Intel’s shares surged 7% on Thursday following a Bloomberg report that the Trump administration is in discussions with the chipmaker over a potential U.S. government stake in the company.

The move, according to sources familiar with the talks, is part of President Donald Trump’s broader push to bring more chip production and high-tech manufacturing back to U.S. soil, a goal he has repeatedly championed since taking office.

Intel remains the only U.S.-based company with the capability to manufacture the world’s most advanced chips domestically, even though competitors like Taiwan Semiconductor Manufacturing Company (TSMC) and South Korea’s Samsung Electronics operate factories in the United States. The proposed government stake would help finance new factories Intel is building in Ohio, a project seen as critical to strengthening America’s semiconductor supply chain.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

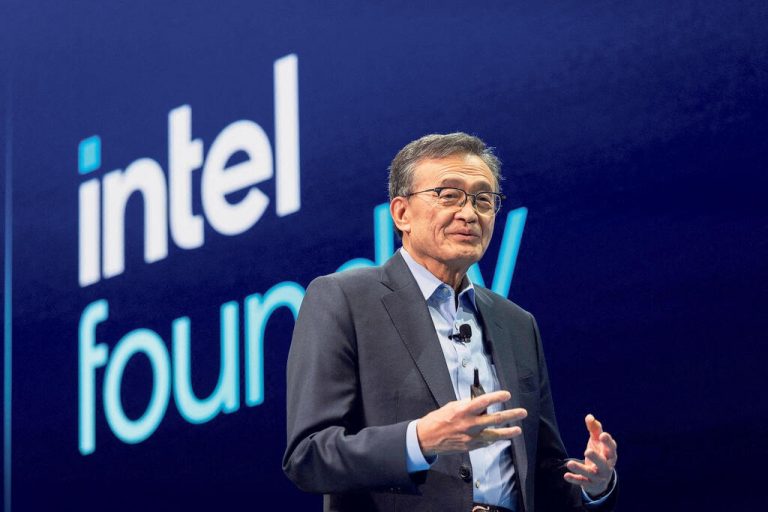

The discussions come just days after a dramatic shift in Trump’s relationship with Intel CEO Lip-Bu Tan. Earlier this week, Tan visited the White House, a meeting that raised eyebrows given that earlier, Trump had publicly called for Tan’s resignation over alleged ties to China. At the time, Intel defended its chief executive, stating Tan was “deeply committed to advancing U.S. national and economic security interests.” Now, Trump appears to have reversed course, not only meeting with Tan but also praising his leadership in what the administration describes as a “shared mission” to secure America’s tech future.

“We look forward to continuing our work with the Trump Administration to advance these shared priorities, but we are not going to comment on rumors or speculation,” an Intel spokesperson said in response to the latest reports.

Tan took the helm at Intel earlier this year amid significant challenges for the company. Once a dominant force in the global semiconductor market, Intel has in recent years struggled to gain ground in artificial intelligence chips, a sector where rivals like Nvidia have surged ahead. At the same time, Intel has poured billions into its foundry business, hoping to attract clients to use its manufacturing capacity. But the effort has yet to secure a major customer — a milestone many analysts see as crucial to restoring the company’s competitive edge.

In July, Tan announced that Intel would cancel planned manufacturing sites in Germany and Poland, while slowing construction in Ohio due to cost pressures and strategic reassessments. Spending across the company has been placed under tight review.

The talks with Intel are the latest in a series of high-profile interventions by the Trump administration into strategic industries. Just last week, the government announced it would take a 15% cut of certain Nvidia and Advanced Micro Devices chip sales to China, citing national security concerns. The Pentagon also bought a $400 million equity stake in rare-earth miner MP Materials and took a “golden share” in U.S. Steel as part of a deal approving its acquisition by Japan’s Nippon Steel.

For Intel, the renewed support from Washington could mark a turning point after a turbulent 2024, when the company saw its stock plummet by 60% — its worst year on record. While the stock is now up 19% this year, the path ahead remains challenging, with global competition intensifying and the race for chip leadership growing more political by the day.