Intel’s sharp sell-off at the end of the week did more than erase tens of billions of dollars in market value. It exposed the fault lines in a comeback story that, until now, had been powered largely by belief that the chipmaker was finally re-entering the center of the artificial intelligence boom it once ceded to rivals.

Shares of Intel fell 14% after the company issued quarterly profit and revenue guidance that missed expectations, jolting investors who had bid the stock up aggressively over the past year. If losses hold, more than $35 billion will be wiped from Intel’s market capitalization, a stark reversal for a company whose shares surged 84% in 2025 and extended that rally into early 2026 with a further 47% gain in January.

At a surface level, the irony is hard to miss. After years of watching Nvidia dominate AI workloads with its graphics processors, Intel is now grappling with the opposite problem: too much demand and not enough supply.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

The AI spillover effect

What has changed is the nature of demand in data centers. While Nvidia’s GPUs remain the backbone of AI training and inference, they do not operate in isolation. They require traditional server CPUs to orchestrate workloads, manage memory, and connect systems at scale. Intel, long the incumbent supplier of these processors, is now seeing a surge in orders as data center operators race to expand capacity.

That surge has reignited interest in Intel’s core server business, helping convince investors that the company could still play a meaningful role in an AI-dominated computing landscape. High-profile backing from the U.S. government, SoftBank, and even Nvidia itself added further credibility to the turnaround narrative, reinforcing the idea that Intel was strategically important to the future of advanced chip manufacturing.

But demand alone does not translate into earnings if it cannot be met. Intel’s factories are running at full capacity, and the company has struggled to shift its production mix quickly enough toward the most in-demand data center processors. Chief Financial Officer David Zinsner acknowledged that available supply hit its lowest point in the first quarter, with improvement expected only from the second quarter.

Analysts broadly agree with that timeline. Jefferies said the supply shortage would likely bottom out in March, while Oppenheimer expects constraints to ease in the second quarter. Still, for a market that had priced in a faster payoff from AI-related demand, that lag proved disappointing.

“The rally had been largely driven by the dream rather than the near-term reality or fundamentals,” TD Cowen analysts said, reflecting a growing view on Wall Street that Intel’s share price had outrun its operational progress.

Capacity, complexity, and miscalculation

Bernstein analysts were more direct, arguing that while the server upgrade cycle appears genuine, Intel “woefully misjudged it,” leaving its capacity footprint “massively caught off guard.” Unlike fabless rivals that rely on external manufacturers, Intel must retool its own factories, a process that is capital-intensive and slow-moving. Changing what a fabrication plant produces is not a matter of weeks or even months, and that rigidity is now weighing on Intel’s ability to respond to the AI-driven upswing.

The problem is compounded by the company’s broader manufacturing transition. Intel is in the midst of a complex effort to modernize its process technologies, regain leadership in chipmaking, and, eventually, attract external customers to its foundry business. Each of those goals competes for capital, engineering resources, and management focus.

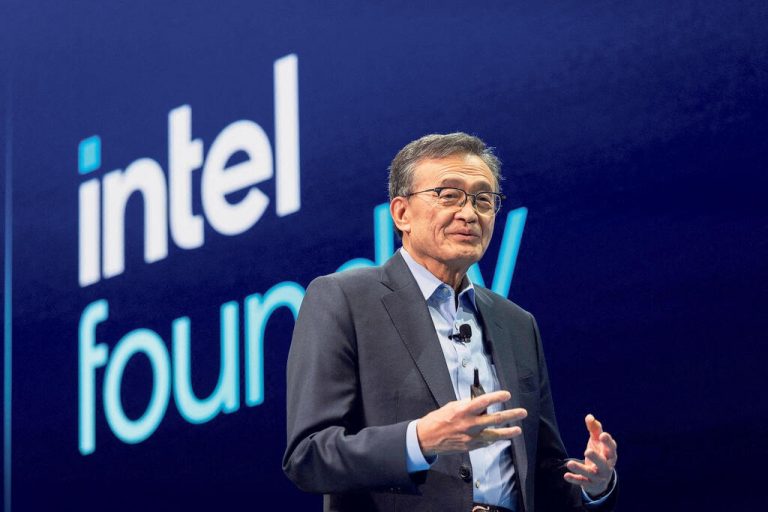

That balancing act became more visible in the latest earnings call. Much of the stock’s rally ahead of results had been fueled by expectations that Intel would announce new external foundry customers, validating its ambition to manufacture chips for other companies. Instead, CEO Lip-Bu Tan said two potential customers had only evaluated the technical details of Intel’s upcoming 14A manufacturing process, stopping short of firm commitments.

That reminded investors that Intel’s foundry aspirations remain a work in progress rather than a proven growth engine.

PC market headwinds return

Beyond data centers, Intel is also facing renewed pressure in its largest business segment: personal computers. A global memory supply shortage is expected to push prices higher, which could dampen demand for PCs just as Intel prepares to launch its “Panther Lake” chips. Those processors were widely seen as a chance for Intel to claw back market share lost to AMD after years of competitive setbacks.

If higher component costs slow PC upgrades, Intel’s hoped-for recovery in that segment could be delayed, limiting its ability to offset volatility elsewhere in the business. That risk added to investor unease, particularly given how central PCs remain to Intel’s revenue base.

All of this feeds into a broader reassessment of Intel’s turnaround under Tan, who has emphasized cost discipline and a more focused strategy. He has already scaled back some of the expansive ambitions around contract manufacturing that raised concerns about cash burn under previous leadership. While that shift has been welcomed by parts of the market, it also means Intel must prove that a leaner approach can still deliver growth and strategic relevance.

Friday’s sell-off suggests investors are no longer willing to take that on faith. The enthusiasm that carried Intel’s shares higher over the past year was built on the idea that the company was finally aligned with the AI wave. The latest results show that alignment exists, but execution is lagging.

Looking ahead into the next few quarters, investors will be watching closely for signs that supply constraints are easing, that AI-driven demand is converting into sustained revenue growth, and that Intel’s manufacturing roadmap is attracting real external customers rather than tentative interest.