Public search interest is one of the clearest mirrors of public curiosity, concern, and behaviour in the age of emerging technologies. In healthcare, search engines have become the first point of consultation for millions of Nigerians seeking information about symptoms, treatment, and care facilities. Between 2020 and 2024, public’s search data reveals an extraordinary story, shaped by the pandemic, recovery, and stabilization. Through the data, our analyst notes that stakeholders can understand not only what Nigerians searched in the past, but also what they are likely to search for by 2029.

The Pandemic Years: A Surge in Health Queries

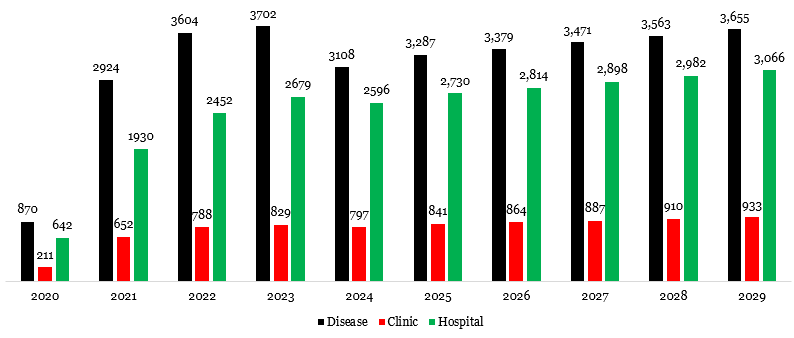

The year 2020 set a modest baseline with just 870 searches for “disease,” 211 for “clinic,” and 642 for “hospital.” By 2021, the situation was very different. As COVID-19 spread, disease-related searches exploded to 2,924, a growth of more than 236 percent. Nigerians were urgently seeking explanations, updates, and guidance about the health crisis. The pattern continued into 2022, with searches for disease surpassing 3,600, and interest in hospitals rising to 2,452. Clinics also gained attention, moving from 211 in 2020 to 788 in 2022.

This was more than digital curiosity. It reflected a population looking for answers in a moment of fear and uncertainty. After searching for diseases, Nigerians began to focus on solutions. They turned to queries about clinics and hospitals, indicating a transition from understanding symptoms to finding treatment options. In a way, search data tracked the nation’s collective movement from confusion to action.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

The Slowdown: Stabilization After the Crisis

By 2023, the pattern shifted again. Searches for diseases increased only slightly, while clinic and hospital queries grew modestly. Then in 2024, interest in all three categories declined. Disease searches dropped by 16 percent, clinic queries fell by nearly 4 percent, and hospital searches slipped by just over 3 percent.

Exhibit 1: Public search interest in disease, clinic and hospital between 2020 and 2029 (with projection)

This slowdown was not surprising. With the most intense phase of the pandemic behind them, Nigerians no longer searched with the same urgency. Instead, health-related searches began to reflect a return to normal rhythms. People could rely on offline knowledge from healthcare providers, community resources, and public campaigns. The search engine was no longer the only source of reassurance or information. What had been a spike of emergency-driven interest gave way to a calmer, more balanced pattern.

The Forecast: Steady Growth Through 2029

Looking ahead, projections suggest that health searches will continue to grow, but at a more stable and modest pace. Between 2025 and 2029, searches for diseases are expected to rise gradually from 3,287 to 3,655. Clinic searches are projected to move from 841 to 933, while hospital searches will grow from 2,730 to 3,066. These increases amount to roughly two to three percent growth per year.

The data indicates that Nigerians will not return to the extreme spikes of the early 2020s, but neither will interest decline further. Instead, a steady climb reflects the maturity of search behavior. Health topics remain important, but searches will increasingly be about ongoing care, preventive health, and accessible treatment. The transition from volatile growth to steady progress suggests that Nigerians are developing a long-term digital relationship with healthcare rather than reacting only to crises.

What This Means for Healthcare Leaders

This evolution in search behavior carries important implications for the health sector. For healthcare providers, the steady rise in searches for clinics and hospitals highlights the need for strong digital visibility. Nigerians will continue to search for care locations, so clinics and hospitals that provide clear online information will remain competitive.

The stabilization of disease searches creates room for preventive education. Public health communicators should take note of this. Nigerians are no longer searching in panic, which means they may be more receptive to campaigns about chronic conditions like hypertension, diabetes, and maternal health.

The trend suggests that search behaviour is a barometer of trust. The shift from self-diagnosis to searching for care institutions indicates that Nigerians are prepared to engage with the health system if access is clear and affordable. Investments in healthcare infrastructure will reinforce this trust and strengthen outcomes.

For technology and digital health innovators, the steady growth curve signals opportunity. Nigerians will increasingly value platforms that connect them to providers, offer telemedicine consultations, and deliver verified health content.