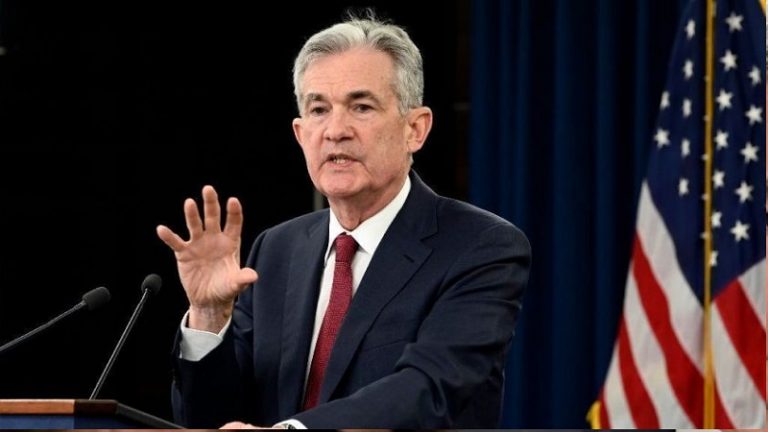

Federal Reserve Chair Jerome Powell struck a cautious but pivotal note at the annual Jackson Hole symposium on Friday, hinting that the U.S. central bank may be preparing to cut interest rates in September.

His remarks marked a turning point in monetary policy discussions, as markets quickly latched onto the possibility of easier borrowing conditions in the months ahead.

“The shifting balance of risks may warrant adjusting our policy stance,” Powell said, carefully avoiding a firm commitment but signaling the Fed’s growing concerns over a cooling job market and uneven inflationary pressures.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

The Fed’s benchmark interest rate directly influences borrowing costs across the economy, including mortgages, credit cards, and business loans. Mortgage rates, in particular, tend to move in tandem with the 10-year Treasury yield, which is highly sensitive to both economic outlook and monetary policy changes.

Powell’s comments immediately rippled through financial markets. Gold prices rebounded sharply, buoyed by heightened expectations of a September cut. Spot gold rose 0.7% to $3,362.53 per ounce by 10:26 a.m. EDT (1426 GMT), while U.S. gold futures were 0.8% lower at $3,408.20. The U.S. dollar slid 0.7%, making gold cheaper for buyers using other currencies.

“In his eighth and final Jackson Hole speech, Powell surprised a worried market, opening the express lanes to a September rate cut, which has boosted every single asset, including gold,” said Tai Wong, an independent metals trader. Wong added that the real test would be whether gold can break and hold above the $3,400 threshold in the coming days.

The CME FedWatch tool showed traders now assigning a 90% chance of a 25 basis-point cut in September, up from 75% before Powell’s remarks. Markets are now hanging on to forthcoming jobs and inflation data due before the September 16–17 FOMC meeting.

Gold, which traditionally thrives in low-interest-rate environments because it carries no yield, has gained favor as investors brace for lower returns on fixed-income assets. However, physical demand in Asia remained subdued this week as price volatility discouraged retail buyers, though jewelers in India began stocking up ahead of the upcoming festival season. Spot silver gained 1.3% to $38.67 an ounce, platinum rose 0.5% to $1,359.75, and palladium firmed 1.4% to $1,126.25.

Yet behind the rallying markets, some economists argue that Powell’s pivot is more political than economic, raising concerns about the Federal Reserve’s independence. Some suggest the Fed Chair may have succumbed to intense pressure from President Trump, who has repeatedly called for steep rate cuts to spur growth.

“Powell caved. All FOMC members should be fired for not hiking rates. At least Powell admitted that our economy is weaker and inflation stronger this year under Trump than last year under Biden… Sell U.S. dollars and buy gold & foreign stocks!” said Peter Schiff, chief economist at Euro Pacific Capital.

Schiff, a longtime Fed critic, argued that the economic indices do not yet justify a cut, warning that the decision risks ushering in an era of persistent inflation and stagnant growth. He further emphasized that Powell’s pivot could be bearish for bonds, as a weaker dollar and stronger inflation will sap investor appetite for U.S. Treasuries.

“As a result, demand for Treasuries will fall just as supply rises thanks to soaring budget deficits. To control long-term rates, the Fed will revert to QE,” he added, referring to quantitative easing—a policy of large-scale bond buying that the Fed has previously relied on during financial crises.

Powell’s balancing act—acknowledging labor market risks while conceding inflation remains uncomfortably high—has set the stage for one of the most consequential FOMC meetings in years. Investors are currently betting big on a September cut, but economists remain divided as investors seek an answer to the question: is this a pragmatic response to shifting risks, or the start of a politically driven gamble that could undermine the Fed’s credibility?