Commerce Secretary Howard Lutnick said Tuesday that Intel must give the U.S. government an equity stake in the company in return for CHIPS Act funds.

“We should get an equity stake for our money,” Lutnick said on CNBC’s Squawk on the Street. “So we’ll deliver the money, which was already committed under the Biden administration. We’ll get equity in return for it.”

Shares of the struggling chipmaker climbed nearly 7% on Tuesday, continuing to rally on recent reports that the Trump administration is weighing different ways to get involved with the company. Bloomberg reported Monday that the White House was discussing a 10% stake in Intel, in a deal that could see the U.S. government become the chipmaker’s largest shareholder.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Intel and SoftBank announced Monday that the Japanese conglomerate will make a $2 billion investment in the chipmaker. The investment, equal to about 2% of Intel, makes SoftBank the fifth-biggest shareholder, according to FactSet. The move is part of SoftBank’s broader pledge to expand investment in the U.S. under President Donald Trump’s domestic manufacturing agenda, which has emphasized “reshoring” critical industries such as semiconductors.

Lutnick said any potential arrangement wouldn’t provide the government with voting or governance rights in Intel.

“It’s not governance, we’re just converting what was a grant under Biden into equity for the Trump administration, for the American people,” Lutnick said. “Nonvoting.”

Lutnick also suggested that President Trump could seek out similar deals with other CHIPS recipients. Intel said last fall that it had finalized a nearly $8 billion grant from the law to build its factories. Taiwan Semiconductor Manufacturing Co. (TSMC) was awarded $6.6 billion under the legislation to boost chip fabrication at its Arizona facilities.

Trump’s “Silicon Heartland” Vision

Trump has repeatedly called for more reshoring of U.S. manufacturing to reduce the country’s reliance on foreign foundries such as Samsung and TSMC. Intel has been spending billions near Columbus, Ohio, to build a series of chip factories that the company previously dubbed the “Silicon Heartland.” Intel has said the factory complex would eventually produce the most advanced chips, including AI semiconductors critical to national security and next-generation computing.

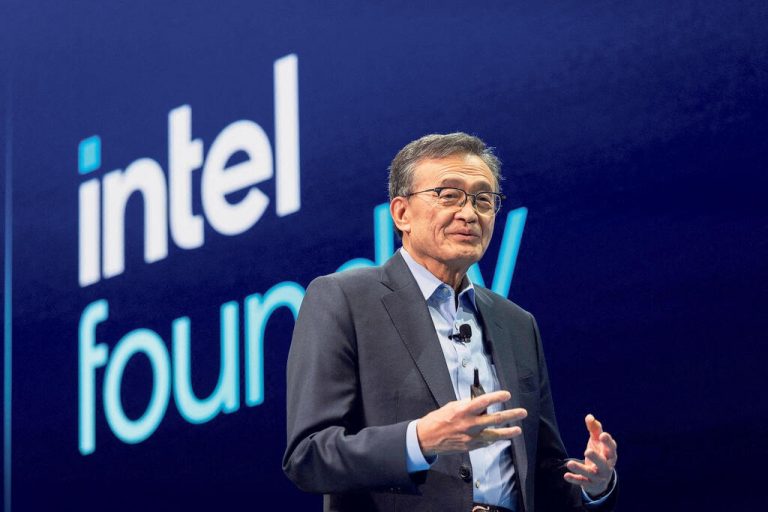

However, in July, Intel CEO Lip-Bu Tan warned employees in a memo that there would be “no more blank checks,” signaling the company was slowing down construction of the Ohio factory complex depending on market conditions. The first factory is now scheduled to begin operations in 2030 — a significant delay from earlier timelines.

The Ohio project remains one of the most high-profile initiatives backed by the CHIPS and Science Act, a $53 billion program passed in 2022 to support semiconductor research, development, and manufacturing in the U.S.

“The Biden administration literally was giving Intel for free, and giving TSMC money for free, and all these companies just giving them money for free,” Lutnick said. “Donald Trump turns that into saying, ‘Hey, we want equity for the money. If we’re going to give you the money, we want a piece of the action.'”

Intel’s Struggles in AI and Leadership Shake-Up

Intel has lagged behind rivals Nvidia and AMD in capitalizing on the artificial intelligence boom. The company has poured billions into standing up a manufacturing business, but has yet to secure a significant long-term customer. Intel tapped Lip-Bu Tan as CEO in March after ousting Pat Gelsinger in December.

Tan’s leadership has already been controversial. He met with Trump at the White House last week after the president publicly called for his resignation, citing concerns over his alleged ties to China.

SoftBank’s Strategic Bet

SoftBank’s $2 billion bet on Intel marks one of the most significant U.S. investments by the Japanese group since Trump urged global firms to channel more capital into American advanced manufacturing. SoftBank founder Masayoshi Son has previously pledged tens of billions toward U.S. technology ventures, aligning with Trump’s broader effort to restore the country’s leadership in critical sectors.

With Trump’s administration pushing to secure domestic control of chipmaking, Intel finds itself at the center of both government oversight and foreign strategic investment. The looming equity arrangement, if finalized, would represent a historic precedent: one that gives the U.S. government a sizable stake in one of its most important technology companies.