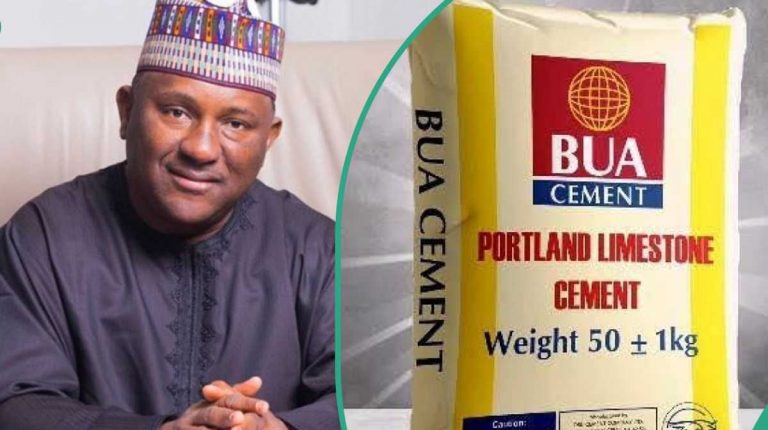

Nigeria’s naira could strengthen significantly against the U.S. dollar by the end of 2025, according to BUA Group Chairman Abdul Samad Rabiu, who expressed rare optimism about the economy after a closed-door meeting with President Bola Ahmed Tinubu at the Aso Villa on Wednesday.

“The exchange rate has continued to improve. Naira is trading below N1,500 today, and I’m confident it will strengthen even further. I expect that the rate should come down to maybe N1,300 to N1,400 before the end of the year. This is something we should all celebrate,” Rabiu said.

The billionaire industrialist tied his forecast to ongoing fiscal reforms, improved market confidence, and reduced reliance on Central Bank of Nigeria (CBN) interventions, arguing that businesses now access foreign exchange more freely through global banking channels, including ATMs and credit cards abroad.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Rabiu also pointed to a softening of food prices as evidence that reforms are trickling down to households. Earlier this year, BUA said it slashed the price of a 50kg bag of rice from over N100,000 to N50,000, triggering what he described as a broader trend of price corrections.

“Products such as flour, pasta, macaroni, semolina, and others that we produce have seen significant price reductions from what they were last year,” he noted.

He credited the Tinubu administration’s duty waivers on key food imports for helping stabilize costs and domestic supply chains, saying, “We must acknowledge and appreciate His Excellency for these waivers. They have contributed greatly in making this possible.”

The BUA chairman stressed that the reforms are beginning to instill confidence among businesses, framing them as “bold” and “decisive” steps, laying the foundation for long-term growth.

“There are bold reforms and decisive policies creating the foundation for a stronger economy, a more stable currency, and a better future for businesses and Nigerians alike,” Rabiu said.

Global Institutions More Cautious

Rabiu’s upbeat projection stands in contrast to more guarded assessments from rating agencies and global lenders. The International Monetary Fund (IMF) has repeatedly warned that Nigeria’s foreign exchange market remains fragile, stressing that currency stability cannot be sustained without higher non-oil revenues, improved fiscal discipline, and stronger reserves. The World Bank has similarly flagged risks tied to low oil production, heavy debt servicing, and ongoing structural bottlenecks, cautioning that reforms, though positive, are not yet sufficient to anchor lasting stability in the naira.

Credit rating agencies have echoed this concern. Moody’s and Fitch both noted earlier this year that while recent measures by the Tinubu administration—including subsidy removals and exchange rate liberalization—have improved transparency, Nigeria’s external vulnerabilities remain high. Fitch said the naira’s recent rally is “vulnerable to reversal” if foreign inflows do not rise substantially.

Analysts Link Gains to Global Trends

Some economists argue that the naira’s recent appreciation is tied less to local reforms and more to global monetary conditions and U.S. fiscal uncertainty.

“Recent disinflationary trends, and more importantly, the easing in the U.S. market, have afforded some room for the CBN to ease off the brakes. As rates decline in the U.S., the risk premium generally becomes lower,” said financial analyst Abdulrauf Bello.

“Additionally, the USD is under pressure due to the current state of the U.S. fiscal deficit and ongoing trade disputes between the U.S. and its trading partners,” Bello added, referencing trade tensions that have escalated under President Donald Trump’s tariff policies.

Against this backdrop, there is concern that if the dollar regains strength, the naira’s fragile recovery could quickly reverse. The Trump administration is already facing legal challenges over the legality of its tariff regime, a development that has injected volatility into global markets. A ruling against the U.S. government could trigger unpredictable shifts in trade flows and currency values.

Currency Still Under Pressure

Despite Rabiu’s optimism, data from the CBN shows the naira remains under pressure. On Thursday, it closed at N1,493.99/$1 in the official market. In the parallel market, it slipped further to about N1,521.5/$1, widening the gap with the official rate.

The projection of a recovery to N1,300–N1,400 per dollar by year’s end, therefore, represents a bold bet on both domestic reforms and global tailwinds aligning—a scenario that, while possible, remains uncertain.