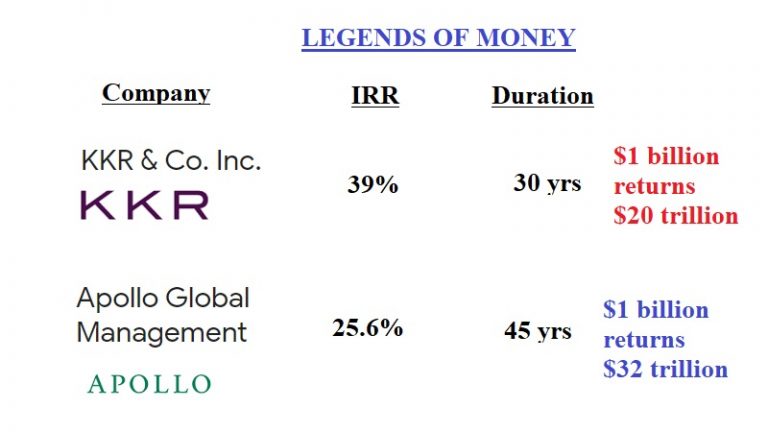

Now you understand why KKR and Apollo are peerless in the world of private equity business. They shared data with the SEC and the world got a window into the the most exclusive club in this world. A $1 billion investment in Apollo, on formation, would be worth $32 Trillion (with T) today. Source.

The SEC was shown a version of Apollo’s annual report which said it had generated an annual IRR of 39.0% over the past 30 years. At that rate, a $1 billion investment would be worth $20 TRILLION over 30 years or roughly the GDP of the US.

The SEC was also shown a of KKR’s annual report, which said it had generated an annual IRR of 25.6% over the past 45 years. At that rate, a $1 billion investment would be worth $32 TRILLION over 45 years or almost half of the GDP of planet earth.

Update: apologies that I did not give the meaning of IRR. IRR means an internal rate of returns. Think of it as an annual rate of growth and investment generated.

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.