Tokenized real-world assets, or RWAs, are popping up in marketing decks, keynote slides, and investor memos. Polymesh estimates that more than USD 800 trillion in traditional markets could eventually migrate on-chain via RWA’s, so today’s USD 24 billion on-chain and even the USD 16 trillion 2030 forecast are only the opening act. Yet moving from buzz to the balance sheet is uneven. This guide separates durable value from hand-wavy hype so you can judge the opportunities, and the risks, with clear eyes.

The real opportunity behind RWAs

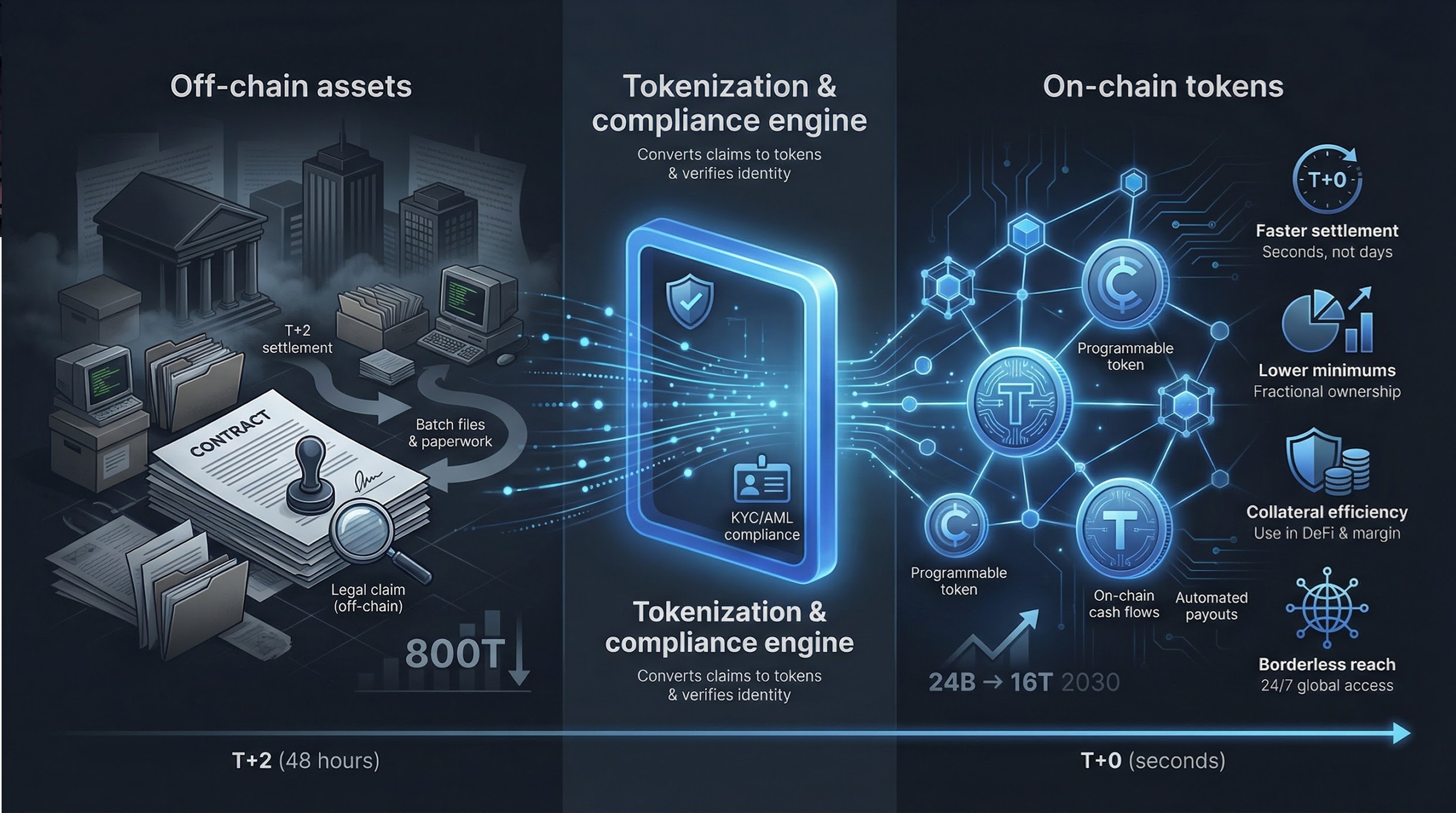

Tokenizing an asset does three things at once: it converts a legal claim into a programmable token, cuts settlement from the traditional T+2 (about 48 hours) to seconds, and lets developers wire cash flows directly into the asset itself.

How tokenization converts traditional off-chain assets into programmable on-chain tokens with T+0 settlement and new cash-flow capabilities.

- Faster settlement. DTCC’s Project Ion already processes 100,000-plus equity trades per day at T+0, proving same-day finality at national-market scale.

- Lower minimums. On Lofty, you can buy a slice of a U.S. rental property for USD 50, versus the five-figure down payments of conventional real estate.

- Collateral efficiency. Tokenized U.S. Treasuries now exceed USD 5 billion, and Fidelity is exploring them as margin for asset-management clients.

- Borderless reach. Stellar aims to host USD 3 billion in RWAs and power USD 110 billion in volume by December 2025, linking issuers and investors across more than 100 jurisdictions.

These gains matter most in areas of finance still run on batch files and bespoke paperwork—private credit, structured notes, cross-border real estate. Trim the manual friction by moving identity checks, investor-suitability rules, and cash-flow processing into shared infrastructure, and the upside comes less from “crypto excitement” and more from shaved counterparty risk, wider access, and yields that settle before your spreadsheet refreshes. According to Polymesh’s real-world asset documentation, one way to do this is to tie every asset-related transaction to a verified on-chain identity and let the