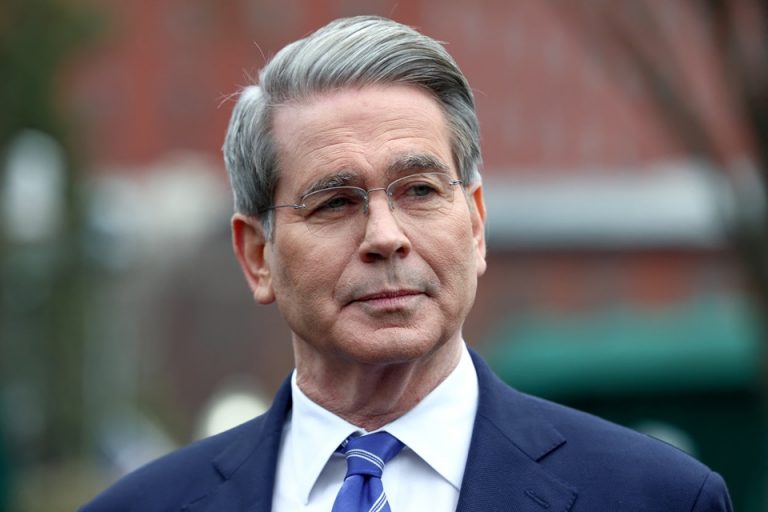

U.S. Treasury Secretary Scott Bessent has publicly stated that cryptocurrencies, particularly stablecoins, could reinforce the U.S. dollar’s global dominance rather than threaten it. In a video interview posted to X on June 18, 2025, Bessent argued that stablecoins, which are typically pegged to the U.S. dollar, could become significant buyers of U.S. Treasuries, thereby increasing demand for U.S. government debt and strengthening the dollar’s position in the global economy.

He emphasized that this could “lock in” dollar supremacy, especially as stablecoins facilitate dollar-based transactions worldwide, such as in Nigeria, without requiring physical dollars. Bessent’s remarks align with President Donald Trump’s pro-crypto stance and came a day after the U.S. Senate passed landmark stablecoin legislation, the GENIUS Act, on June 17, 2025. He also criticized the Biden administration for attempting to stifle crypto innovation, suggesting that embracing digital assets is key to maintaining U.S. financial leadership.

Scott Bessent’s belief that cryptocurrencies, especially stablecoins, will reinforce U.S. dollar supremacy carries significant implications for global finance, geopolitics, and domestic policy. Stablecoins, pegged to the U.S. dollar, incentivize global users to hold and transact in dollar-backed digital assets. Bessent highlighted in his June 18, 2025, X interview that stablecoins could become major buyers of U.S. Treasuries, increasing demand for U.S. debt and reinforcing the dollar’s role as the world’s reserve currency.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

This could extend dollar dominance in emerging markets (e.g., Nigeria, as Bessent noted), where stablecoins facilitate dollar-based transactions without physical currency, reducing reliance on local currencies and central banks. A stronger dollar bolsters U.S. influence over global trade, sanctions enforcement, and financial systems, countering efforts by nations like China to promote alternatives (e.g., digital yuan).

Crypto as a U.S. Financial Asset

Bessent’s view aligns with the Trump administration’s pro-crypto pivot, evidenced by the GENIUS Act (passed June 17, 2025), which regulates stablecoins and encourages innovation. This contrasts with the Biden administration’s perceived hostility toward crypto, which Bessent criticized. By integrating crypto into the U.S. financial system, the U.S. could attract blockchain investment, talent, and infrastructure, potentially creating jobs and fostering a new tech-driven economic sector.

Stablecoin regulation ensures transparency and reserve backing, mitigating risks like those seen in past failures (e.g., TerraUSD), which could stabilize markets and build trust. Stablecoins bypass traditional banking rails, potentially reducing the role of commercial banks in cross-border payments and remittances. This could pressure banks to innovate or lose market share. While stablecoins may lock in dollar demand, they could complicate Federal Reserve control over money supply if digital dollars proliferate outside traditional channels.

The U.S. must balance innovation with oversight to prevent illicit use (e.g., money laundering), which could otherwise undermine the dollar’s credibility. Stablecoins enable unbanked populations in developing nations to access dollar-based financial systems via smartphones, promoting inclusion but also tying these economies to U.S. monetary policy. Increased reliance on dollar-backed stablecoins could deepen global dependence on the U.S. economy, potentially exacerbating vulnerabilities to U.S. policy shifts or sanctions.

Figures like Bessent, Trump, and crypto advocates (e.g., posts on X celebrate the GENIUS Act) see crypto as a tool to modernize finance, boost U.S. competitiveness, and lock in dollar supremacy. They argue stablecoins amplify the dollar’s reach without undermining its value. Traditional economists and regulators (e.g., some Federal Reserve officials) worry that crypto could destabilize markets, evade monetary policy, or enable illicit activity. They question whether stablecoins truly strengthen the dollar or merely shift control to private issuers like Tether or Circle.

As of June 2025, Tether (USDT) and USD Coin (USDC) dominate stablecoin markets, with over $150 billion in circulation, per web sources, underscoring their economic weight but also regulatory concerns about reserve transparency. The Trump administration, with Bessent as Treasury Secretary, champions crypto as part of a broader deregulation and innovation agenda. The GENIUS Act’s passage reflects GOP support for integrating crypto into U.S. finance, as seen in X posts from pro-Trump accounts praising the move.

Many Democrats, including Biden-era regulators, advocate stricter oversight, citing consumer protection and systemic risks. Some, like Senator Elizabeth Warren, have called crypto a haven for crime, creating a partisan split on policy. The GENIUS Act’s bipartisan Senate passage (June 17, 2025) suggests some convergence, but debates over enforcement and scope persist. Crypto purists on X and elsewhere argue that cryptocurrencies should challenge state-controlled currencies, including the dollar, by enabling decentralized finance (DeFi). They view Bessent’s dollar-centric vision as co-opting crypto’s revolutionary potential.

Bessent and establishment figures see crypto as a tool to extend, not disrupt, U.S. financial power. This aligns with Wall Street interests (e.g., BlackRock’s crypto ETFs) that seek to integrate digital assets into existing systems. The libertarian camp fears stablecoins, backed by U.S. policy, could centralize crypto markets, while statists worry that unregulated DeFi could undermine dollar stability.

Bessent’s vision positions the U.S. to lead the crypto economy, countering China’s digital yuan and Russia’s crypto experiments to evade sanctions. X posts from crypto analysts note that U.S. stablecoin dominance could marginalize rival digital currencies. Countries adopting crypto (e.g., El Salvador’s Bitcoin experiment) may resist dollar-backed stablecoins, fearing economic subordination, while others embrace them for stability and access.

Stablecoins could enhance U.S. sanctions enforcement by tracking dollar flows, but privacy-focused coins (e.g., Monero) could enable evasion, deepening global tensions. Bessent’s belief that crypto will lock in dollar supremacy signals a strategic embrace of digital assets to maintain U.S. financial dominance. The implications include stronger dollar demand, economic growth through innovation, and enhanced geopolitical leverage, but also risks like banking disruption and regulatory challenges.