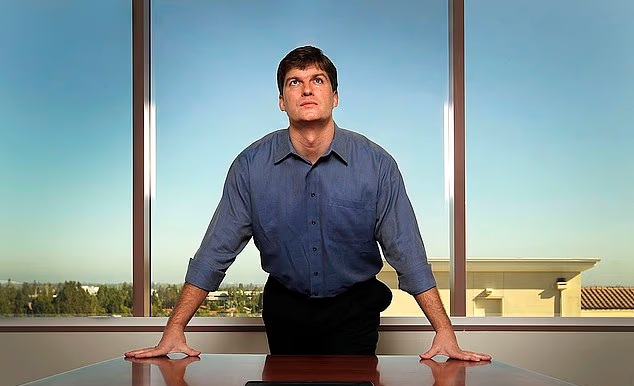

Michael Burry, the contrarian investor immortalized in “The Big Short” for his prescient bet against the housing market, issued a stark warning late Tuesday that the artificial intelligence frenzy represents a bubble of unprecedented scale—one destined to burst and drag down stocks and the broader economy, with government intervention powerless to prevent it.

In a post on X under his account @michaeljburry (branded “Cassandra Unchained”), Burry responded to a detailed critique from former hedge fund manager George Noble, who argued that OpenAI is “falling apart in real time.” Noble highlighted intensifying competition from Google’s Gemini 3, plunging ChatGPT traffic, massive quarterly losses ($12 billion in one period per Microsoft’s disclosures), talent departures, unsustainable spending on tools like Sora, and Elon Musk’s ongoing lawsuit seeking up to $134 billion.

Burry agreed emphatically, saying, “This is not surprising and will not end with OpenAI. All the capital being spent and lent by the richest companies on earth will not buy enough time—by the very definition of mania.”

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

He added that authorities would “pull out all the stops to save the AI bubble to save the market to save the economy,” but concluded, “The problem is too big to save, again by that very same definition.”

The remarks build on Burry’s longstanding skepticism. Since pivoting from hedge fund management to Substack commentary late last year, he has repeatedly likened the AI surge to the dot-com era. He has called OpenAI “the next Netscape, doomed and hemorrhaging cash,” criticized its projected $1.4 trillion spending over eight years as “dreamy,” and expressed surprise that ChatGPT’s launch ignited a multi-trillion-dollar infrastructure race.

Burry has positioned bearishly, including options bets against Nvidia and Palantir as “poster children” of the hype, arguing that returns on invested capital are declining and much of the spending will ultimately be written off.

OpenAI’s trajectory underscores his concerns. The company’s annualized revenue run rate surged from $2 billion in 2023 to $6 billion in 2024 and more than $20 billion in 2025, according to CFO Sarah Friar in a recent blog post. Compute capacity grew similarly, from 0.2 GW in 2023 to about 1.9 GW by the end of 2025. Yet critics like Noble point to escalating costs, diminishing returns on model improvements, user disappointment with releases like GPT-5 (described as “underwhelming” and quickly overshadowed by prior versions), and internal turmoil—including key executive exits and allegations of leadership issues.

Burry’s view aligns with other prominent skeptics. Veteran investor Jeremy Grantham, known for calling past bubbles, recently described AI as “obviously a bubble” with “slim to none” odds of avoiding a bust, comparing it to 19th-century railroads and the late-1990s internet mania. He expects leaders like Nvidia to spearhead any downturn, leaving markets “a whole lot cheaper” before eventual recovery.

However, contrasting opinions persist. Optimists such as “Shark Tank” star Kevin O’Leary and investor Ross Gerber argue AI is driving genuine productivity gains and rapid growth, far from a fleeting euphoria. Broader market sentiment remains mixed: America’s eight most valuable public companies—Nvidia, Alphabet, Apple, Microsoft, Amazon, Broadcom, Meta, and Tesla—collectively exceed $22 trillion in market cap, all deeply invested in AI infrastructure. Yet warnings of overvaluation and circular financing (e.g., intertwined deals among hyperscalers) have intensified debates.

Burry’s latest salvo arrives amid fresh volatility in tech stocks, including recent dips tied to geopolitical tensions. His track record lends weight to the cautionary tone, though past predictions have not always timed perfectly. The success of AI buildout has so far remained speculative, casting doubts on the investments. As Burry sees it, the scale of capital deployed—trillions across Big Tech—has created a mania too vast for even extraordinary measures to contain once cracks appear.