How do you tax Facebook, Google and other ICT utilities which are used around the world where they make money, by selling adverts, but in some cases do not have physical locations that can be hammered by tax agencies? The old industrial age tax ordinances have relied on the physical domains of entities. So, provided Twitter does not have a physical location (i.e. not registered) in Nigeria, it can afford NOT to pay taxes to Nigeria even though it makes money in Nigeria as Nigerian users click adverts it shows, and Nigerian companies buy its adverts.

GE cannot easily avoid paying tax in Nigeria because its products are “physical” which typically require a local presence with a local team. But for Twitter, for example, it has a product that can be distributed through the web, making having a local subsidiary in Nigeria largely unnecessary. Simply, Twitter can operate and serve Nigerian customers without having to be registered in Nigeria. (Sure, it can register and run operations in Nigeria for deeper connections with the community.)

That redesign is a big challenge as these digital ICT utilities disrupt and accumulate more market positions, distorting the frameworks of the old empires which have been paying taxes to governments. Yes, if Facebook and Google advance, and local newspapers which typically pay taxes fade, governments will not have money to hire teachers in places like Gambia and Mali where I do think Facebook and Google may not be registered, and consequently do not send the governments cheques for taxes.

Register for Tekedia Mini-MBA edition 18 (Sep 15 – Dec 6, 2025) today for early bird discounts. Do annual for access to Blucera.com.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment.

To deal with this issue, many ideas have been proposed. I think they have now gotten something that makes sense. Yes, the answer is to tax ICT utilities where customers consume their products and services irrespective of whether they are there (physically operating or legally registered) or not. Just set a minimum number that must be served to activate the tax payment.

The search for a new agreement on how countries should tax multinational corporations advanced Wednesday, as international negotiators proposed rules that would force tech giants such as Facebook Inc., Amazon.com Inc. and Alphabet Inc.’s Google to pay more tax in countries where customers consume their products and services.

This will bring fairness, but I do not see this happening anytime soon since the country that creates most of these utilities will fight back! I do not blame America because no one will like to disarm without fighting. If Facebook and Google spread money all over Africa where they are used, U.S. Treasury may see that as a loss. Possibly, the Treasury may engineer something that would make it nearly impossible for Facebook and Google to wire the payments. Alternatively, it can allow the companies to wire the payments but recover same via penalties and tariffs (import or export) on the small countries.

