Diem is a blockchain-based licensed stable coin payment system As a crypto project launched by social giant Meta, Diem has attracted attention since its debut.

The market has placed high expectations on Diem and believes its launch will change the world’ s payments landscape. Social media, e-commerce, ride-sharing, music, travel, payments and other supergiants, such as Visa, Uber, eBay, Spotify, Coinbase and others, have become Diem’s partners.

But the project provoked strong opposition from government regulators in the EU, the US and other countries based on issues of monetary sovereignty, financial stability, privacy and anti-monopoly. Diem, which was due to be released in 2020, was renamed, suspended and finally retired at the end of January.

Register for Tekedia Mini-MBA edition 18 (Sep 15 – Dec 6, 2025) today for early bird discounts. Do annual for access to Blucera.com.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment.

But Diem left behind a number of important technical “legacies”, the most important of which is its design of a new programming language, Move.

The Programming language — — Move

Move is a rust-based programming language originally developed by Facebook for the Diem blockchain. Currently, Move’s Github code base is mainly managed by Mysten Labs. Aptos and Sui team members are also the core development team of Move.Move wants to be the Javascript of Web3, enabling more developers to quickly build blockchain products.

While Three protocols under review is promising not to use any Diem IP owned by Silvergate in building the blockchain, comparing Diem’s white paper, you will find that the three public chain projects, Sui, Aptos and Linera, inherit some aspects of the development language or technical logic.

Next, we will compare the development progress and technical highlights of these three public chain projects.

1. Sui/Mysten Labs

Sui’s development team came from Mysten Labs, the founding team includes Evan Cheng, Adeniyi Abiodun, Sam Blackshear, George Danezis, and Kostas Kryptos, all of whom worked on Novi and Diem projects at Meta. Among them, CEO Evan Cheng served as Director of Engineering and Technology for the development of the Meta blockchain from 2018 until September of this year.

Last December, Mysten Labs received $36 million in a funding round led by a16z, with participation from Coinbase Ventures, NFX, Slow Ventures, Scribble Ventures, Samsung NEXT, Lux Capital, and others.

In May, Mysten Labs released its first test network Sui DevNet and the token economics model, announcing that it would launch a total of 10 billion Sui tokens.

In July, Mysten Labs was seeking to raise at least $200 million in Series B funding at a $2 billion valuation, led by FTX Ventures, which has already raised $140 million in that round.

At present, Sui Network has launched two encrypted wallets for testing: Sui Wallet, an official Chrome plug-in Wallet, and Ethos Wallet, a third-party wallet that allows users to experience the Sui Network for transferring and casting NFTs. Sui will launch the motivation test network in August.

The key to Sui performance is transaction Parallelization. In most blockchains, transactions must be ordered and placed in blocks for sequential execution. Sequential execution unnecessarily limits throughput on these chains, since most transactions are independent of each other. Because Sui requires the subordination of the transaction to be explicitly stated, it is able to process them in conjunction with each other. In cases where a few transactions are intertwined, Sui can still sort them and execute them sequentially.

In terms of technology, Sui uses Move language to realize smart contract, ensuring standardization and security. In terms of consensus protocol, Sui uses BFT consensus for affiliated transactions and uses Byzantine broadcast algorithm for parallel verification of independent transactions. Therefore, high TPS is guaranteed while communication between nodes is reduced to achieve extremely low latency. Simple transactions can be verified immediately, and complex transactions take less than 3 seconds.

