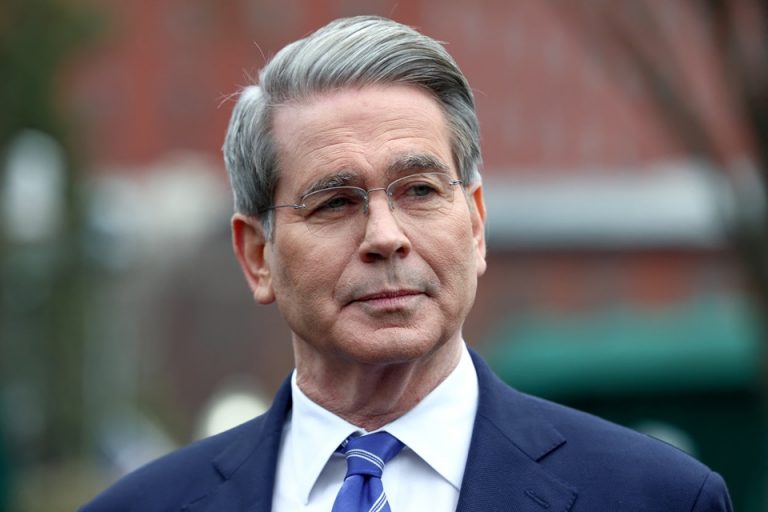

U.S. Treasury Secretary Scott Bessent on Sunday rejected dire warnings from JPMorgan CEO Jamie Dimon that the country’s bond market is heading for a rupture due to runaway spending and lax fiscal discipline.

Speaking on CBS’ Face the Nation, Bessent downplayed Dimon’s concerns as typical of his forecasting style and reassured Americans that the administration was already on course to reduce the deficit gradually over time.

“I’ve known Jamie a long time and for his entire career, he’s made predictions like this. Fortunately, none of them have come true,” Bessent said. “That’s why he’s a banker — a great banker. He tries to look around the corner.”

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Dimon, speaking Friday at the Reagan National Economic Forum, warned that excessive stimulus spending during the COVID-19 pandemic — including quantitative easing and record-breaking deficits — has created a structural imbalance that could result in a “crack in the bond market.”

“It is going to happen,” Dimon said. “I just don’t know if it’s going to be a crisis in six months or six years.”

He said market makers have lost much of their flexibility to absorb shocks, and warned that unless the U.S. reverses its debt trajectory, confidence in its creditworthiness and institutions could erode rapidly.

But Bessent insisted the administration remains committed to fiscal discipline.

“So the deficit this year is going to be lower than the deficit last year, and in two years it will be lower again,” Bessent said. “We’re going to bring the deficit down slowly. We didn’t get here in one year — this has been a long process.”

However, concerns over U.S. fiscal policy are not limited to Dimon. Tesla and SpaceX CEO Elon Musk, who recently stepped down as head of the White House Department of Government Efficiency (DOGE), also voiced his disappointment in what he called reckless spending.

“I was, like, disappointed to see the massive spending bill, frankly, which increases the budget deficit — not decreases it — and undermines the work that the DOGE team is doing,” Musk said in an interview with CBS Sunday Morning. “I think a bill can be big, or it can be beautiful. But I don’t know if it can be both.”

The bill in question, President Donald Trump’s “Big Beautiful Bill”, recently passed in the House and is now under Senate review. The legislation, designed to expand infrastructure, defense, and energy spending, is expected to add $2.5 trillion to the federal deficit over the next decade, according to the Committee for a Responsible Federal Budget.

Peter Schiff, chief economist and global strategist at Euro Pacific Capital, was even more direct, warning that the bill could erode global confidence in the U.S. dollar itself.

“Jamie Dimon warned that if we don’t get our fiscal house in order soon, then in forty years the U.S. dollar won’t be the world’s reserve currency,” Schiff said. “He’s right, but his time frame is off. If the Big, Beautiful Bill passes, the U.S. dollar won’t be the reserve currency in four years!”

Schiff, known for his bearish views on U.S. debt and inflation, has long argued that Washington’s addiction to deficit spending risks destabilizing global markets, especially at a time when countries like China and Russia are building alternative settlement systems that bypass the dollar.

The concerns shared by Dimon, Musk, and Schiff highlight a growing consensus among influential business leaders that the U.S. is approaching a tipping point.

While Bessent continues to defend the administration’s fiscal path, pointing to its pledge to “leave the country in great shape in 2028,” many believe that the rising debt burden, aging infrastructure, and costly new spending plans are placing the U.S. on a dangerous trajectory — one that could rattle global markets and weaken the foundations of the dollar-based global order.