The United States and Taiwan finalized and signed the U.S.-Taiwan Agreement on Reciprocal Trade often referred to as a reciprocal trade agreement.

This deal, negotiated under President Donald Trump administration, reduces U.S. tariffs on most Taiwanese imports including key exports like semiconductors to a maximum of 15%. This is down from higher rates initially imposed or proposed such as 20% in some earlier frameworks or up to 32% in discussions, and it aligns Taiwan’s tariff treatment with that of other key U.S. partners in the region like Japan and South Korea.

U.S. side: Applies a 15% cap; combining most-favored-nation rates plus any reciprocal adjustments on originating Taiwanese goods. It also provides preferential treatment for Taiwanese semiconductors and related products under Section 232 investigations (national security tariffs on chips and equipment), with exemptions or lower rates tied to investments in U.S. production.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Taiwan side: Commits to eliminating or reducing 99% of its tariff barriers on U.S. goods, granting preferential market access for American exports including automobiles, auto parts, beef, pork, dairy, wheat, pharmaceuticals, machinery, chemicals, and agricultural products. Some specific tariffs on certain pork products drop but may not go to zero immediately.

Taiwan plans to purchase significantly more U.S. goods from 2025–2029, including around $44.4 billion in liquefied natural gas and crude oil, $15.2 billion in civil aircraft and engines, and $25.2 billion in power equipment, generators, marine equipment, and related items; totaling roughly $85 billion in some reports.

Taiwanese companies led by firms like TSMC pledge major investments in U.S. high-tech sectors (semiconductors, AI, energy), with figures cited around $250 billion in direct investment plus government credit guarantees for additional amounts. This supports U.S. “reshoring” of chip manufacturing and supply chain resilience.

