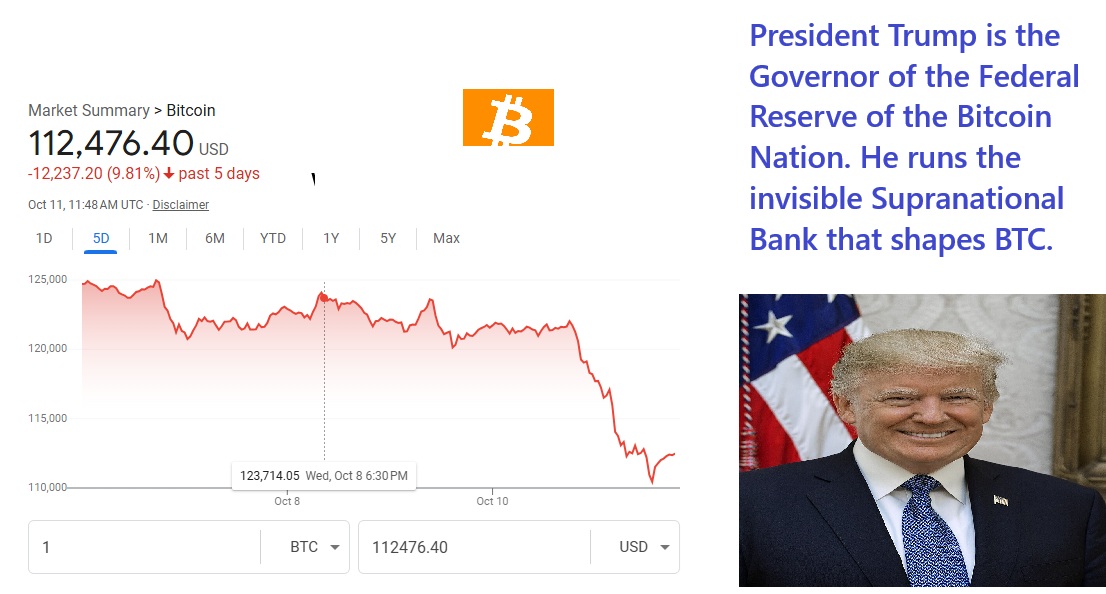

When the leader of the free world sneezes, the crypto economy catches a cold. And this week, President Donald Trump sneezed hard, declaring a 100% tariff on Chinese imports and imposing export controls on what he called “any and all critical software.” The markets panicked. Equities tumbled, and Bitcoin joined the sell-off chorus. It was a powerful reminder that bits are not immune to the physics of global economics. Bitcoin, though decentralized, lives within the gravitational pull of geopolitics.

My doctoral work in banking & finance focused on currency and globalization, studying how currencies ripple through interconnected economies. I have published on these themes in the World Bank and African Union journals (see African Union Paper https://base.afrique-gouvernance.net/docs/volume_21.pdf ). My thesis showed how a single currency, under a supranational authority, can destabilize an entire region when the dominant economy fails to maintain discipline. Imagine a West African ECO currency governed by a “Central Bank of West Africa.” If Nigeria, with its outsized GDP, mismanages inflation or fiscal policy, smaller economies like Benin or Togo will experience welfare losses, not because they did anything wrong, but because Nigeria’s instability would hijack the regional monetary equilibrium.

The Eurozone avoided that fate largely because of its homogeneity. Yes, similar economic structures and governance systems. West Africa, by contrast, is a mosaic of heterogeneity. What happens in Port Harcourt does not mirror what happens in Cotonou. The same asymmetry now plays out on a global scale with Bitcoin. Though it is borderless, its pulse responds to decisions made in Washington, Beijing, and Brussels. El Salvador may adopt Bitcoin as legal tender, but when America coughs, El Salvador’s balance sheet trembles. The irony is profound: a decentralized asset now depends on centralized politics.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

In this new construct, the G6 leaders plus China, whether they know it or not, are the de facto central bankers of Bitcoin. Through fiscal decisions, tariffs, and macroeconomic posturing, they set the emotional temperature of the crypto market. The ideal of Bitcoin as a sovereign-free refuge is noble. But in practice, it remains a derivative of global trust, a trust still denominated in dollars. The dream of total independence from the traditional order remains a work in progress. But the path is long!

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube