Make time and read the state of the sector. Maro Elias writes amazingly on the drivers of the fintech era. But note this, if you go back to the Great Debate where Greek philosophers postulated on the makeup of the universe, you will understand why fintechs are better in fixing frictions in financial markets.

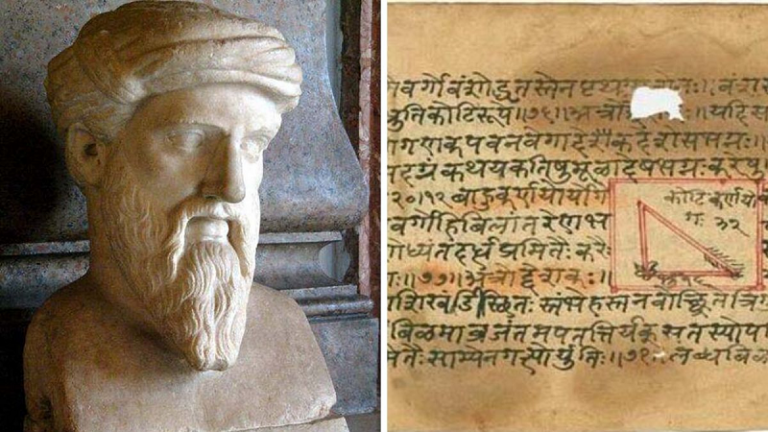

How? Fintech is built on data – and Pythagoras in his landmark thesis explained that the world is nothing but numbers. Those numbers are what you call data. And it is self-evident: if you understand the data around customers, you will have the capacity to deliver better services to them. So, Fintech improves customer experiences because it has better data than traditional banking.

You can write that in a mathematical way: as fintech penetration tends to infinity, customer experience will improve. Read Maro on click.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Comment on Feed

Comment 1: Ndubuisi Ekekwe – Having “better data than traditional banking” is not enough fir Fintech to find glory and competitive edge. Fintech, I believe, improves customer experiences by putting data to better use, and in doing so create more elements of value for customers (consumers and businesses alike).

Response from another member: Data provides the insight for better products offering .

Traditional banking products are developed based on customer and market data, but with limited data insight .

Fintech bridges information gap by providing adequate data for better product development that meets customers’ expectations. Data and competitive Edge have a linear relationship.

Comment 2: We still don’t have anything in abundance here, so there’s room for a lot of players, since nothing delivers near 100% here. Making payments and moving funds around are still ridden with challenges here, depending on where you are and who you are transacting with. So anyone who can improve or deepen what currently obtains is highly welcome.

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube