My team sent this email today; resharing here as many members get info here.

Dear Sir/Madam,

Greetings! We are happy to note that the exit which we announced last month for one of our startups* has officially closed. Though it is just a 5X exit, Tekedia Capital along with our invested members agreed that it was the correct decision. We had modeled the potential terminal value of the startup, with more data from the industry, and we concluded that getting out was the right call. We will contact all invested members, on this startup, from next week.

Register for Tekedia Mini-MBA edition 18 (Sep 15 – Dec 6, 2025) today for early bird discounts. Do annual for access to Blucera.com.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment.

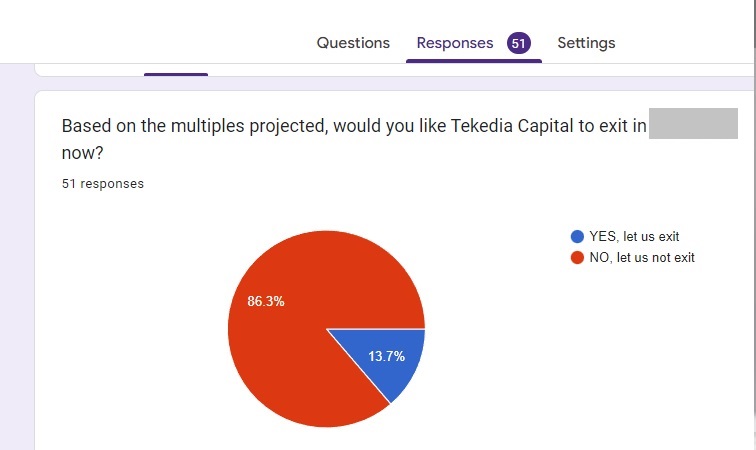

Meanwhile, for the other startup* which we polled for a potential exit within the last two weeks, the data is clear: “NO, let us not exit”. We have dozens of members in this startup. From the 51 members who voted, 86.3% voted “No, let us not exit”. As a result, Tekedia Capital will not change our earlier “No” entry. (The data is attached above).

To our members who feel that exiting is the right thing, we want to assure you that staying, based on all indicators today, is the right call. Typically when we think an exit is necessary, we present reasons before members. In this case, a little patience will be strategic. More so, some members in the WhatsApp group have indicated interests to buyout others. All shares are restricted which means they cannot be transferred. For this, though, we can seek approval from the company Board to allow transfer since it does not change anything in the cap table since everything will happen within Tekedia Capital.

Finally, the free course for all Tekedia Capital members – Venture Investing and Portfolio Management (VIPM) – will now be held from July 3 to 29, 2023. Tekedia Institute, a sister company, which focuses on business education, will lead that. This postponement is necessary to understand why current learners in Tekedia Institute who are taking a similar course struggled with some analytical homeworks. The plan is to integrate the lessons learned to make sure VIPM delivers impact. All members would be updated accordingly.

*Go to the Board, and login for the startups here.

Regards,

Tekedia Capital Team

---

Register for Tekedia Mini-MBA (Sep 15 – Dec 6, 2025), and join Prof Ndubuisi Ekekwe and our global faculty; click here.