Dogecoin’s roller-coaster reputation remains intact. After an unprompted public apology to former president Donald Trump on 11 June, Elon Musk followed up with a flurry of light-hearted DOGE memes on X. Traders immediately piled in: DOGE leapt to $0.20 before cooling to $0.176 in Sunday trading, with 24-hour volume still hovering near $690 million.

Musk’s on-again, off-again courtship of the canine-themed token has repeatedly driven short-term price spikes, and analysts expect more of the same now that the billionaire is free from the political spotlight. Options data show renewed open interest around the $0.22–$0.24 strike for late-summer expiries—hardly a moonshot, but enough to keep day traders alert.

Why Twitter Feeds Are Suddenly Full of “$APORK”

Scrolling Crypto Twitter this weekend, it is impossible to miss the red frog snout of Angry Pepe Fork (APORK). The project positions itself as a next-gen meme coin that blends CommunityFi (social tasks that pay), GambleFi (on-chain mini-games that burn tokens on each payout), and soon-to-come multi-chain bridging to Solana, Ethereum, and BNB Chain.

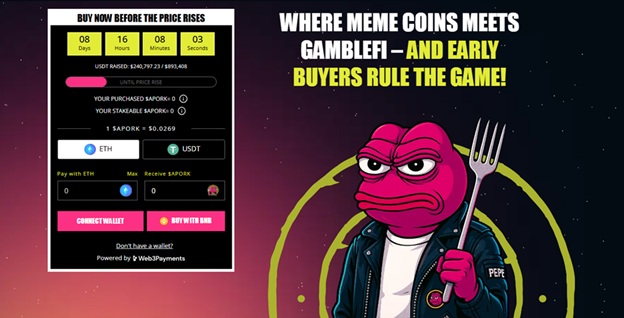

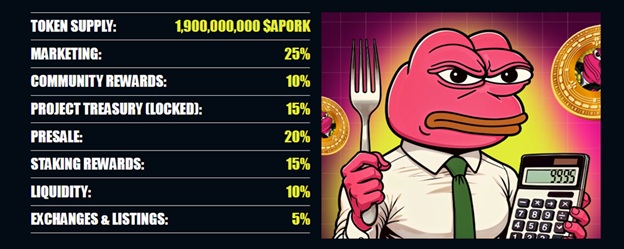

The numbers behind the excitement are straightforward: the presale has raised $240,797.23 out of a first-stage target of $893,408, selling tokens at $0.0269 USDT (that’s roughly 92,661 APORK per ETH at current rates). Solidproof-audited, supply is capped at 1.9 billion, with 380 million reserved for presale and a deflationary burn every time someone wins inside the GambleFi arcade. Early entrants can also stake immediately—APYs start in five digits and shrink each time a new tier fills, creating a visible countdown.

From Presale Hype to Main-Net Reality—Can Gains Stick?

Presale tokens regularly tout “10x potential,” yet many crumble the moment they list. APORK’s team is trying to mitigate that by spreading liquidity across three chains and locking trading fees for subsequent burns.

If the cast burn rate of 2% of every prize pot holds, circulating supply could fall by about 10% in the first year of live gaming—small, but meaningful for a meme coin. Add the fixed presale price and tiered airdrops, and presale buyers effectively lower their dollar-cost average before the first DEX pair is seeded.

A quick back-of-the-envelope comparison: DOGE would need to revisit its 2021 all-time high of $0.73 to deliver a 4× return from today’s levels. For APORK, a first-listing pop to just $0.11—not unusual for well-marketed meme launches—would already be a 4×.

Whether that happens depends less on tokenomics than on attention, and the project is leaning hard into viral antics. Weekly presale round-ups even slotted APORK ahead of several Solana newcomers in the presales to watch list, citing its GambleFi hook as the main differentiator.

Risk Meter: Blue-Chip Meme vs. High-Beta Newcomer

Investors weighing DOGE against APORK are really choosing between liquidity and leverage. DOGE enjoys billion-dollar daily volumes and institutional exposure via futures markets, but its upside is increasingly tied to Musk’s unpredictable headlines. APORK offers low float and aggressive reward mechanisms, yet lives or dies by sustained social engagement after launch.

The presale soft-cap sits at $4 million; if it closes there, APORK’s fully diluted value at $0.0269 would be just over $51 million—peanuts compared with DOGE’s $25 billion market cap. That small base makes triple-digit percentage moves plausible, but it also means slippage can be brutal if hype fades. Prospective buyers should treat APORK as a high-beta satellite position rather than a core holding.

Price Outlook: DOGE Drifts, APORK Counts Down

Chart watchers see DOGE oscillating between $0.17 support and $0.19 resistance until a fresh Musk catalyst arrives. A daily close above $0.195 could invite a push to $0.24, while a slump below $0.169 might test $0.155. For APORK, every hour of presale inflow inches the staking APY lower, nudging latecomers toward larger tickets. If the hard-cap of $10 million is hit before month-end, first-day liquidity could exceed $3 million—ample fuel for a speculative surge.