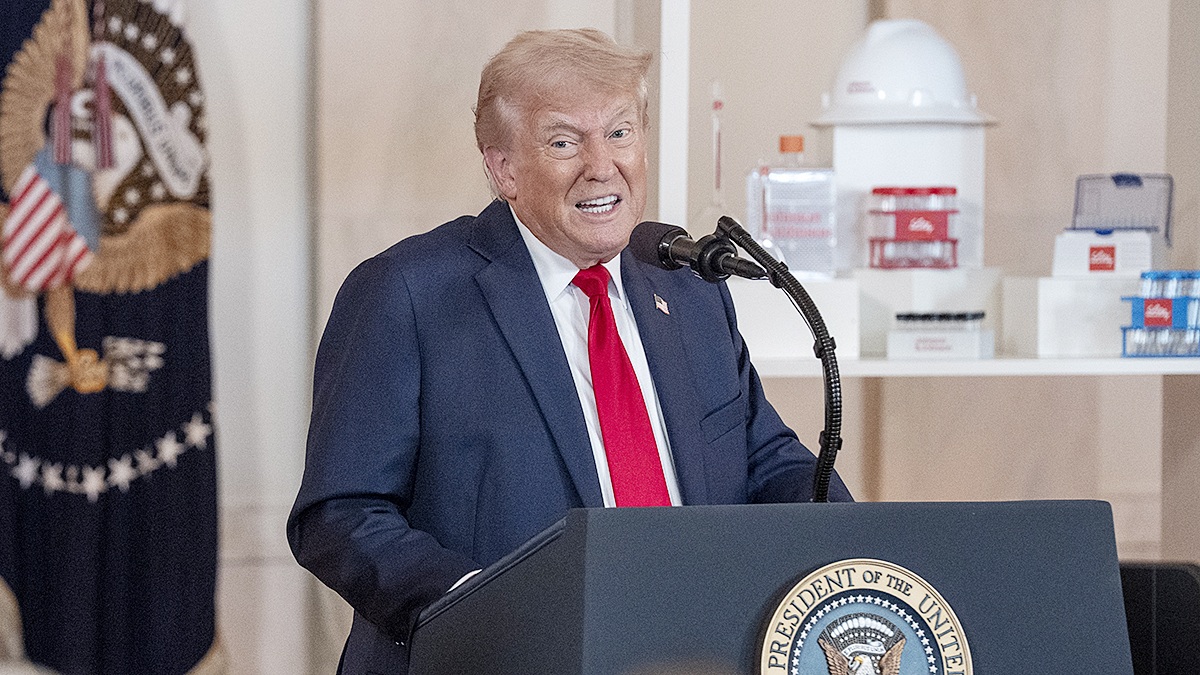

One year into President Donald Trump’s return to the White House, a palpable tension is building between the administration’s aggressive economic interventions and the traditional pillars of American business.

With tariffs expanding, government stakes in private sectors deepening, and immigration enforcement escalating, executives are increasingly voicing measured concerns, signaling a shift from the cautious optimism that marked the early months of his second term.

This dynamic was underscored last week by U.S. Chamber of Commerce President and CEO Suzanne Clark, whose annual State of American Business address served as a rallying cry for unfettered markets amid what she described as a national “hinge point.” In her January 15 keynote, delivered to an audience of business leaders, policymakers, and journalists at the Chamber’s headquarters, Clark declared the state of American business to be “growth-oriented, market-driven, future-focused—but above all, fearless.”

Register for Tekedia Mini-MBA edition 20 (June 8 – Sept 5, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Framing 2026 as a critical juncture coinciding with the nation’s 250th anniversary, she urged a recommitment to free enterprise principles that have historically driven innovation and prosperity. Clark highlighted the lessons of history, pointing to post-World War II policy choices that ushered in eras of growth through low taxes, stable regulations, and robust trade.

She advocated for policies enabling sustained 3% GDP growth, including investments in education, research and development, and infrastructure, while warning against fear-based decisions that could lead to stagnation.

“These pro-growth policy choices begin to alleviate the pressures and frustrations people are feeling right now, today,” Clark said, emphasizing openness to global exchanges of talent, goods, ideas, and innovation.

While Clark avoided direct references to Trump or specific policies, her emphasis on resisting government control resonated as a subtle rebuke to the administration’s hands-on approach. Trump has directed federal involvement in tech companies, influenced corporate equity structures, imposed broad tariffs, and advanced strict immigration measures—actions the Chamber has historically opposed.

