Since last month, the Ethereum Price has resonated in the fixed range spread from $1680 to the $1500 mark. With the recent sell-off in the crypto market, the Ethereum price has returned to $1500 support, trying to replenish the exhausted bullish momentum, $ETH is currently trading around $1549 per Ether.

However, the U.S. Bureau of Labor Statistics released January CPI as 6.4% causing mixed sentiment in the crypto market, with Ethereum declining in Price following Investors reactions on the latest CPI data.

The Ethereum coin daily time frame chart showed the formation of a cup and handle pattern. This is one of the famous bullish reversal patterns that showcase a sign of sustained recovery in the market. Under the pattern influence, the coin price managed to surpass a crucial horizontal price level that bolstered further price recovery.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (begins Nov 15th).

This pattern formation consists of a U-Shaped Recovery which is the cup, followed by a minor consolidation or retracement called the handle. Thus, the ongoing consolidation in Ethereum price is the handle portion getting ready. By the pressure time, the Ethereum price trades at the $1509 mark with an intraday gain of 0.29%. However, over the past five days, the altcoin is hovering above the $1500 support trying to recuperate bullish momentum.

On a contrary note, a daily candle closing below $1500 will trigger a longer correction. However, The daily RSI Slope rising above the midline indicates the buyer’s confidence is returning to Ethereum. The long lower price rejection candle at $1500 indicates the buyers are obtaining storing support. The Ethereum price will trigger the aforementioned bullish pattern upon the breakout of the $1680 barrier. The intraday trading volume in Ether is $10.8 billion, indicating an 18% gain.

Apparently, The U.S. Bureau of Labor Statistics just announced January CPI as 6.4%, which is higher than the expected 6.2%. Just after CPI data was released, the Ethereum price showed huge price fluctuation, but by press time registered a 3.3% intraday gain.

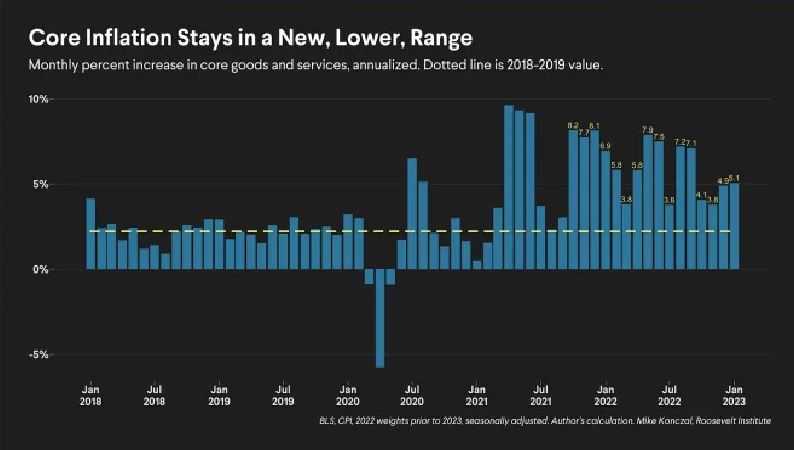

Mike Konczal, Macroeconomic Analyst at RooseveltINST opines that the Jan ‘22 CPI report is Fascinating, lot going on under the hood you might not see from the headline numbers. After seasonal revisions, Inflation looks stuck in a 4-5% range, between where it was (6-7%) and its target, but there are cautious and optimistic signs underneath.

Over last several decades, core goods inflation is basically near 0 percent over time. This was a big argument, even from Powell, for ‘transitory’ in 2021 and onion now – with time, core goods inflation would settle back near zero. But what if it doesn’t, at least in 2023?.

However, as long ETHEREUM’s price sustains above $1500 support, the above-mentioned bullish pattern will remain valid, and so does its potential to raise a bullish rally above $1680. Interestingly, Polygon zkEVM Mainnet is the next chapter of Ethereum scaling, the Mainnet Beta for Polygon zkEVM is set to launch on March 27th, 2023. Polygon zkEVM is suitable for various use cases; DeFi applications, NFT, GameFi, and Enterprise applications, as well as payments any Dapp that is compatible with EVM can be deployed on zkEVM.

There are alternative cryptocurrencies that are easy to mine and do not require the additional cost of setting up mining farms. For example, Crypton CRP privacy coin launched by the Utopia P2P project