Bitcoin staged a sharp rally early Monday after a cryptic message from MicroStrategy’s CEO Michael Saylor ignited a wave of speculation across the market.

Saylor on his X profile posted, “Back to Orange Dots?” His post teases at a potential new Bitcoin purchase by Strategy, referencing “orange dots” as markers for their acquisition events on a StrategyTracker chart showing 659,000 BTC held at a $57.8 billion valuation.

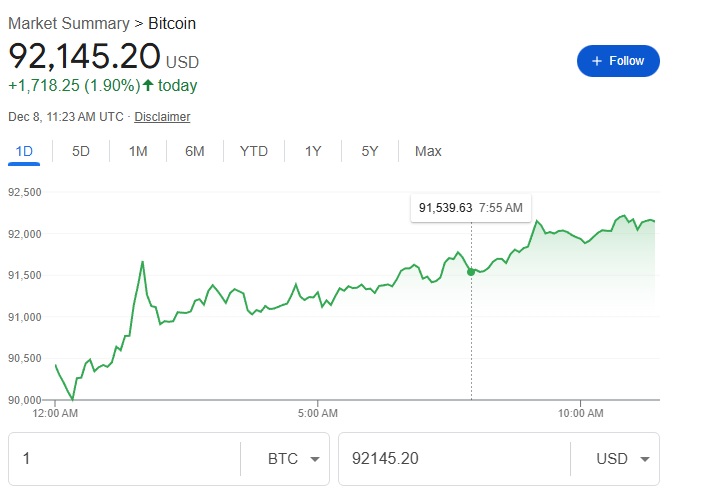

This single enigmatic post from Saylor sent Bitcoin soaring by more than $4,000 in under three hours, driving the asset from just below $88,000 to above $91,000. The reaction underscored how strongly the executive chairman’s remarks continue to sway market sentiment even as broader indicators remain locked in extreme fear.

Register for Tekedia Mini-MBA edition 20 (June 8 – Sept 5, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Strategy’s “Orange and Green Dots” Tracking System

The strategy color-coded tracking system has become a key signal for crypto observers. The “orange dots” represent each Bitcoin purchase by MicroStrategy, displayed on the company’s tracker portfolio chart. Every dot marks another addition to its long-running accumulation strategy.

Alongside these markers, a green line tracks the company’s average purchase price, a benchmark for gauging portfolio performance. As of December 8, MicroStrategy held 650,000 BTC valued at roughly $57.80 billion, with an average cost of $74,436 per coin. This position reflected a 19.47% gain, amounting to about $9.42 billion in unrealized profits.

Recently, Saylor introduced “green dots,” prompting speculation about a strategy shift. The green dashed line showing the average cost has drawn increased attention, with some analysts suggesting that renewed or heavier buying could push it higher.

MicroStrategy’s holdings, acquired at an average $74,436 per BTC, underscore their leveraged accumulation approach, drawing both praise for bold HODLing and criticism for shareholder dilution risks. Last week, the company announced the establishment of a USD Reserve of $1.44 billion to support the payment of dividends on its preferred stock and interest on its outstanding indebtedness (“Dividends”).

The USD Reserve was funded using proceeds from the sale of shares of class A common stock under Strategy’s at-the-market offering program. Strategy’s current intention is to maintain a USD Reserve in an amount sufficient to fund at least twelve months of its Dividends, and intends to strengthen the USD Reserve over time, with the goal of ultimately covering 24 months or more of its Dividends.

The maintenance of this USD Reserve, as well as its amount, terms, and conditions, remains subject to Strategy’s sole and absolute discretion and Strategy may adjust the USD Reserve from time to time based on market conditions, liquidity needs, and other factors.

Commenting on it, CEO Saylor said, “Establishing a USD Reserve to complement our BTC Reserve marks the next step in our evolution, and we believe it will better position us to navigate short-term market volatility while delivering on our vision of being the world’s leading issuer of Digital Credit”.

Strategy is the world’s first and largest Bitcoin Treasury Company. The treasury strategy is designed to provide investors with varying degrees of economic exposure to Bitcoin by offering a range of securities, including equity and fixed-income instruments.

CEO Phong Le acknowledged that the company may consider selling Bitcoin if its stock falls below 1x modified Net Asset Value and external capital cannot be raised. With mNAV having dipped to 0.95 in November 2024, the scenario is no longer theoretical.

This marks a notable departure from the firm’s earlier “never sell” philosophy. Rising annual dividend obligations estimated between $750 million and $800 million—are forcing a reassessment of liquidity options. As a result, MicroStrategy’s role in the market is increasingly being compared to that of a leveraged Bitcoin ETF. Meanwhile, the company’s stock has dropped more than 60% from its peak, raising questions about how sustainable aggressive accumulation will be during high-volatility periods.

Outlook

Despite the sudden rally in the price of Bitcoin, overall market sentiment has remained cautious. The Fear and Greed Index continued to signal anxiety, even though trader positioning leaned bullish.

The contrast between fearful sentiment indicators and bullish trader positioning highlighted the market’s current psychological divide: fear persists, yet many traders are willing to bet on momentum, especially when triggered by influential Bitcoin holders.

Meanwhile, former BitMEX CEO Arthur Hayes, has noted that Bitcoin is poised for lift-off as key bullish catalysts kick in.