The United States is experiencing one of its biggest industrial growth cycles in decades. New semiconductor plants, battery factories, renewable-energy facilities, data centers, and major manufacturing hubs are breaking ground everywhere. Billions of dollars in investment are flowing into industrial construction, and companies are reshoring production at a pace few expected.

It’s an exciting moment for the sector—but behind the progress is a challenge that’s becoming impossible to ignore: there simply aren’t enough skilled workers to build all of these projects.

Industrial construction has always relied on tradespeople with deep, hands-on expertise. But the demand for electricians, welders, pipefitters, millwrights, and other skilled professionals has skyrocketed just as the availability of those workers has dropped. As a result, the very projects meant to drive America’s economic future are now facing delays and staffing bottlenecks that threaten to slow everything down. And with new industrial incentives encouraging even more megaprojects, this problem isn’t temporary—it’s growing.

The Growing Imbalance Between Industrial Growth and Skilled Labor

The mismatch between the number of projects underway and the number of qualified workers ready to fill those roles is widening quickly. These are not jobs that can be filled overnight. Most require years of training, apprenticeship, and real-world experience—not to mention certifications, safety knowledge, and technical skill.

Meanwhile, companies building these massive facilities face tight timelines, strict quality standards, and financial incentives that depend on staying on schedule. When a project doesn’t have enough workers, the consequences can be immediate and expensive. That’s why many contractors are turning to partners who can provide industrial construction staffing solutions that bring in vetted, experienced workers who can get on-site quickly.

This shift isn’t just a convenience—it’s a necessity. Traditional hiring alone can’t keep up with the pace of today’s industrial expansion, especially as demand grows in multiple regions at once.

Why the Workforce Shortage Is Getting Worse

The skilled-trades shortage isn’t new, but several powerful trends are pushing it into crisis territory:

1. An Aging Workforce

A large portion of the existing trades workforce is nearing retirement, and younger workers aren’t stepping in fast enough to replace them. Years of experience are leaving the industry with no one ready to pick up the torch.

2. Fewer Young People Pursuing Trade Careers

For years, schools have emphasized four-year degrees over trade education. As a result, many young adults don’t realize the construction trades offer solid pay, benefits, job security, and advancement opportunities.

3. Too Many Large Projects at the Same Time

Industrial megaprojects aren’t spaced out like they once were. Now, multiple massive facilities are being built simultaneously in the same regions. This creates fierce competition for the same limited pool of skilled workers.

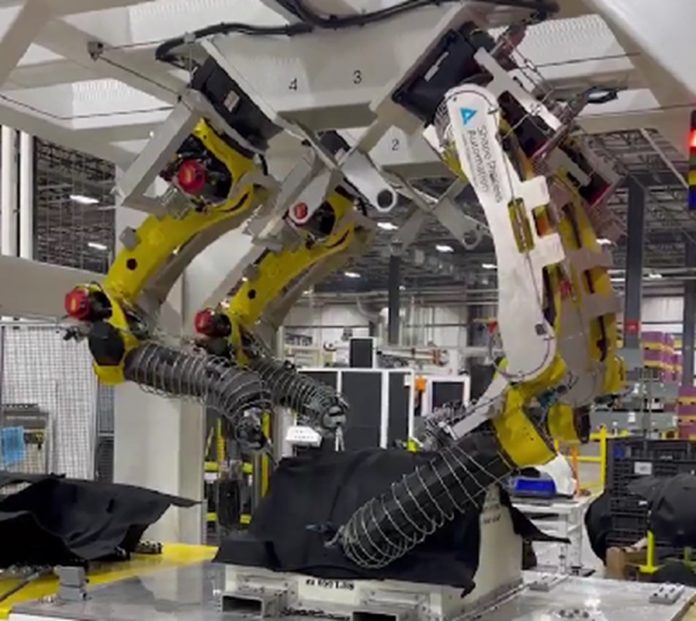

4. Increasing Job Specialization

Modern industrial facilities rely on advanced technology, automation, and precision instrumentation. Workers need greater technical knowledge than ever before, which makes trained specialists even harder to find.

5. Higher Safety and Compliance Requirements

Industrial jobs demand strict safety training and certification. Even if a worker has the right skills, they may not meet all requirements for a particular site—making the qualified pool even smaller.

How Labor Shortages Affect Industrial Construction Projects

The effects of the skilled labor shortage are becoming clearer with every new project:

Schedule Delays

Projects stall when the right people aren’t available. Missing even a few key trades can delay entire phases of construction.

Higher Labor Costs

More companies competing for fewer workers naturally drives wages higher. Many contractors are forced to pay premium rates or add incentives just to attract talent.

Lower Productivity

Short-handed teams can’t hit expected productivity levels. That leads to inefficiencies, rushed work, and increased stress on existing crews.

More Safety and Quality Risks

Industrial construction demands accuracy and consistency. When teams are stretched thin or less experienced workers are rushed into roles, mistakes become more likely.

How Contractors Are Adapting to the New Workforce Reality

Since the shortage won’t resolve itself anytime soon, companies are adopting new strategies to keep projects moving:

1. Partnering with Skilled Staffing Providers

Staffing partners who specialize in industrial construction can provide pre-vetted, certified workers who are ready to mobilize. This gives contractors the flexibility to respond quickly to workforce gaps without sacrificing quality.

2. Investing in Apprenticeships and Training Programs

Some companies are taking workforce development into their own hands, creating training programs or partnering with trade schools to help build a stronger pipeline of new talent.

3. Improving Workforce Forecasting

Contractors are becoming more proactive about planning labor needs far ahead of time, using better forecasting models and manpower planning tools.

4. Using Technology to Boost Efficiency

Tools like digital project management, AR training, and automation can help reduce labor strain and improve overall jobsite productivity.

A Challenge That Will Shape the Future of Industrial Construction

Industrial growth in the U.S. isn’t slowing down—in fact, it’s expected to accelerate. But the success of this growth depends on having enough skilled workers to build the facilities driving this new era of domestic production. If the shortage continues unchecked, it could reshape schedules, budgets, and the way companies compete for talent.

The skilled labor shortage is no longer a side issue. It’s one of the industry’s most pressing challenges, and it will play a major role in how future projects are planned and delivered. Companies that adapt early—through better training, smarter planning, and strong staffing partnerships—will have a clear advantage.

America has the momentum. Now it needs the workforce to match it.