For years, Dogecoin and Shiba Inu ruled the meme coin world. They sparked millionaires, trended globally, and rewrote the rules of what crypto could be. But the throne isn’t bolted down, and two new contenders are shaking the table: Little Pepe ($LILPEPE) and Pudgy Penguin ($PENGU). These aren’t your typical copycat coins. Both tokens chart their path with real use cases, strategic expansion, and strong early adoption. Here’s why the meme coin leaders might finally face real competition.

Little Pepe (LILPEPE) Is Redefining the Meme Coin Blueprint

While Dogecoin rode on internet culture and Shiba Inu built a community-first ecosystem, Little Pepe combines both with more thoughtful execution. The strategy? Deliver fun with fundamentals. Little Pepe introduced a Layer 2 meme chain built exclusively for meme coins. It offers a faster, cheaper, and safer alternative to traditional meme ecosystems. This outrightly puts it on course to challenge for the meme king status. A standout feature is its sniper bot-resistant design. Many meme coins suffer from bot attacks during presale and launch, leaving real investors with poor entry prices. Little Pepe has tackled this head-on by embedding anti-sniping measures that ensure fairer allocation. This attention to detail shows a rare level of care and professionalism in meme land.

LILPEPE also comes with a bold vision beyond speculation. Its upcoming Pepe Launchpad will offer a platform for meme coin incubation, helping new projects launch with community backing and visibility. That’s a powerful utility that adds long-term relevance to its token, unlike most meme coins that fizzle after launch.

While still in presale, it already achieved what most meme tokens only dream of: an early listing on CoinMarketCap, giving potential buyers real-time insight into its performance and legitimacy. This transparency created massive investor trust long before the exchange launched.

Meanwhile, the token’s fundraising momentum is no joke either. LILPEPE has sold out seven stages within a few weeks of launching. So far, over $11.2 million has been raised, with 8 billion tokens sold. The current price of $0.0017 reflects a 70% increase from the first presale stage. The price goes to $0.0018 in Stage 8.

The project is also turning heads with its viral $777,000 giveaway, where 10 lucky participants will win $77,000 each in LILPEPE tokens. This massive campaign is doing more than marketing. It’s building a global army of supporters who are both investors and evangelists.

Token distribution is VC-free, meaning no backroom deals or venture capital dumping. This makes it one of the few meme coins designed to be truly decentralized and community-first from day one. Add in a strong holder’s base, and it’s clear Little Pepe has hit critical mass.

With a presale that’s defied typical timelines, a strong media presence, and tokenomics designed to reduce post-launch dumping, analysts are calling LILPEPE a potential 500x–1000x gem in the current cycle. If it lands Tier-1 listings after presale, the move to a $40 billion+ market cap to challenge DOGE and SHIB could happen sooner than most expect.

Pudgy Penguin (PENGU) Is Backed by NFTs, Whale Action, and Mainstream Deals

Unlike most meme tokens, Pudgy Penguin didn’t start with a coin; it began with a viral NFT brand. After dominating the NFT space, the team brought the $PENGU token into play, and the result has been explosive. Since June, the token has surged 402%, backed by massive trading volumes, whale accumulation, and some of the best branding in Web3.

PENGU Price Chart | Source: CoinGecko

PENGU isn’t just riding nostalgia. Its success is rooted in strong fundamentals. Built on Solana for speed and low fees, it integrates with Lufthansa’s loyalty program, partners with NASCAR, and offers gamified use via “Pengu Clash,” a Telegram-based Web3 game. The token is also used in e-commerce through the Pudgy Shop, blending real-world and digital utility.

Currently trading around $0.037, analysts expect another 10x move toward $0.47, which could be just the beginning. Whale wallets continue to accumulate, while speculation about a potential PENGU ETF filing has further energized the community. With a market cap crossing $2.7 billion and trading volumes above $2.5 billion, PENGU is climbing the ladder faster than its counterparts. Simply put, Pudgy Penguin is the first NFT-born token with meme coin-level velocity, and it’s now moving in institutional circles to claim its seat among the top two meme coins.

Why DOGE and SHIB May Lose the Crown

DOGE and SHIB were revolutionary, but today’s landscape demands more than hype and loyalty.

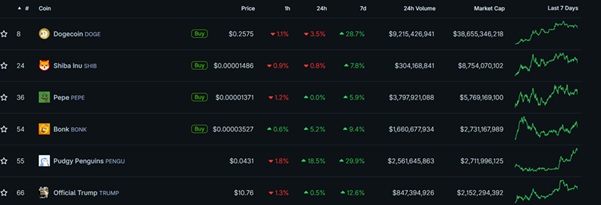

- Despite ETF speculation and whale accumulation, Dogecoin is a slow mover with capped near-term upside. At $0.25, a jump to $1 would mean 4x gains at best, tough compared to early-stage tokens.

- Although still riding on community energy and burn hype, Shiba Inu faces a ceiling. With a current market cap of $9.17B, even a tripling barely scratches what early LILPEPE or PENGU investors could see.

Top Meme Coins by Market Cap | Source: CoinGecko

The new leaders bring utility, narrative, and energy, and the trifecta that built DOGE and SHIB has now been upgraded.

LILPEPE vs. PENGU: Which One Will Replace the Meme Kings?

Both tokens are climbing different ladders, but either could reach the top.

- Little Pepe targets the retail revolution, bringing fairness and virality to the presale-to-listing journey. With listings incoming and presale rounds selling out quickly, LILPEPE could hit a 500x to 1000x ROI by listing, a run SHIB had in its first year, but might never revisit.

- Pudgy Penguin has already won hearts in the NFT space. Now it’s capturing market share in crypto with real revenue streams, brand licensing, and Web3 gaming. Its market structure supports strong continuation, possibly pushing it toward the top 3 meme coins by fall.

In short? DOGE and SHIB aren’t finished, but their monopoly is. Little Pepe has the early-entrance and post-CEX debut rally edge over Pudgy Penguin. Its micro market valuation also allows it to soar to unprecedented heights before the market even wakes.

Final Thoughts: The Meme Market Is Shifting, Don’t Be Late

Crypto rewards the early, punishes the late, and forgets the idle. Little Pepe and Pudgy Penguin are no longer just underdogs. They are leaders of the next meme coin generation. Both can leave their predecessors in the dust with fresh features, smart market plays, and roaring communities. As the bull run unfolds, ask yourself: Are you chasing 2x with DOGE, or riding the early wave of the next 500x with LILPEPE?

For more information about Little Pepe (LILPEPE) visit the links below:

Website: https://littlepepe.com

Whitepaper: https://littlepepe.com/whitepaper.pdf

Telegram: https://t.me/littlepepetoken

Twitter/X: https://x.com/littlepepetoken