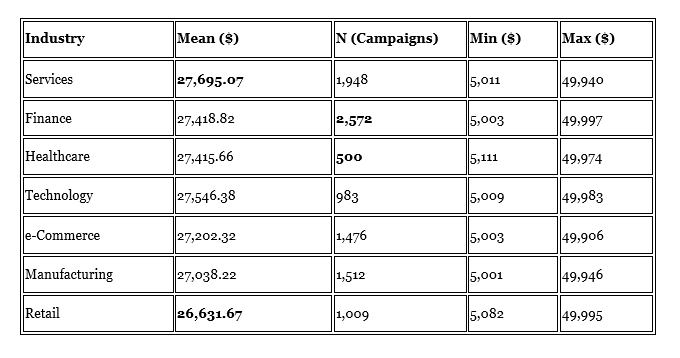

In a world where digital marketing has become essential for business growth, small and medium-sized enterprises (SMEs) are navigating a complex landscape of spending decisions. Analysis of a global data from 10,000 digital marketing campaigns by our analyst reveals intriguing patterns in how different industries approach ad spending. While the overall average investment hovers around $27,000 per campaign, the insights across sectors tell a much deeper story. Understanding these differences can help SMEs make smarter choices and compete more effectively.

Among all sectors, service-based businesses emerge as the top spenders on digital advertising. With an average investment of nearly $27,700 per campaign, the services industry appears to place strong emphasis on visibility and customer acquisition. This makes sense when you consider how competitive and diverse the service sector is. From consulting to hospitality to personal care, service businesses often rely on digital platforms to stand out and build trust with potential customers. For SMEs in this space, the lesson is clear: consistent and bold investment in digital channels can pay off, especially when differentiation is key.

Finance and technology also sit near the top of the list, with average spending just slightly below that of the services sector. Financial firms, in particular, lead the pack in terms of campaign volume. This suggests a high level of engagement with digital marketing strategies. For finance-related SMEs, from fintech startups to small advisory firms, this level of investment reflects a push to attract and retain digitally savvy customers. Trust, clarity, and visibility are critical in this sector, and digital ads offer a fast track to earning them.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Technology firms follow closely behind. These companies often operate in highly dynamic markets, where speed, innovation, and customer attention are everything. Their relatively high ad spend suggests that tech SMEs understand the importance of staying top-of-mind. For entrepreneurs in this space, the takeaway is that digital presence is not just an option. It is often the foundation of long-term growth.

Exhibit 1: Average ad-spend by industry

At the other end of the spectrum lies the retail sector, which shows the lowest average spend among all industries in the analysis. While the difference is not drastic, it is still notable. Given how competitive and fast-paced retail has become, this lower investment might come as a surprise. One possible explanation is the continued reliance on organic reach through social media, foot traffic, or word-of-mouth. However, the data raises a question: Are retail SMEs missing out on opportunities by not investing more aggressively in digital campaigns? With changing consumer habits and growing online competition, there may be real value in revisiting old strategies.

The healthcare sector presents another interesting case. Though it shares a similar average ad spend with top-performing industries, it had the smallest number of campaigns. This may reflect the specific challenges healthcare businesses face, such as advertising restrictions or the highly personalized nature of patient relationships. Still, the relatively high average spend suggests that when healthcare SMEs do engage in digital marketing, they do so with purpose. For businesses in this space, the message is that while digital marketing may require careful planning, it also holds strong potential for outreach and education.

What stands out most from this data is the wide range of spending behaviors, even within the same industry. This shows that there is no one-size-fits-all approach. Some SMEs spend close to the minimum, while others commit near the top of the range. These variations likely reflect differences in business size, digital maturity, growth goals, and market conditions.

For any SME looking to refine its marketing strategy, these sector-specific patterns offer a valuable benchmark. Leaders in services, finance, and technology are setting the pace, showing that smart digital investment can lead to broader reach and stronger brand positioning. Meanwhile, sectors like retail and healthcare reveal opportunities for growth, especially for businesses willing to evolve their approach.

Ultimately, the key takeaway is that ad spend is more than just a number. It reflects a mindset. SMEs that treat digital marketing as a long-term investment rather than a short-term expense are more likely to stay competitive, reach new audiences, and build lasting connections with their customers.