Crypto markets entered late January with total capitalization near $3 trillion, while daily volumes topped $100 billion amid uneven sentiment. XRP news shows tight consolidation at support, and Pudgy Penguins price action stays volatile, but can either deliver outsized profit now?

That uncertainty fuels attention toward ZKP, which researchers describe as a privacy-first AI network and data marketplace built on advanced cryptography. Analysts highlight its energy efficiency, hybrid consensus, and proof-based monetization as a structural upgrade overall.

Technical analysts call Stage 2 the pivot point, where 190 million coins maintain balance. When Stage 3 reduces supply to 180 million, experts anticipate market psychology to drive increased demand, boosting valuations and positioning ZKP as the best crypto to buy.

ZKP Crypto: The Supply Pressure Thesis

ZKP crypto is designed as a private AI network and decentralized data marketplace that rewards users for computation, storage, and verified data. Built on Substrate, it blends zero-knowledge cryptography with real utility, aiming to solve privacy abuse, data leaks, and unfair value extraction across global users and institutions seeking long-term upside worldwide.

Analysts focus on its technical depth: hybrid Proof-of -Intelligence and Proof-of-Space, zk-SNARK verification at 128-bit security, AES-256 encryption, and energy use near 10 watts per terabyte. These mechanics support scalable AI computation while keeping sensitive information mathematically sealed.

Market researchers describe the current presale auction phase as a pressure-building zone, with 190 million tokens released daily to keep liquidity steady. This balance is why some experts already label Zero Knowledge Proof the best crypto to buy, citing disciplined distribution and controlled inflation.

According to technical analysts, the next supply adjustment reduces daily issuance to 180 million tokens. Behavioral models suggest shrinking availability shifts sentiment fast, as participants rush ahead of scarcity, compressing timeframes and amplifying valuation expectations tied to presale milestones.

With a fixed 257 billion supply, 99% lower energy use than Bitcoin mining, and earning paths from Proof Pods, staking, and data markets, analysts see compounding upside. That setup is why experts again frame ZKP as the best crypto to buy before momentum accelerates.

XRP News: Price Holds Key Support as Traders Watch Next Move

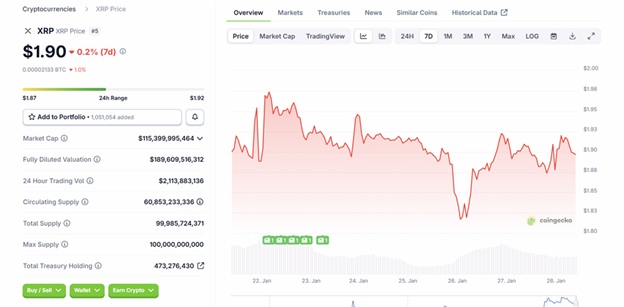

Recent XRP news shows the token trading near $1.88–$1.90 after a 4% pullback, with buyers defending the $1.80 zone. Analysts flag $1.77 as a critical level, noting that a break below it could deepen losses. Despite this pressure, exchange balances are at multi-year lows, suggesting holders are moving coins off platforms and reducing near-term sell supply.

On the development side, Ripple’s Middle East expansion and Saudi sandbox testing support the long-term payments story. Chart watchers see XRP moving in a tight range unless the $2.30 resistance breaks. The latest XRP news reflects a market waiting for direction, where strong fundamentals contrast with cautious sentiment and broader risk-off conditions across crypto.

Source- CoinGecko

Daily volume remains steady, while analysts note that sustained holding above support could set the stage for a momentum shift once overall market confidence improves later this quarter if liquidity and macro pressure ease globally now.

Pudgy Penguins Price: Volatility Around Key NFT Events

Recent Pudgy Penguins price action shows the token trading near $0.0095 – $0.0099, after a sharp 17% pullback ahead of the January 29 NFT snapshot. Circulating supply sits near 62.8 billion tokens, placing market capitalization around $620 – $630 million.

Volume remained active as traders repositioned, while short-term volatility reflected event-driven selling rather than a broad loss of interest across the ecosystem. Community discussions and exchange data suggested holders continued watching roadmap updates closely.

In the days following the snapshot, Pudgy Penguins’ price stabilized within a narrow range, signaling a cautious balance between buyers and sellers. Analysts noted that brand partnerships, including recent sports licensing news, support visibility, but price growth depends on sustained demand.

With meme-driven cycles often short, traders are weighing whether utility expansion can offset speculative fatigue during the coming months. Market participants continue tracking social engagement metrics and on-chain activity for early trend signals this quarter ahead.

The Final Take: Does ZKP Have the Edge as the Best Crypto to Buy?

Recent XRP news points to consolidation near key support, with holders reducing exchange supply while price waits for a clear trigger. Pudgy Penguins’ price action tells a different story, driven by NFT events and short bursts of volatility, followed by stabilization as traders reassess demand.

Analysts reviewing ZKP crypto note a presale auction structure designed to control distribution and behavior. Daily issuance remains steady, which researchers say keeps liquidity balanced and sentiment calm before the next structural shift arrives.

As issuance tightens, experts expect psychology to change quickly, pushing attention toward ZKP crypto. That setup is why analysts increasingly describe it as the best crypto to buy, comparing its timing and structure against slower-moving alternatives across current market conditions globally.

Find Out More about Zero Knowledge Proof:

Website: https://zkp.com/

Buy: https://buy.zkp.com/

Telegram: https://t.me/ZKPofficial