chain automatically enforce rules like KYC, accreditation, and jurisdiction for each transfer. Polymesh’s public-permissioned design uses a network of customer due diligence providers and an on-chain compliance engine so issuers can set eligibility and lockup rules at the protocol level instead of tracking them in spreadsheets or side databases. For allocators and builders, that kind of identity-aware, rules-based settlement is a useful benchmark for whether an RWA stack can actually deliver the risk reduction and access gains this section describes.

Where hype creeps in

Some tokenization pitches look great in a pitch deck, yet fail basic diligence. Watch for three tell-tale red flags:

- Unsourced trillion-dollar forecasts. A 2024 report from XYZ Digital predicts RWAs will reach USD 30 trillion in five years, but devotes just two pages to regulation. No major jurisdiction has finalized cross-border custody rules.

- “Risk-free” double-digit yields. Anchor Protocol attracted USD 17 billion with nearly 20 percent “stable” returns; after UST lost its peg in May 2022, deposits fell 99 percent.

- Price over fundamentals. Maple Finance’s outstanding loans dropped from USD 900 million to 82 million in 2022 after defaults exposed weak underwriting.

Tokenization cannot turn a shaky loan or an over-leveraged property into a safe asset. When off-chain cash flows stay opaque, the on-chain token eventually trades like a lottery ticket, not a bond.

Regulatory and governance challenges

Bringing an asset on-chain means inheriting rulebooks from at least three domains:

- Securities disclosure. In the United States, the SEC has sued several token issuers for selling unregistered securities. The agency is also finalizing a custody rule that would require advisers to hold crypto assets with “qualified custodians.”

- Cross-border licensing. Europe’s Markets in Crypto-assets Regulation (MiCA), adopted on April 20, 2023, offers a single passport if issuers publish a white paper and meet reserve and governance tests. Switzerland goes further: its 2021 DLT Act lets “ledger-based securities” settle natively on distributed ledgers, and FINMA licensed the first DLT trading facility in March 2025.

