In the digital age of cryptocurrency, the Casascius Coin stands out as a rare and tangible relic. Introduced in 2011 by Utah-based software engineer Mike Caldwell, these physical Bitcoins bridged the gap between the virtual and physical worlds—embedding real Bitcoin value into a handheld, brass coin.

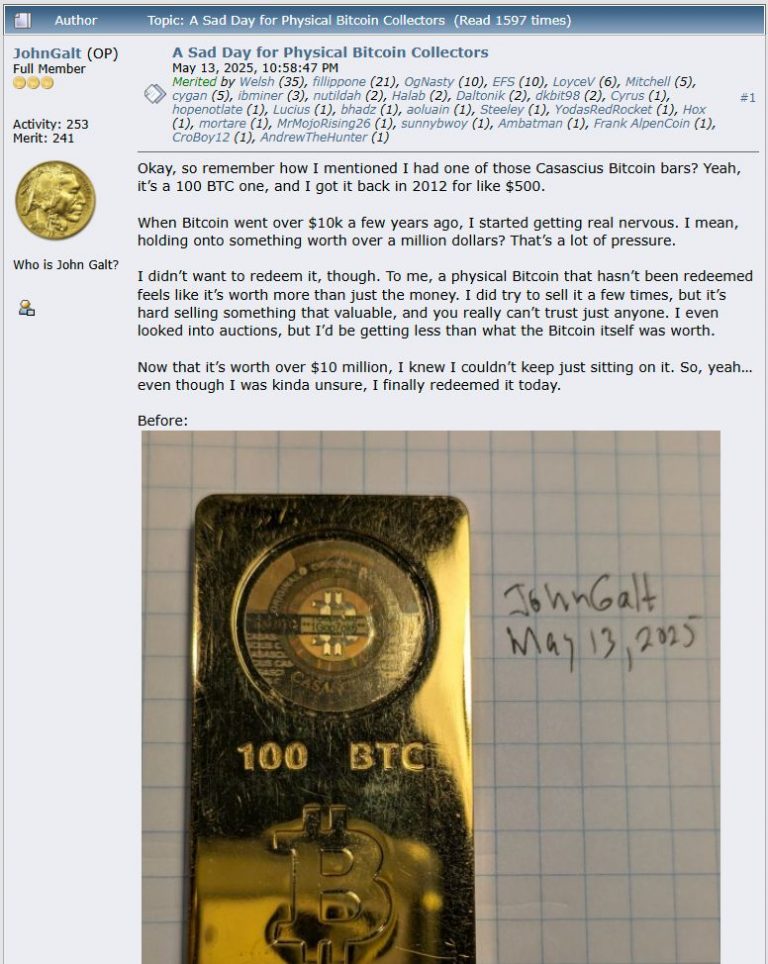

Here we see the journey of indecision between 2012, when John Galt bought a 100BTC Casasius Coin for $500 USD and May 2025, when he sold it for $10 Million.

There is still some subtle anxiety in his decision to sell it when he did.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

9ja Cosmos don’t take a position on Bitcoin, neither as a BTC maxi, nor as a sceptic. A lot has to do with global perception of exactly what liquidity is.

At the moment FIAT is still king from a liquidity perspective.

You go into many online sites with some focus on crypto and Web3, and you will see Coinmarketcap, Coingeko, Trading View, Coinbase, and Yahoo Finance telling you the value of Bitcoin in US Dollars.

You pick up a quick entry level job anywhere, from the Diner in Chicago to the Pub in Ireland to the open-air market in Lagos, Nigeria, they pay you in local currency, there are no crypto options.

FIAT currently is still dominating markets globally.

But things are changing. The product segment that includes debit/credit cards like Chainlink, MetaMask, Holyheld, Sora, Crypto.com, Nexo, and Gnosis are becoming more numerous and the product segment is expanding.

They allow people to hold crypto on account but allow them to pay for everyday services with either MasterCard or Visa as partners, handling the PoS (Point of Sale) payment journey. They look like any regular Debit or Credit Card.

These draw in all sorts of people that don’t actually need to have niche knowledge about Blockchain or Web 3, but they may struggle in economies like Nigeria where trade among the masses is often done with cash changing hands, rather than card payments.

Perhaps one day we will reach the point where Bank of America, Goldman Sachs, Wells Fargo, Royal Bank of Canada, HSBC, Mitsubishi UFJ Financial Group, CitiGroup, or indeed First Bank or Guaranty Trust Bank need to clarify exactly what a Dollar or a Naira means, by illustrating its value in Bitcoin?

While Nigeria contemplates an archaic and obsolete monetary future with an UNstablecoin backed by Naira, the US is already securing the future of the $USD by creating a STABLEcoin that backs it with Bitcoin.

This is the endeavour of New Bretton Woods (NBW) Labs, formed by several Harvard students and alumni, leveraging membership of the Harvard Innovation Labs.

Yes, it is Bitcoin that becomes guarantor for the US Dollar, not the other way around!

Did John Galt pick an opportune time to sell? Or is he due for a disappointment of monumental proportions?

A liquidity tipping point away from FIAT may be on the Horizon.

New Bretton Woods is here, while old Bretton Woods, and the Gold Standard are long dead.

John Galt’s legacy as a visionary or strategic blunderer remains uncertain.

Only time will tell.

Credit : Veronica Bridgewater, 9ja Cosmos Ambassador focusing on LinkedIn presence.

9ja Cosmos is here…

Detoxants – FiendYard Fruit & Veg

Opaque Emotion Pathways Tokenized Artworks

Preview our Sino Amazon/Sinosignia releases (Ente)

Visit 9ja Cosmos LinkedIn Page