Elon Musk’s artificial intelligence venture, xAI, is investing over $20 billion to build a sprawling new data center in Southaven, Mississippi, as competition for advanced computing power intensifies across the generative AI sector.

State officials confirmed the project on Thursday, with operations at the facility, called “MACROHARDRR, expected to begin by February 2026.

The investment comes amid a nationwide surge in AI infrastructure spending, driven by the need to train increasingly sophisticated AI models. xAI, which competes directly with industry leaders such as OpenAI’s ChatGPT and Anthropic’s Claude, is seeking to expand its computational capacity and secure a strategic foothold in the AI hardware arms race.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Strategic Location and Synergies

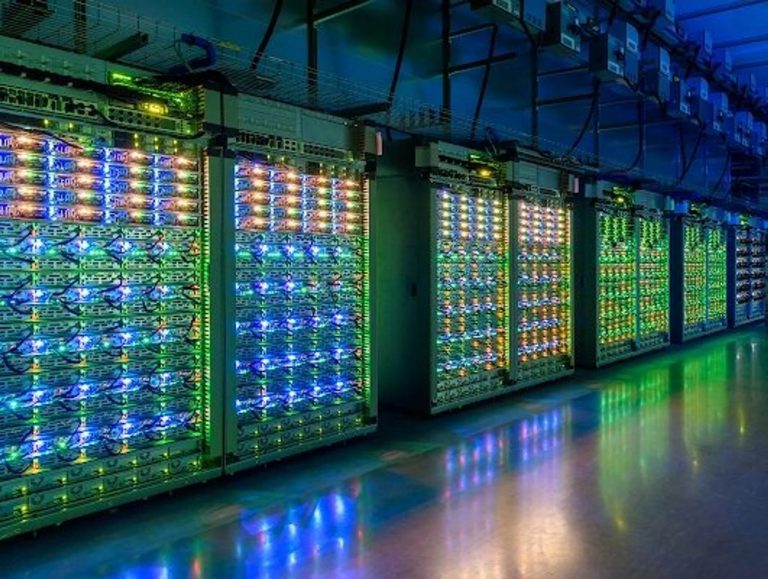

The Southaven data center sits near xAI’s newly acquired power plant and the company’s existing data center in Memphis, Tennessee, home to its Colossus supercomputer cluster, which Musk has described as the world’s largest. By co-locating compute facilities near power sources, xAI aims to mitigate energy costs—a critical factor for running high-performance AI clusters.

The expansion is expected to raise xAI’s overall compute capacity to 2GW, enabling faster training of massive models and lowering latency across its AI services.

Timeline of xAI Infrastructure Moves (2025–26)

- January 2025 – Memphis Expansion: xAI officially launched operations at its Memphis supercomputing hub, Colossus, solidifying its first major AI compute cluster. The facility became the central node for training large language models and powering the Grok chatbot.

- June 2025 – Strategic Hardware Acquisitions: xAI began deploying state-of-the-art GPUs and specialized AI accelerators, with Bloomberg reporting $7.8 billion in cash outflows in the first nine months of 2025 for hardware, software, and operational costs.

- December 30, 2025 – Southaven Purchase: Musk announced the acquisition of a site in Southaven for a new data center and nearby power plant. At the time, he described the investment as a move to boost compute to 2GW, but did not disclose the financial scale.

- February 2026 (Projected) – Southaven Operations Begin: xAI expects the MACROHARDRR data center to go online, connecting to both its Memphis supercomputer and the adjacent power plant, creating a contiguous AI compute and energy ecosystem.

- Q2 2026 (Projected) – Further Scaling: Additional compute capacity is expected to come online as xAI leverages its Mississippi assets and secures new high-performance servers from key suppliers, cementing its ability to train increasingly advanced models.

The scale of xAI’s investments underscores the enormous capital requirements for AI infrastructure. Training a single next-generation model can cost hundreds of millions of dollars in electricity, hardware, and personnel. Musk’s $20 billion commitment is among the largest single-site investments in U.S. AI infrastructure, signaling that xAI is taking an aggressive stance to compete with well-capitalized rivals such as OpenAI, Anthropic, and tech giants including Google and Microsoft.

Access to computing is noted as a critical differentiator in generative AI. But the largest models require both high-capacity servers and reliable, low-latency power.

The AI Infrastructure Boom

xAI’s expansion comes amid intensifying race across the tech industry to expand AI infrastructure. AI hyperscalers and cloud providers have been investing billions in data centers to keep up with surging demand for generative AI services. States are also increasingly competing to attract such projects, offering access to power, land, and logistical support. Mississippi’s success in attracting xAI highlights the growing importance of regional incentives and infrastructure in shaping the U.S. AI landscape.

While xAI has deep financial resources, the burn rate is significant. Bloomberg reported that the company spent $7.8 billion in cash in the first nine months of 2025, primarily on servers and AI accelerators. Such investments are essential, analysts say, because the speed at which a model is trained directly impacts competitiveness in the fast-moving AI market.

For Musk, the Southaven data center is not just about compute; it is a strategic signal of xAI’s ambition to challenge entrenched players. By creating a high-capacity, energy-secure AI hub, xAI is aiming to handle trillion-parameter-scale models, potentially narrowing the gap with OpenAI, Anthropic, and other well-funded startups.

The Southaven project also marks a new phase in Musk’s approach to AI infrastructure: integrating energy production with compute operations to reduce costs, ensure uptime, and maintain control over the entire AI training pipeline—a model increasingly seen as essential for any company seeking to compete at the cutting edge of generative AI.

In sum, xAI’s $20 billion Southaven investment, combined with the Memphis Colossus cluster and new power plant assets, underpins the company’s determination to become a major global AI contender. It also underscores how infrastructure—and not just algorithms—is increasingly the battlefield for AI dominance.