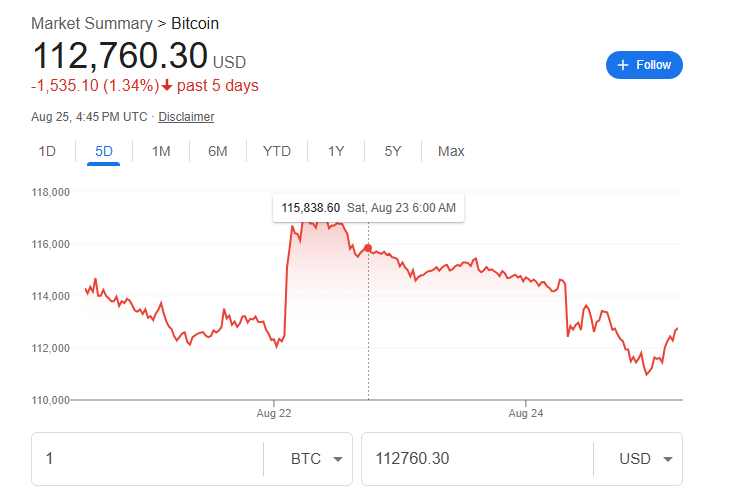

A Bitcoin whale sold 24,000 BTC, worth approximately $2.7 billion, on August 24, 2025, triggering a rapid $4,000 price drop in Bitcoin within minutes, contributing to a 4% decline in the total crypto market cap, with Bitcoin’s price currently trading around $112k as per CoinMarketCap data.

This event led to $250 million in long position liquidations within 30 minutes and a total of $840 million in liquidations over the previous 24 hours. The whale, holding coins dormant for over five years, transferred the BTC to the Hyperunite trading platform, with some reports indicating a rotation into Ethereum, including 416,598 ETH ($1.98 billion) purchased and 275,500 ETH ($1.3 billion) staked.

This sell-off amplified market volatility, with Bitcoin dropping to around $111,600-$112,700, while the broader crypto market cap fell to approximately $3.84 trillion. Analysts note that such moves by early Bitcoin OG can significantly influence market dynamics due to the large capital required to absorb their sales.

Register for Tekedia Mini-MBA edition 20 (June 8 – Sept 5, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

The sale of 24,000 BTC caused Bitcoin’s price to drop by approximately $4,000 within minutes, reflecting the immediate impact of large-scale liquidations on a relatively illiquid market. This contributed to a 4% decline in the total crypto market cap, bringing it to around $3.84 trillion.

Such rapid price drops can erode investor confidence, particularly among retail traders, leading to panic selling and further downward pressure. The sale triggered $250 million in long position liquidations within 30 minutes and $840 million over 24 hours.

Liquidations occur when leveraged positions are forcibly closed due to insufficient margin, amplifying price declines as automated systems sell assets to cover losses. This cascade effect disproportionately affects leveraged traders, exacerbating market downturns and creating a feedback loop of selling.

High-profile whale sales, especially from early Bitcoin holders signal to the market that large players may be exiting or reallocating their positions (e.g., rotating into Ethereum, as seen with the whale’s purchase of 416,598 ETH). This can spark fear, uncertainty, and doubt (FUD), prompting smaller investors to sell.

The visibility of such transactions, often tracked on-chain, amplifies their psychological impact, as traders interpret them as indicators of market tops or strategic moves by insiders. Large sales require significant liquidity to absorb, and in a market with limited immediate buyers, prices drop sharply to match available demand. This highlights Bitcoin’s sensitivity to large transactions, especially when executed on centralized platforms like Hyperunite.

Bitcoin’s price movements heavily influence altcoins and the broader crypto market. A 4% market cap drop reflects correlated declines across assets, as traders adjust portfolios or exit positions in response to Bitcoin’s fall. The whale’s reported rotation into Ethereum may temporarily bolster Ethereum’s price but could also signal a shift in capital allocation, potentially pressuring other assets.

How High-Profile Sales Trigger Sell Pressure

Bitcoin’s blockchain allows real-time tracking of large transactions. When a whale moves 24,000 BTC from a dormant wallet to an exchange, tools like Whale Alert broadcast this to the public, signaling potential selling intent. Traders react preemptively, selling to avoid anticipated losses, which initiates sell pressure even before the actual sale.

The crypto market’s high leverage (common in futures and margin trading) means small price movements can trigger large liquidations. The $4,000 Bitcoin price drop forced $250 million in longs to liquidate in 30 minutes, as traders’ stop-loss orders or margin calls were hit. These forced sales flood the market with additional supply, intensifying downward pressure.

Large sales on exchanges like Hyperunite deplete buy-side liquidity in order books, causing prices to drop until new buyers step in at lower levels. Market makers, anticipating further declines, may widen spreads or reduce buy orders, exacerbating the price fall.

Retail and smaller institutional traders often follow whale movements, assuming they reflect superior market insight. A high-profile sale triggers FUD, leading to a herd mentality where traders sell to cut losses or avoid further declines, amplifying sell pressure.

Speculators and algorithmic trading bots react to price drops and whale activity, often selling automatically based on technical indicators. This creates a self-reinforcing cycle of selling, as seen in the $840 million in liquidations over 24 hours.

Bitcoin’s dominance (often 50-60% of total market cap) means its price movements ripple across altcoins. The whale’s sale not only pressured Bitcoin but also dragged down correlated assets, contributing to the broader 4% market cap decline.

Over time, new buyers (institutions, retail, or other whales) may absorb the excess supply at lower prices, stabilizing the market. The whale’s rotation into Ethereum suggests capital remains in crypto, potentially supporting other assets.

While whale sales still move markets, growing institutional adoption and deeper liquidity pools may reduce their impact over time. External factors could either exacerbate or mitigate sell pressure. For instance, positive developments like ETF approvals or favorable monetary policy could offset whale-driven volatility.

The $2.7 billion Bitcoin sale by a whale underscores the crypto market’s vulnerability to large transactions, triggering sell pressure through on-chain signals, leverage liquidations, and herd behavior. The immediate $250 million in liquidations and $840 million over 24 hours highlight the market’s fragility, while the 4% market cap drop reflects Bitcoin’s outsized influence.