2. Aptos

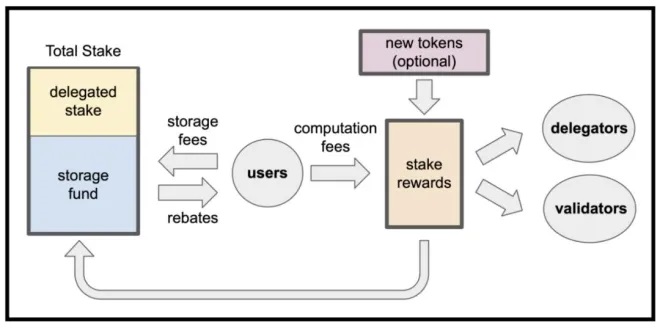

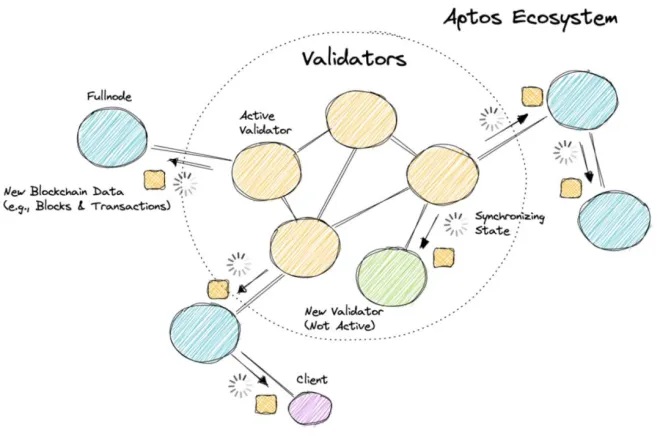

Aptos is the fastest growing public chain of the three in terms of development progress and the start of the ecosystem. Technically, Aptos also uses the Byzantine Fault Tolerance (BFT) consensus protocol and the Move programming language to build a more scalable blockchain.

In March, 2022, Aptos closed a $200 million round of funding led by A16Z, Tiger Global, Katie Haun, Multicoin Capital, Three Arrows Capital, FTX Ventures, Coinbase Ventures and other prominent VCs. Since then, Binance Labs has announced an investment in Aptos Labs. Payment giant PayPal also said it was involved in the venture, which is PayPal Ventures’ first Layer1 public chain project.

In May, Aptos launched its Incentive Test Net registration. The Incentive Test network has four rounds in Aptos roadmap and is currently in the second aIT-2 pledge testing phase.

In a blog post, Aptos said its test network has reached more than 20,000 nodes, making it the largest community of proof-of-stake nodes. At the same time, the test network can validate and synchronize over 10,000 transactions per second (TPS) with sub-second latency, and is on its way to reach over 100,000 TPS. Aptos expects to launch the Aptos mainnet by the end of September.

In terms of eco-incentives, Aptos has hosted a hackathon and also launched an eco-funding program in late June to grow its ecosystem, which according to Aptos has over 100 projects built on the web with use cases covering DeFi, NFT, games, and more. In addition, Austin, the former head of marketing at Solana, recently announced that he will officially join Aptos in August as the ecosystem director. Austin spent most of his web3 career focusing on incubating and expanding the global community, and his experience may be of great help to Aptos’ ecological expansion.

3. Linera

Linera is the latest to get off the ground compared to the other two projects and is still in the early stages of development. Its goal is to create a low-latency blockchain that can scale as easily as Web2 applications, enabling most account-based operations to be confirmed in a fraction of a second.

Linera founder Mathieu Baudet previously worked as an engineer at Meta and helped create the Diem blockchain. As a principal researcher and engineer at Novi, he was a central figure in inventing the FastPay and Zef protocols These two protocols speed up transactions by completely removing memory pools and minimizing interactions between authenticators, and Linera continues to build on these two protocols. In addition, Linera’s founding team is comprised primarily of former Zcash and former Meta/Novi engineers and researchers.

On June 29, Linera completed a $6 million seed round led by A16Z, with the participation of Cygni Capital, Kima Ventures and Tribe Capital.

As mentioned above, Linera’s name is a direct indication of its characteristics; Linera will develop and promote new execution models for “linear scaling”. Linear scaling means that it is always possible to double the capacity of a system by doubling the number of machines. Currently, blockchains give preference to a model of “sequential” execution, which allows an account and a smart contract to interact arbitrarily in a series of transactions, but prevents linear scaling.

In Linera’s linear model, operations for different user accounts run simultaneously in different threads of execution, by which execution can always be scaled by adding new processing units to each verifier. At present, Linera has not explicitly developed in Move language in its the public documentation, only stated that it is based on Rust language. But from the technical characteristics of Linera, the logic of the two is very similar.