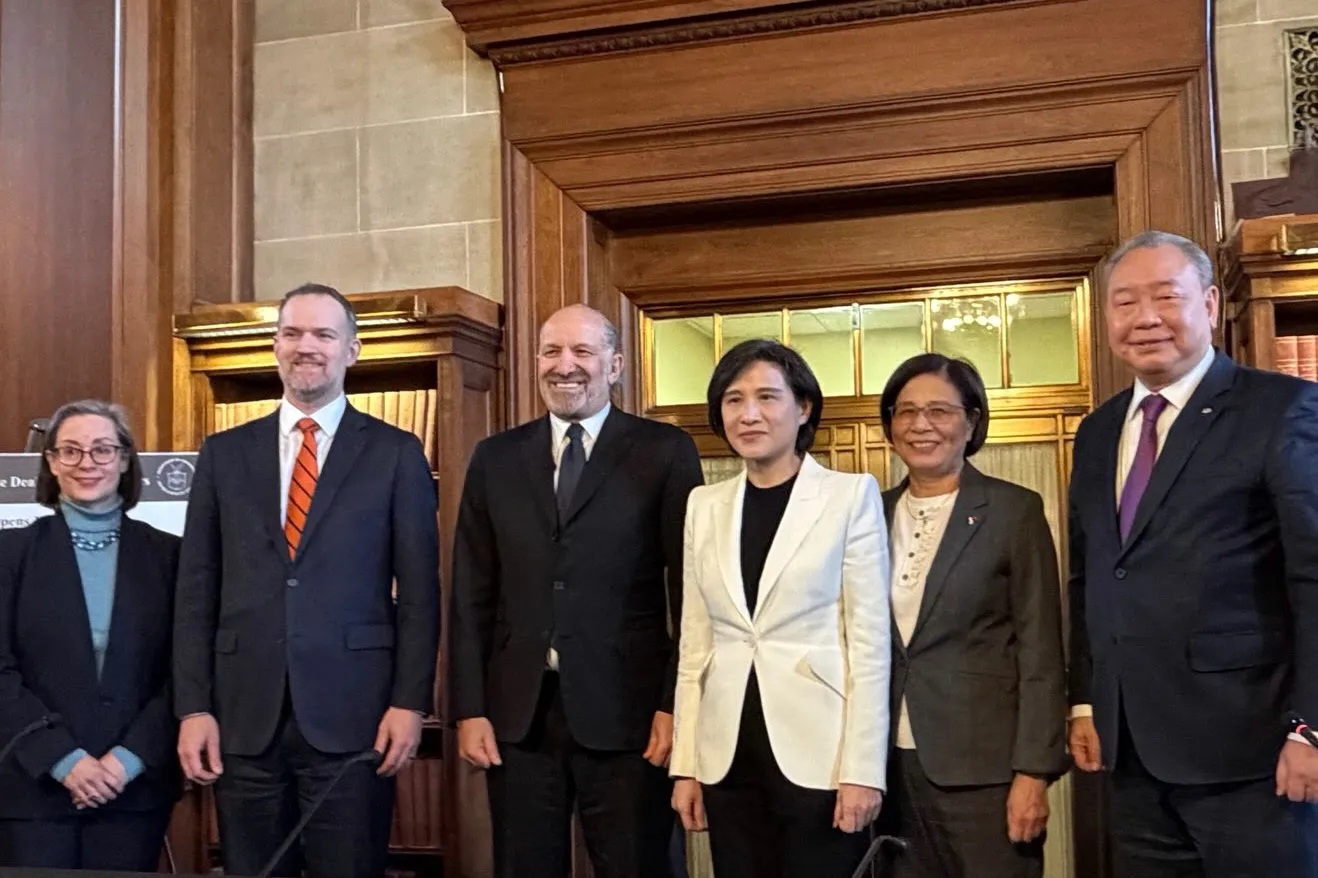

The agreement builds on a January 2026 framework/MOU and aims to address the large U.S. trade deficit with Taiwan (driven heavily by chips), deepen high-tech cooperation, and strengthen economic ties amid geopolitical dynamics with China. The deal was signed under the auspices of the American Institute in Taiwan (AIT) and Taipei Economic and Cultural Representative Office (TECRO), as the U.S. does not have formal diplomatic relations with Taiwan.

It requires approval by Taiwan’s legislature where opposition holds a majority, and some pushback has been noted. U.S. officials, including Trade Representative Jamieson Greer and Commerce Secretary Howard Lutnick, highlighted it as advancing “America First” trade while boosting mutual prosperity and national security.

This is viewed as a win for Taiwan’s export competitiveness and U.S. efforts to secure supply chains and increase exports to Asia. Markets and analysts have noted it as part of broader Trump-era reciprocal trade deals.

Taiwan’s commitments open its market to U.S. autos, pharmaceuticals, beef, pork, dairy, wheat, chemicals, machinery, and more, while removing non-tariff barriers. The $85 billion procurement pledge including $44.4 billion in LNG/crude oil, $15.2 billion in aircraft/engines, and $25.2 billion in power/marine equipment directly supports American farmers, energy producers, manufacturers, and high-tech sectors.

This helps address the ~$127 billion U.S. trade deficit with Taiwan (driven by chips). Massive Taiwanese investments accelerate “massive reshoring” of chip production, creating high-paying U.S. jobs and “world-class” industrial parks.

This reduces reliance on overseas supply chains, enhances domestic AI/energy/tech capacity, and mitigates risks from disruptions. The 15% cap aligns Taiwan with partners like Japan/South Korea, providing predictability for U.S. importers while advancing “America First” reciprocal trade.

The tariff reduction to 15%; non-stacking with most-favored-nation rates levels the playing field against competitors, shielding key exports especially semiconductors from higher duties or Section 232 national security tariffs. Exemptions/preferential treatment for chips reward U.S. investments.

While opening to U.S. goods increases competition domestically, it fosters two-way investment and strengthens high-tech ties. Heavy U.S. investment commitments could shift production abroad, raising concerns about “hollowing out” Taiwan’s semiconductor edge. The deal requires legislative approval in Taiwan, where opposition may push back.