- Bank and custodian capital. The Basel Committee’s December 2022 standard caps banks’ exposures to crypto and tokenized assets, with full implementation on January 1, 2025.

Ignore any of these layers, and your token may never leave a sandbox. Worse, it could keep trading until a regulator shuts it down. Sustainable RWA teams treat compliance as product design, not an after-launch patch.

How to evaluate an RWA platform

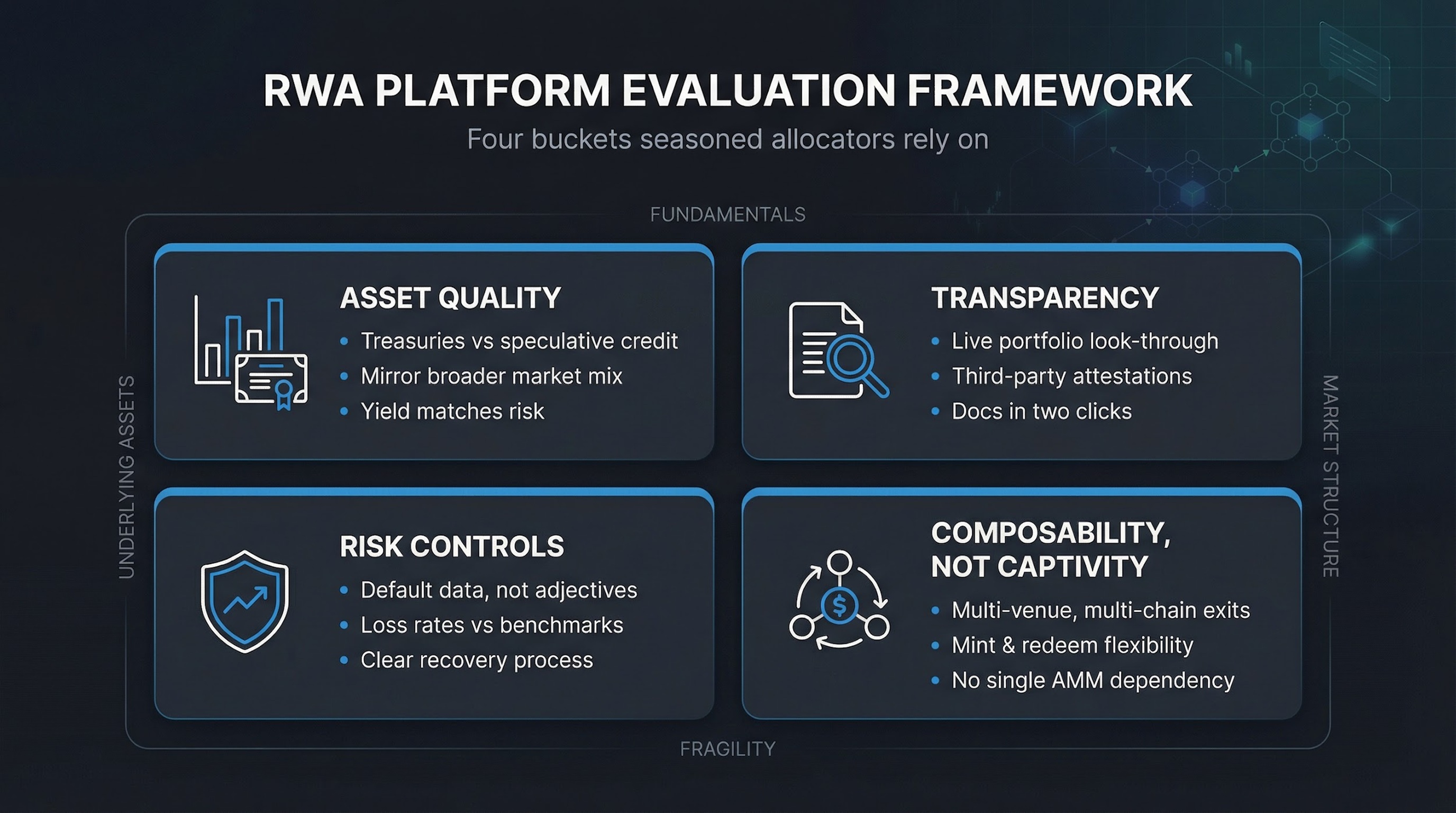

Seasoned allocators group diligence into four buckets, then test the numbers behind every slide.