In a follow-up briefing with reporters on January 16, Clark reiterated the group’s stance, saying: “We are against government intervention in business, no matter which party is suggesting it.”

Neil Bradley, the Chamber’s chief policy officer, had earlier emphasized a nonpartisan approach to maintaining free-market support.

The address drew praise from industry figures, including Gary Shapiro, CEO of the Consumer Technology Association, who commended Clark for “championing a pro-business, growth economy future” in a powerful speech.

Yet, it also highlighted a broader reluctance among leaders to confront the White House head-on, a departure from Trump’s first term when executives more openly split over issues like the 2017 Charlottesville rally.

Corporate governance experts attribute this caution to fears of retaliation, as the administration has shown a willingness to punish dissent through investigations or exclusions from deals.

Recent examples illustrate this tempered pushback. On January 9, Exxon Mobil CEO Darren Woods labeled Venezuela “uninvestable” during White House discussions on oil infrastructure, directly countering administration optimism about the region’s potential.

While expressing confidence in Trump’s plans and mentioning a potential technical team deployment, Woods’ candor prompted a swift rebuke from the president, who suggested Exxon might be sidelined from future opportunities.

“I didn’t like their response. They’re playing too cute,” Trump told reporters.

Exxon declined to comment further. JPMorgan Chase CEO Jamie Dimon, on January 13, defended Federal Reserve Chair Jerome Powell’s independence amid a Justice Department criminal probe into Powell’s conduct, warning that meddling could reignite inflation.

Trump dismissed the remarks, stating, “I don’t care what he says.”

Dimon’s comments came as the administration proposed a 10% cap on credit card interest rates, prompting JPMorgan to declare “everything is on the table” in fighting the directive.

Pfizer CEO Albert Bourla, on January 12, voiced frustration over Health Secretary Robert F. Kennedy Jr.’s efforts to roll back childhood vaccine recommendations, deeming them without “scientific merit.”

These critiques, while pointed, remain sector-specific, aligning with experts’ observations that CEOs are taking “baby steps” only when policies directly impact their operations.

Broader critiques have emerged from figures like Sen. Elizabeth Warren, who noted on January 9 that Trump’s second year is starting with a weaker job market and higher prices, contrary to campaign promises.

Internationally, Canadian business sentiment has soured, with pessimism spiking as Trump enters 2026, citing uncertainty from tariffs and trade tensions.

Experts like Richard Painter, a University of Minnesota law professor and former ethics lawyer under President George W. Bush, called for a more aggressive Chamber stance, decrying Trump’s “authoritarian approach” in contrast to Bush’s free-market policies.

“A lot of executives may have voted for Trump, but they need to speak out against coercion,” Painter said.

New York City Comptroller Mark Levine criticized the limited scope of CEO responses, arguing that allowing autocratic tendencies undermines capitalism.

The Conference Board’s recent CEO survey identified uncertainty as the paramount risk for 2026, with chief economist Dana Peterson noting evolved lobbying dynamics under Trump.

Gary Clyde Hufbauer of the Peterson Institute for International Economics warned that calibrated criticisms might position companies for short-term gains but risk heavier post-Trump regulation, labeling state capitalism as “catnip” for both parties.

Economic indicators paint a mixed picture. Trump’s approval on the economy stands at 36%, below his overall 41% rating, per recent polls. Inflation has dipped to 2.6%, but job growth stagnates in a “low hire, low fire” market, with the federal deficit swelling by $6.2 billion daily to $30 trillion.

Despite Trump’s claims of exploding growth and defeated inflation, public pessimism persists over affordability. Supporters highlight tariff successes, with economist Mohamed El-Erian noting minimal consumer impact and boosted onshoring.

Trump’s first year has also raised alarms on press freedom, with actions like censoring government data, dismantling public broadcasters, and halting international media aid, according to Reporters Without Borders.

These moves, combined with mass deportations (over 622,000 reported) and federal workforce downsizing, reshape the business landscape. The Partnership for Public Service predicts increased political interference in the civil service this year, potentially hampering efficiency.

As midterms loom, analysts like conservative Yuval Levin question Trump’s legacy, suggesting his actions may not endure without institutional foundations. Atlantic Council’s Josh Lipsky anticipates more tariffs in 2026, despite potential Supreme Court setbacks.

Privately, executives admit limited appetite for compliance, adopting a strategy of grand promises followed by minimal action until Trump’s focus shifts.