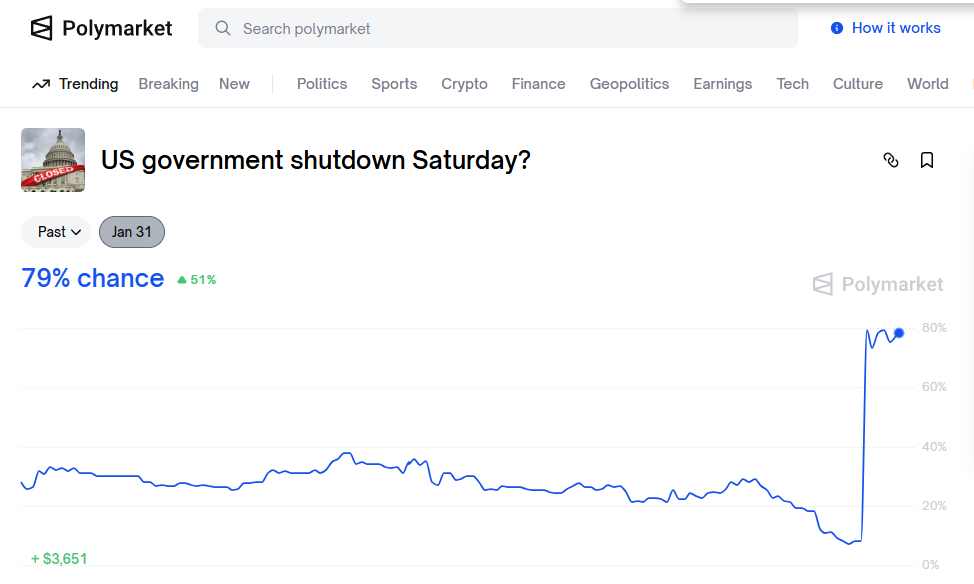

The odds of another US government shutdown occurring by January 31, 2026, have surged on Polymarket, currently standing at 81% for “Yes” on that outcome.

This represents a sharp increase from lower probabilities just days ago, such as around 9-11% late last week, as reported across multiple sources. The spike aligns with recent political developments, where Senate Democrats, led by Minority Leader Chuck Schumer, announced they would withhold votes to advance a government funding package if it includes funding for the Department of Homeland Security (DHS).

This stance follows a fatal shooting in Minneapolis involving federal agents, reportedly from Border Patrol or ICE, which has intensified Democratic calls for changes to DHS provisions, including restrictions on ICE funding.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Government funding is set to expire at the end of this week (January 31), and without bipartisan agreement, a partial shutdown could affect non-essential federal operations, though essential services like Social Security and military pay would continue.

Republicans have pushed back, framing any potential shutdown as a “Schumer shutdown” due to Democratic opposition, while emphasizing the need for uninterrupted funding to support ongoing efficiency reforms like those from the DOGE initiative.

Discussions on platforms like X highlight trader sentiment, with some estimating even higher odds up to 85% based on the impasse over DHS reforms. Similar prediction markets like Kalshi show comparable jumps, reaching 79%.

Market reactions could influence stocks, particularly in sectors tied to government contracts, though historical shutdowns like those in 2018-2019 have often had limited long-term economic impact. Negotiations are ongoing, with senators like Chris Murphy and Tim Kaine seeking amendments, but resolution remains uncertain as the deadline approaches.

Government shutdowns in the United States have occurred periodically since the 1980s, stemming from failures to pass funding legislation, often due to partisan disputes over spending or policy riders.

Prior to that era, funding gaps rarely disrupted operations, as agencies continued functioning under the assumption of eventual appropriations. Since 1977, there have been about 20 such events, with an average duration of eight days, though some have lasted weeks or months.

Notable historical shutdowns include: 1995-1996: Two separate closures under President Clinton and a Republican-led Congress, totaling 26 days, triggered by disagreements over budget cuts and Medicare reforms.

Impacts included delayed passport processing, closed national parks, and halted toxic waste cleanups, affecting millions.

2013: A 16-day shutdown during the Obama administration over Affordable Care Act funding, leading to furloughs of 800,000 federal workers and economic losses estimated at $24 billion.

2018-2019: The longest on record at 35 days under President Trump, centered on border wall funding disputes. It reduced U.S. economic output by $11 billion over the following quarters, with ripple effects on contractors and small businesses.

Economic impacts have varied but are generally short-term and disruptive. Shutdowns have caused losses in tourism e.g., closed national parks costing millions daily aviation delays due to understaffed TSA and FAA operations, and halted government contracts, leading to broader supply chain issues.

The 2018-2019 event alone resulted in $3 billion in permanent losses after accounting for back pay and recoveries. Additionally, they delay economic data releases from the Bureau of Labor Statistics, complicating market predictions and policy decisions.

Federal workers bear significant burdens: During shutdowns, non-essential employees often hundreds of thousands are furloughed without pay, while essential staff e.g., in law enforcement or air traffic control work unpaid until resolution.

Congress typically approves back pay afterward, but the interim financial strain leads to missed bills, depleted savings, and reliance on food banks or loans. Public services face interruptions, including delayed Social Security verifications, suspended FDA inspections, halted IRS audits, and paused research grants.

Vulnerable populations, such as those on food assistance or housing subsidies, experience payment delays, exacerbating hardship. National security can be affected through reduced military training or border operations, though core defenses continue.

Financial markets have historically shown resilience, with limited long-term effects on stock prices or bond yields, as investors view shutdowns as temporary political theater.

However, short-term volatility can occur, particularly in sectors reliant on government spending, like defense or healthcare. While shutdowns impose real costs—estimated in the billions—they rarely lead to structural changes in government size or function.