- Asset quality. Start with the cap table: what share of the book sits in cash-equivalent Treasuries versus speculative credit? A healthy venue mirrors the broader market. Tokenized Treasuries now exceed USD 7.2 billion, and Ondo’s OUSG alone floats USD 693 million, second only to BlackRock’s BUIDL. If a platform is 90 percent junior real-estate debt, treat the yield like high-yield bonds, not money-market cash.

- Transparency. Ask for live portfolio look-throughs and third-party attestations. Backed Finance releases monthly auditor letters and chain-verifiable CUSIPs. Centrifuge’s Tinlake pools post every loan term sheet and controller signature on IPFS. If you cannot reach the documents in two clicks, consider it a red flag.

- Risk controls. Look for default data, not adjectives. New Silver’s fix-and-flip pool on Centrifuge shows a 0 percent principal-loss record across 190 loans since 2019, outperforming the 1–2 percent industry average. Compare that to venues that hide or disclaim loss rates.

- Composability, not captivity. Tokenized positions should clear in multiple venues. OUSG can be minted on Ethereum, Solana, and the XRP Ledger, and redeemed around the clock via Ripple’s RLUSD stablecoin. If exit liquidity relies on one in-house AMM, you are inside a walled garden, not a market.

Platforms that land in the top quartile on these four metrics may grow slower, yet they fail far less often. In RWAs, boring delivers the real alpha.

Participating carefully as an investor or a builder

Treat RWAs like any new asset class: start small, read the footnotes, and track outcomes instead of hype.

For investors: Franklin Templeton’s BENJI money-market token shows that a cautious entry can still earn Treasury-level yield. Assets grew from USD 360 million to 580 million over the past 12 months while maintaining daily liquidity. A one- to five-percent sleeve in products this transparent lets you study the plumbing without risking your core capital. Spread exposure across issuers, structures, and geographies; Tinlake, for example, lists more than ten independent pools, so one default will not sink the whole position.

For builders and institutions: J.P. Morgan’s Onyx repo network cut intraday funding costs by 56 percent for one global dealer. Similar gains appear only when compliance, engineering, and operations share the same whiteboard, and when success is measured in basis-point savings or hours trimmed from settlement, not “total value locked.” Select one high-friction workflow such as trade-finance invoices, cap-table equity, or margin collateral, then automate it end to end before expanding.

Whether you are wiring USD 5,000 or writing 5,000 lines of code, treat the token as a regulated security first and a crypto artifact second. That mindset protects both capital and roadmaps when the regulations evolve.

Long-term view: RWAs as plumbing, not headlines

If tokenization succeeds, you will barely notice it; you will simply wonder why funds move faster. JPMorgan’s Kinexys network already settles about USD 2 billion a day for corporate treasurers, yet few outsiders realize the dollars travel across an internal blockchain. BNY Mellon’s triparty repo pilot let UBS borrow cash from Swiss Re and return the collateral before lunch, compressing a 24-hour cycle into four hours. The BIS Project Helvetia study showed that tokenized central-bank money can close wholesale trades in seconds without touching legacy core systems.

These quiet wins point to the future: settlement layers embedded in bank pipes, collateral tokens gliding between margin accounts, and investor dashboards that reference “fund shares,” not “smart contracts.” RWAs will prove their value not by trending on social media, but by shaving basis points, freeing intraday liquidity, and removing a few manual clicks from finance’s daily routine.