Short sellers of artificial intelligence (AI)-related stocks reaped massive profits after the debut of low-cost AI models from China’s DeepSeek sent shockwaves through Wall Street.

The sharp market reaction saw traders betting against AI giant Nvidia walk away with record profits exceeding $6 billion, while other AI-linked stocks also suffered steep declines.

According to data analytics firm Ortex, short sellers of Nvidia raked in about $6.6 billion in profits—the biggest single-day gain ever recorded on a single stock. This came after Nvidia’s market capitalization plummeted by an unprecedented $593 billion on Monday, marking the largest single-session loss for any company in history.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

The massive selloff was triggered by DeepSeek’s launch of AI models that it claimed were on par with or superior to the industry-leading models in the U.S., but available at a fraction of the cost.

The fallout extended beyond Nvidia, with short sellers of chipmaker Broadcom also securing more than $2 billion in profits. AI-related stocks such as Super Micro, a server manufacturer, data-center operator Equinix, and energy provider Vistra also suffered significant losses. Investors who bet against these firms reportedly earned a combined profit of more than $900 million, according to Ortex.

The stunning market reaction underscores the growing competition in the AI sector, particularly as Chinese firms seek to challenge U.S. dominance in AI technology. DeepSeek’s low-cost AI models have raised fresh concerns about pricing pressures and competition in the semiconductor and AI hardware industries, leading to a wave of selloffs among investors.

The shocking debut of DeepSeek’s AI models, which the company claims match or even surpass leading U.S. models at a fraction of the cost, sent panic through Wall Street, forcing investors to reassess their long-term bets on AI dominance by U.S. firms like Nvidia, Broadcom, and Super Micro Computer.

The stock market rout wasn’t confined to Nvidia. Other AI-heavy firms suffered massive losses, with Broadcom losing more than $200 billion in market value. The AI-driven tech selloff extended to Super Micro Computer (SMCI), data-center operator Equinix, and power provider Vistra, causing further losses.

DeepSeek’s Threat to US’ AI Dominance

The Chinese startup, backed by state-linked investors and prominent tech firms, introduced an advanced large language model (LLM) that reportedly rivals, if not outperforms, top-tier AI models from OpenAI, Google DeepMind, and Meta. What stunned the market, however, was the ultra-low cost of DeepSeek’s AI solutions—a direct threat to the high-margin business models of Nvidia and other AI chipmakers that have dominated the market.

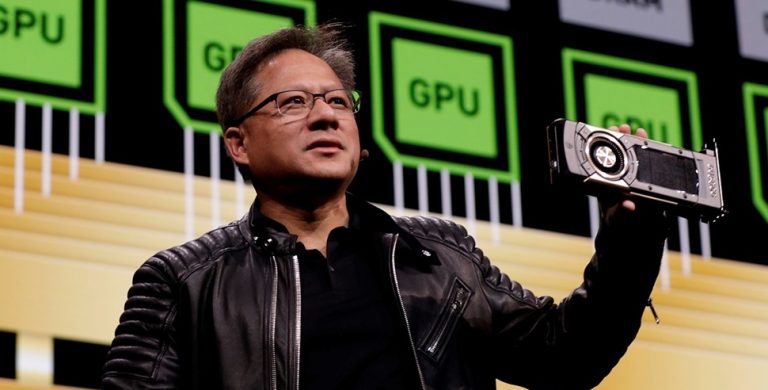

For years, Nvidia’s cutting-edge graphics processing units (GPUs) have been the backbone of AI computing, with tech giants like Microsoft, Amazon, and Google heavily investing in Nvidia’s chips to power their AI ambitions. DeepSeek’s launch has now sparked fears that China is rapidly closing the gap in AI development, potentially reducing demand for Nvidia’s GPUs and challenging the U.S.’s dominance in the sector.

The DeepSeek-induced panic has led to urgent discussions among analysts about whether this signals a longer-term shift in the AI market. Wall Street analysts are now warning that pricing pressures and rising competition from China could drastically alter the AI investment landscape, forcing companies like Nvidia, Broadcom, and Google to adjust their strategies.

Tech analyst Dan Ives of Wedbush Securities described the market reaction as a “gut-punch to the AI hype cycle.”

He said: “The stunning collapse of Nvidia’s stock and the broader tech market shows just how fragile the AI boom is. If China can produce competitive AI at a fraction of the cost, the entire AI supply chain—especially chipmakers like Nvidia—faces a serious long-term threat.”

Similarly, David Sacks, a former Trump administration tech adviser, told Fox News that the situation was a wake-up call for U.S. AI firms, warning that companies like OpenAI and Nvidia must act fast to counter China’s rapid advancements.

The dramatic market reaction to DeepSeek’s AI debut highlights growing anxieties about U.S.-China competition in AI and semiconductor technology. The White House is reportedly closely monitoring the implications of DeepSeek’s technology, with the National Security Council (NSC) now reviewing its potential impact on national security and U.S. tech leadership.

Meanwhile, industry giants like Nvidia, Microsoft, and Google are expected to respond swiftly to mitigate the competitive threat posed by DeepSeek. Some analysts predict that U.S. AI firms may ramp up lobbying for stricter regulations on Chinese AI technology or push for new government subsidies to maintain their edge.