This week the cryptocurrency market unravelled almost overnight, caught midway between rising Middle East hostility and a raw public spat between two of its most famous backers. Traders were jolted when nearly $1.2 billion in long positions evaporated as volatility spiked.

Congress, however, refused to flinch. In a rare display of cross-aisle momentum, a coalition of Democrats and Republicans pushed the Digital Asset Market Clarity Act—one bill that finally tries to pin down the gray zone between a currency and a security. Lobbyists now expect at least a committee mark-up by early December.

While Washington haggles, some investors have decided that waiting for calm is overrated. A deflationary newcomer known as Angry Pepe Fork is luring late-night buyers with sky-high staking yields that flirt with 10,000% APY, and it’s CommunityFi framework let’s holders start earning within hours of their deposit. A handful of hedge funds already describe the token as a high-risk, high-beta hedge on mainstream renewal.

Bitcoin Threatens Five-Digit Territory as Markets Collapse

Bitcoin itself slipped 4% in ugly candles that took it to $100,500 and threatened to thrust it back into five-digit territory for the first time in weeks.

The Trump-Musk Catalyst

The spark was simple enough: Musk, for the second time this month, blasted Trump’s so-called Big Beautiful Bill as a “disgusting abomination,” to which Trump retorted with threats to yank federal contracts from any firm dabbling in disloyal chatter.

Exchanges lit up almost instantly, and Slack rooms of quantitative desks buzzed with orders to trim delta before liquidity vanished. For investors hoarding options, the brief chaos offered a textbook Gamma scalp that padded PnLs by Monday morning.

Political Crypto Holdings Reveal Market Paradox

A financial filing attributed to Donald Trump claims he netted $57.3 million from token placements linked to World Liberty Financial and still controls at least $1 million in ether. Such disclosures underscore how public officials are diversifying into digital assets even as their squabbles send prices swinging.

Middle East Tensions Amplify Crypto Selloff

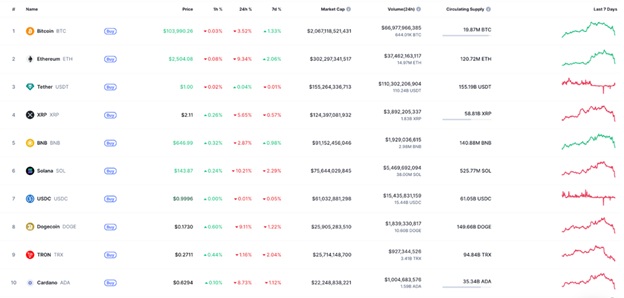

Fresh hostilities in the Middle East injected new stress into global markets almost overnight. Israeli bombardments meant to cripple Iran’s alleged nuclear sites sent the aggregated value of all cryptocurrencies tumbling 7% to about $3.3 trillion, with Bitcoin sliding roughly 5% to $103,464.

Liquidation Tsunami Sweeps Exchanges

Exchange records kept by CoinGlass reveal that forced liquidations surged 125% in 24 hours, reaching a staggering $1.2 billion. Ethereum was knocked down 10% to $2,471, while Solana retraced 11% as jittery traders moved toward traditional havens.

Anxieties rippled beyond crypto when oil futures jumped almost 9% on Friday, pushing West Texas Intermediate crude toward the $74-per-barrel mark and reviving inflation fears that had only just begun to subside.

Congressional Breakthrough: CLARITY Act Advances

In the midst of such turbulence, lawmakers in Washington advanced legislation that could reshape the digital-asset landscape. The CLARITY Act is now scheduled for a full markup before the House Financial Services Committee, with a hearing date targeted for June 10.

Regulatory Framework Revolution

The new 236-page Clarity Act places most digital assets squarely under the Commodity Futures Trading Commission’s watch rather than the Securities and Exchange Commission’s tougher regime. A remarkable bipartisan coalition—three Democrats included—has signed on as co-sponsors, signaling broad political momentum.

In the upper chamber a complementary stablecoin bill is nearing final passage. Senator Ruben Gallego predicts a lopsided vote that could free up institutional dollars now sitting on the sidelines out of sheer regulatory uncertainty.

Angry Pepe Fork: Meme Culture Meets Serious DeFi

Away from Beltway headlines cryptocurrency markets are still feeling the weight of macroeconomic pressure. Enter the presale of Angry Pepe Fork, a project combining meme-culture flair with serious DeFi mechanics, priced right now at $0.0269 and already sparking chatter among risk-loving investors.

Sky-High Staking Yields and Supply Discipline

Early participants can stake their allocation during the sale for eye-popping annual yields of over 10,000%.

Supply discipline is baked in as well—1.9 billion tokens total, with a burning protocol meant to sustain upward price momentum.

Cross-chain availability on Ethereum, BNB Chain, and Solana maximizes the project’s reach.

CommunityFi: Activity-Based Income Revolution

Perhaps the most distinctive feature lies in its CommunityFi experiment: users earn rewards for tweeting, blogging, and otherwise promoting the protocol instead of simply parking coins in a wallet. That activity-based income stream cushions holders when broader markets slump.

GambleFi Integration

Shortly after the initial launch, the interface incorporates a set of on-chain mini-games in which participants stake $APORK tokens. Victors are rewarded on the spot, and a fixed proportion of the staked tokens is burnt, ensuring that the overall supply steadily contracts and every existing holder quietly benefits from the continuous deflationary force.

Presale Momentum Building

A staggered bonus schedule sweetens early participation: those who invest at least $50 earn 5% extra, while purchases of $150, $250, and $500 push the rewards up to 10, 15, and 20% respectively. The bracketed tiers create a built-in incentive for retail backers to commit larger sums sooner rather than later.

Market Outlook: Opportunity in Crisis

Angry Pepe Fork pairs instant-on staking rewards with a design that deliberately shreds supply while also opening several parallel earning channels. That combination gives it an edge over older blockchains now leaking capital amid regulatory headwinds. Members of Congress who once hesitated are drafting bills that lean crypto-friendly, meaning platforms with demonstrable utility and engaged user bases could be first in line for incoming institutional dollars.

The current presale is the rare window that lets new investors board before wide exchange listings and general mainstream attention. History shows that entering at this stage often delivers the richest returns in the cryptocurrency world.

Learn more about the $APORK here: Visit Angry Pepe Fork