The Trump administration, through the Commodity Futures Trading Commission (CFTC) under Chairman Michael Selig, announced the formation and full membership of the Innovation Advisory Committee (IAC).

This 35-member committee brings together top executives from crypto, decentralized finance (DeFi), traditional finance, prediction markets, sports betting, and major exchanges. The goal is to advise the CFTC on regulating emerging technologies like blockchain, AI, crypto derivatives, tokenized assets, and prediction markets—helping “future-proof” U.S. financial markets and establish clear rules for what Selig called the “Golden Age of American Financial Markets.”

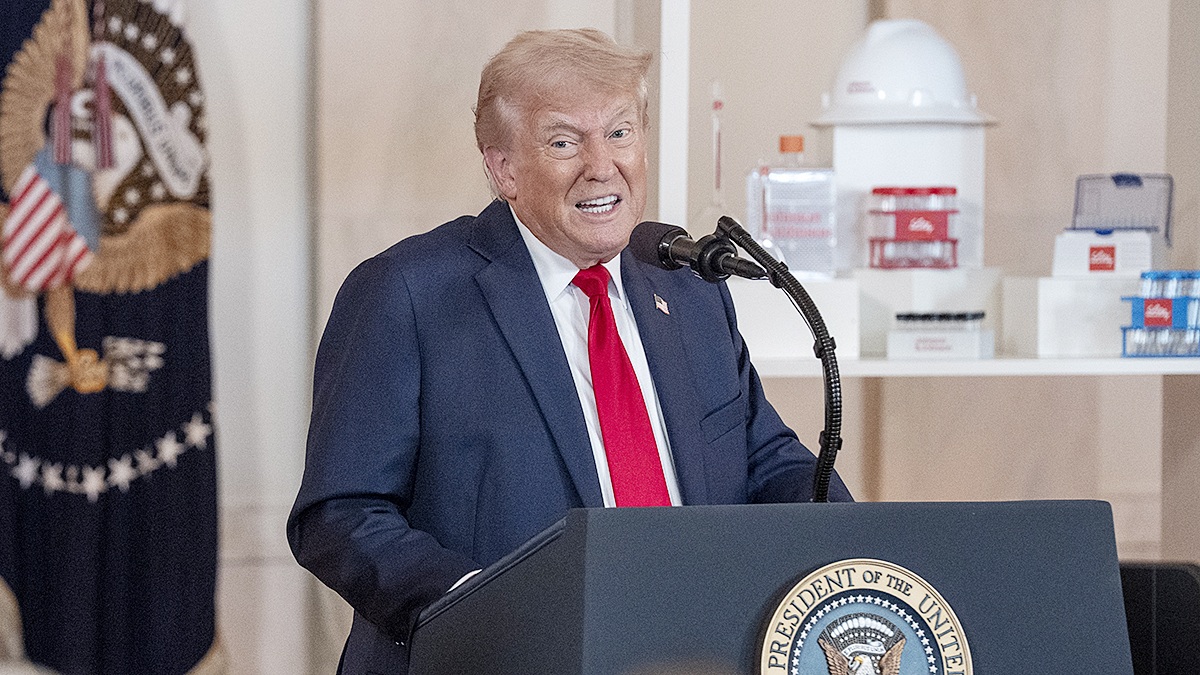

This reflects the administration’s pro-innovation, pro-crypto stance, aiming to position the U.S. as the “crypto capital of the world” by integrating industry leaders into regulatory discussions rather than adversarial enforcement.

Crypto and DeFi Leaders: Includes CEOs from major centralized and decentralized platforms. Notable inclusion of platforms like Polymarket and Kalshi, signaling potential mainstreaming and clearer oversight for event contracts. Heavy representation from exchanges and clearinghouses. Venture capital like a16z crypto, Paradigm and sports betting (FanDuel, DraftKings).

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Notable Members include; Brian Armstrong — CEO, Coinbase, Brad Garlinghouse — CEO, Ripple, Hayden Adams — CEO, Uniswap Labs, Anatoly Yakovenko — CEO, Solana Labs Sergey Nazarov — CEO, Chainlink Labs, Vlad Tenev — CEO, Robinhood, Tyler Winklevoss — CEO, Gemini, Arjun Sethi — Co-CEO, Kraken, Shayne Coplan — CEO, Polymarket, Tarek Mansour — CEO, Kalshi, Chris Dixon — Managing Partner, a16z crypto, Adena Friedman — Chair & CEO, Nasdaq, Terry Duffy — Chair & CEO, CME Group, Jeff Sprecher — CEO, Intercontinental Exchange, Jason Robins — CEO, DraftKings, Christian Genetski — President, FanDuel.

This move builds on earlier Trump-era efforts to clarify crypto regulations and reduce fragmentation between agencies like the CFTC and SEC. It’s seen as a major step toward institutional integration and regulatory clarity for the sector.

This 35-member panel—packed with industry heavyweights—signals the Trump administration’s intent to foster innovation through collaboration rather than enforcement-heavy tactics. The committee’s mandate focuses on advising the CFTC on blockchain, AI, tokenized assets, derivatives, and market infrastructure.

This directly supports goals like establishing a clear crypto asset taxonomy, reducing jurisdictional overlaps with the SEC, and minimizing duplicative compliance burdens. Expect accelerated guidance on tokenized real-world assets (RWAs), perpetual futures, and decentralized platforms, potentially unlocking broader institutional adoption and positioning the U.S. as the “crypto capital of the world.”

Unlike prior administrations’ “regulation by enforcement,” this move emphasizes industry input before rulemaking. It aligns with broader Trump-era policies ending “Operation Chokepoint 2.0”-style restrictions and advancing legislation like the GENIUS Act or market structure bills.

The result could be lighter-touch rules, exemptions for certain DeFi activities, and support for onchain markets—boosting liquidity, volume, and investment in sectors like Bitcoin and ETH derivatives. Platforms like Polymarket (Shayne Coplan) and Kalshi (Tarek Mansour) are prominently featured, alongside sports betting leaders. This indicates the CFTC views event contracts as legitimate financial instruments rather than gambling.

Imminent rulemaking on prediction markets is expected, potentially withdrawing restrictive 2024 proposals and enabling mainstream growth in political, sports, and other event-based derivatives. This could drive explosive volume in platforms offering bets on elections, economic outcomes, or real-world events—while integrating them under federal oversight for greater legitimacy and investor protection.

Heavy representation from Nasdaq (Adena Friedman), CME Group (Terry Duffy), Intercontinental Exchange (Jeff Sprecher), and others bridges crypto with traditional finance. This could accelerate tokenized assets, cross-chain infrastructure via Chainlink’s Sergey Nazarov, and hybrid products—enhancing U.S. competitiveness against global rivals like China.

Some observers from public interest groups note the committee’s heavy industry tilt, questioning balance with consumer protection or academia. Rapid changes might spark short-term volatility or legal challenges, but the overall direction prioritizes “clear rules of the road” for a “Golden Age of American Financial Markets.”

Building on prior initiatives like the CEO Innovation Council and joint CFTC-SEC efforts, this committee could influence near-term rules, with market structure legislation potentially reaching the President’s desk soon.

This isn’t just an advisory group—it’s a deliberate step toward embedding crypto and DeFi leaders in policymaking, signaling regulatory embrace over resistance. It could catalyze a surge in innovation, liquidity, and U.S. dominance in digital finance, though execution will depend on balancing industry input with public safeguards.