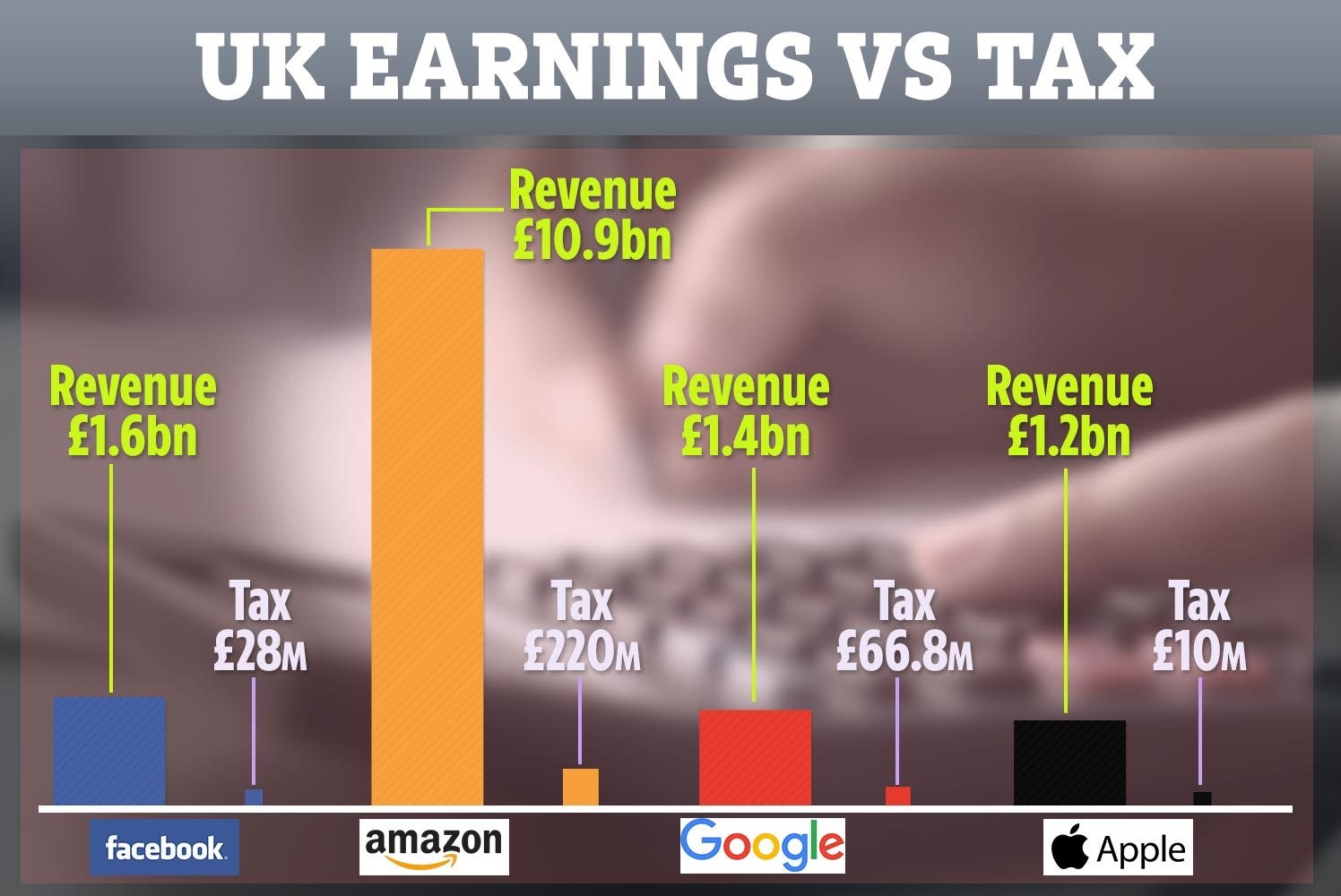

The United Kingdom is lucky that Facebook sent it 28 million pounds on 1.6 billion pounds revenue, Mali got zero irrespective of the revenue Facebook generated therein. A unification of global tax system on the ICT utilities will surely help Mali and other smaller countries in this age.

Facebook’s UK operations paid £28m in corporation tax last year despite achieving a record £1.6bn in British sales.

The social media company’s latest UK accounts show that gross income from advertisers rose almost 30% last year to £1.65bn, and pretax profits surged by more than 50% from £63m to £97m.

Steve Hatch, the Facebook vice-president for Northern Europe, said: “Businesses across the country use our platforms to grow and revenue from customers supported by our UK teams is now recorded here so that any taxable profit is subject to UK corporation tax.”

But John McDonnell MP, Labour’s shadow chancellor, criticised the relatively small amount of corporation tax the US tech giant paid last year.

---

Register for Tekedia Mini-MBA (Sep 15 – Dec 6, 2025), and join Prof Ndubuisi Ekekwe and our global faculty; click here.

No quick fix, because most of the digital companies to be taxed are America’s, so you need cooperation of the US government. It’s very easy for countries that don’t own any big corporation to talk about taxes, the home government won’t smile just like that.

It’s a lot of work, which requires highest level of transparency and honesty, because it’s not straightforward to determine the portion of a revenue that constitutes ‘profits’ from digital natives; they can still bamboozle many countries if there is no international consensus.

Let’s see how it works out, Nigeria will equally be interested in getting some dollars from the digital behemoths.

That is the summary – U.S. has to bless any strategy!