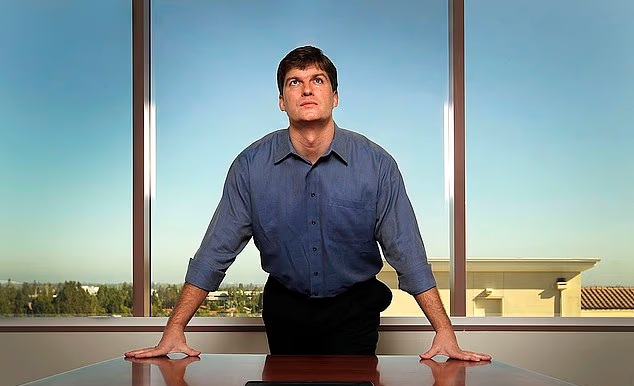

Michael Burry, the investor famed for predicting the 2008 housing market crash, is once again wagering that another market frenzy is approaching its breaking point — this time, the artificial intelligence boom.

According to a regulatory filing released Monday, Burry’s hedge fund, Scion Asset Management, has made massive bearish bets on Nvidia and Palantir Technologies, two companies at the heart of the AI rally. The fund disclosed put options, which increase in value when stock prices fall, on 1 million Nvidia shares valued at $187 million, and 5 million Palantir shares worth about $912 million as of the end of September.

The bets mark a dramatic move by Burry, whose skepticism of speculative bubbles has become legendary since his “Big Short” against subprime mortgages earned him hundreds of millions during the 2008 crash. His latest wager targets the extraordinary surge in AI-driven valuations that has fueled Wall Street’s recent highs.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Nvidia, the world’s first $5 trillion company and the undisputed leader in AI chips, has seen its shares climb more than 54% this year, building on a multiyear rally as demand for AI hardware soars. Palantir, the data analytics company known for its deep ties to U.S. defense and intelligence agencies, has surged an even steeper 174% in 2025, buoyed by growing demand for AI-powered defense and enterprise systems.

The filing also showed that Scion had no positions in either company during the previous quarter, indicating a deliberate pivot toward shorting the AI sector. While Scion declined to comment, Burry recently hinted at his cautious outlook in a cryptic post on X:

“Sometimes, we see bubbles. Sometimes, there is something to do about it. Sometimes, the only winning move is not to play.”

His remarks come amid a broader debate on whether the AI-fueled market rally has created an unsustainable bubble. The S&P 500 and Nasdaq 100 have both reached record highs, driven largely by investor excitement around AI and chip stocks.

While Burry placed bearish bets on Nvidia and Palantir, his fund also bought call options — bullish bets — on Halliburton and Pfizer, signaling a more defensive rotation into energy and healthcare. Scion also maintained smaller holdings in Lululemon, Bruker, Molina Healthcare, and Sallie Mae (SLM Corp.), according to the filing.

As of March, Scion managed about $155 million in assets, with its U.S. stock portfolio shrinking to eight positions from fifteen at the end of June.

Meanwhile, Palantir’s latest earnings underlined both the optimism and the concern surrounding AI valuations. The company reported third-quarter revenue of $1.18 billion, beating analysts’ estimates of $1.09 billion, and earnings per share of 21 cents, above forecasts. It also raised its full-year revenue guidance to as high as $4.4 billion, reflecting strong demand from both commercial clients and military contracts.

Palantir shares initially jumped during regular trading on Monday before falling 4.3% in after-hours trading following the earnings report. Analysts say investors are torn between excitement over its AI potential and alarm at its towering valuation — with a 12-month forward price-to-earnings ratio of 246, far higher than Nvidia’s 33.3.

“Given the stock’s lofty valuation, even a slight deceleration in growth could cause turbulence,” said Blake Anderson, associate portfolio manager at Carson Group, noting that Palantir’s revenue growth slowed slightly from 63% to 61% quarter-over-quarter.

However, D.A. Davidson’s Gil Luria said the results remain strong enough to sustain market confidence “at these unprecedentedly high valuation levels.”

Major government deals have also bolstered Palantir’s momentum. The U.S. Army recently issued an internal memo directing all units to adopt Palantir’s Vantage platform, and the company announced a new collaboration with Nvidia to integrate its chips and AI software into defense and industrial systems.

Nvidia, meanwhile, continues to dominate the AI semiconductor market, supplying chips to nearly every major tech player — from Microsoft and Amazon to OpenAI. But the company’s soaring valuation and dependence on continued AI demand have become a cause for concern to some investors, who have drawn similarities with the dot-com bubble of the early 2000s.

Burry’s latest moves suggest he sees the current AI mania as another speculative peak. His warning comes as more investors question whether AI’s promise has already been priced into the market — and whether the next correction could prove as brutal as the housing crash he famously foresaw.