on OpenAI, predicting the startup would “one day become the most valuable company in the world.” This bet has already reaped substantial rewards. SoftBank reported last month that its second-quarter net profit more than doubled to 2.5 trillion yen ($16.6 billion), a surge driven primarily by valuation gains in its OpenAI holdings.

According to sources familiar with the matter, SoftBank could “potentially” increase its investment in the ChatGPT maker depending on its performance and the valuation of future funding rounds.

Unlike merely investing in Nvidia, which sells its chips to everyone, SoftBank is investing heavily to control the underlying infrastructure, thereby ensuring guaranteed supply and optimization for its own portfolio:

SoftBank is a lead partner in the massive Stargate Project, a $500 billion joint venture announced in January 2025 with OpenAI, Oracle, and MGX to build vast AI infrastructure in the United States. Son is the venture’s chairman, and SoftBank has the “financial responsibility” for the project, which involves constructing colossal data centers (starting in Abilene, Texas) that will house the computing power necessary for the next generation of AI.

SoftBank recently closed the acquisition of U.S. chip designer Ampere Computing for $6.5 billion. Ampere specializes in high-performance, energy-efficient processors based on the ARM compute platform—technology that complements the design strengths of SoftBank’s majority-owned Arm Holdings. This acquisition ensures SoftBank has proprietary control over the chips powering its ambitious Stargate data centers and AI ventures, guaranteeing supply and customization for its own needs, a key strategic advantage that a simple Nvidia stake does not provide.

Dismissing the Bubble: The Trillions-of-Dollars Rationale

Son also used the forum to address the “growing fears and jitters in markets about a potential AI bubble.” He pushed back forcefully against these concerns, arguing that those who talk about a bubble are “not smart enough.”

He provided a bold long-term outlook to justify the trillions of dollars of cumulative spending projected for the sector, predicting that “super [artificial] intelligence” and AI robots will generate at least 10% of global gross domestic product over the long term. This economic value creation, he asserted, will far outweigh the current massive investment levels.

SoftBank is aiming not just to invest in the AI future, but to own the full stack—from the chips (Ampere/Arm) to the infrastructure (Stargate) to the application layer (OpenAI).