A high-energy debate unfolded in Dubai as Changpeng Zhao (CZ) and long-time gold advocate Peter Schiff delivered one of the most widely watched Bitcoin-versus-gold showdowns of the year. Their exchange ignited a global conversation about scarcity, real-world utility, and how value will be defined in the coming digital era.

Meanwhile, investor attention within cryptocurrency presales 2025 continues to shift toward Mono Protocol, now viewed as one of the best crypto presale opportunities of the current cycle.

A Debate That Split the Audience Across Bitcoin and Gold

The discussion at Binance Blockchain Week 2025 drew both a packed venue and a massive online audience. Binance described the event as “intense and intellectual,” capturing how firmly both sides defended their beliefs.

CZ argued that Bitcoin’s fixed supply and transparent ledger give it an advantage over gold in long-term value preservation. He emphasized that global gold reserves remain partly uncertain, while Bitcoin offers verifiable supply and seamless transferability. In his view, BTC’s design positions it to outperform gold over extended time horizons.

Schiff pushed back sharply, repeating his long-held view that Bitcoin lacks intrinsic value. He argued that BTC has no industrial function, nothing in the world is priced in Bitcoin, and most usage still revolves around speculative trading rather than economic activity.

Their sharpest exchange came when CZ held up a 1kg gold bar from Kyrgyzstan and asked Schiff to authenticate it. Schiff admitted he could not confirm its legitimacy without laboratory testing — a moment CZ used to highlight Bitcoin’s instant verifiability.

The two also disagreed on payments. Schiff said crypto cards convert BTC to fiat behind the scenes. CZ responded that users care about speed, not the backend, and that crypto is already being used in commerce with conversions handled automatically.

Mono Protocol Gains Visibility as Investors Seek Early-Stage Utility

While Bitcoin and gold continue to dominate macro discussions, early-stage investors tracking the presale crypto market are concentrating on utility-driven projects. Mono Protocol has emerged as one of the most talked-about entries in the top crypto presale category thanks to its unified cross-chain execution model.

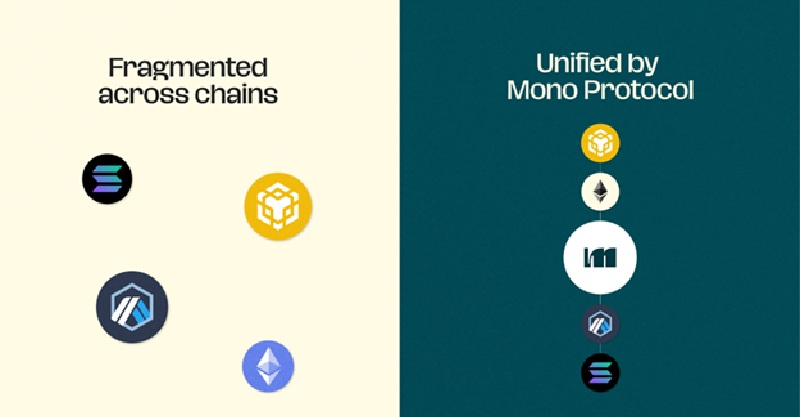

Mono Protocol introduces a single balance per token across all networks, eliminating bridges, manual routing, and fragmented experiences. Its architecture features Liquidity Locks, universal gas, MEV-resistant routing, execution bonds for instant settlement, and staking-secured governance.

This unified approach addresses one of Web3’s most persistent problems: the complexity of using and building across multiple blockchains. As more investors evaluate long-term infrastructure plays, Mono Protocol continues drawing attention within cryptocurrency presales 2025.

Presale Progress and Growing Demand Ahead of Beta Launch

Mono Protocol is currently in Stage 19 at $0.0550, with $3.76M raised. The project’s December 8 beta release is expected to demonstrate unified balances and cross-chain execution under live market conditions. Its projected 809% listing margin has contributed to steadily rising interest among those searching for the best crypto presale opportunities before the next market cycle strengthens.

Conclusion

CZ and Peter Schiff’s debate emphasized the enduring divide between digital and physical stores of value, offering a clear snapshot of how global narratives around money continue to evolve.

At the same time, Mono Protocol is gaining momentum as a standout in the presale cryptocurrency market, offering structural solutions that position it differently from speculative early-stage tokens. As investors evaluate macro assets and emerging infrastructure projects, both narratives reflect the shifting landscape heading into 2025.

Learn More about Mono Protocol

Website: https://www.monoprotocol.com/

X: https://x.com/mono_protocol

Telegram: https://t.me/monoprotocol_official