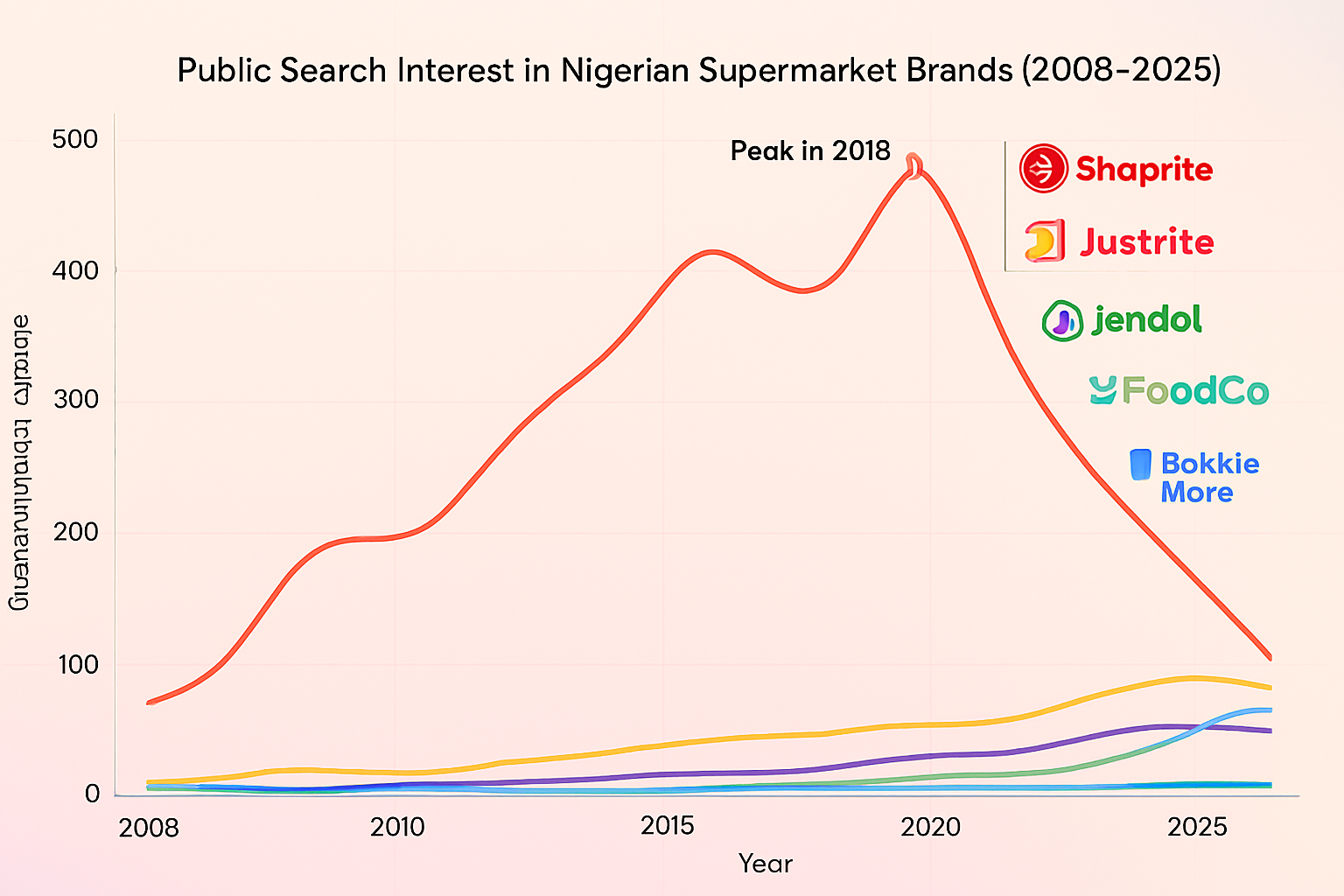

For more than a decade Shoprite was the face of modern retail in Nigeria. From the time it entered the market in 2005, its outlets inside shopping malls redefined what many Nigerians understood as a supermarket. By 2016 public interest in Shoprite had reached a peak, with search trends showing that no other retail chain came close. For many families, a trip to Shoprite was more than grocery shopping. It was a social activity linked to visits to malls, cinemas, and restaurants.

However, the dominance began to wane as the decade closed. Between 2019 and 2025 public interest dropped dramatically. The reasons are not hard to find. Rising operational costs, economic headwinds, and changing consumer habits exposed weaknesses in Shoprite’s model. The closure of outlets across the country further reduced its visibility. The brand that once represented novelty and modernity was now seen as a retreating force. Public data captures this shift clearly. Search volumes that once surged above 400 in relative terms have fallen to less than half of that figure.

The Emergence of Indigenous Alternatives

While Shoprite’s presence weakened, indigenous players steadily built public recognition. Justrite was among the earliest to register growth in visibility. Starting from almost zero interest in 2014, it grew steadily to become a household name in Lagos, Ogun, and Oyo. Its model was different from Shoprite’s. Instead of focusing on large malls it created outlets in neighborhoods and closer to residential areas. This strategy meant that even as incomes tightened Nigerians could find an affordable supermarket within reach. Public search data confirms that people increasingly turned their attention to Justrite, peaking in 2024 before settling slightly lower in 2025.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Jendol followed a similar trajectory, though it came into public consciousness later. Virtually invisible before 2018, the chain rose rapidly and achieved higher search interest than Justrite by 2024. Jendol’s appeal was its promise of value. It positioned itself as an accessible alternative for urban families looking for affordable shopping options. The trend line shows a clear hunger among Nigerians for local brands that match their daily realities.

New Entrants and Market Volatility

FoodCo represents another interesting case. Although it recorded public attention earlier than most local chains, its growth has been modest. Its strength lies in Ibadan and other parts of the Southwest, but it has not been able to establish a significant national presence. The data suggests stability but not dominance. FoodCo’s story highlights the importance of geographic expansion in sustaining public visibility.

The real disruption came from Bokku Mart. Practically invisible until 2023, the chain burst into the scene with a dramatic spike in 2024 that briefly put it ahead of all the other local competitors. Public search interest more than doubled that of Justrite and Jendol. Yet the following year interest fell sharply. This pattern shows the volatility that comes with aggressive expansion without matching customer experience or building trust. Nigerians are willing to give attention to new players but they are quick to withdraw it if expectations are not met.

What the Future Holds for Nigerian Retail

The data tells a clear story. Shoprite’s early monopoly in Nigeria has ended. For years it dominated not only the physical market but also the public imagination. Today the market is fragmented and competitive. No single chain has replaced Shoprite’s role as the undisputed leader. Instead we see a more dynamic environment where local brands compete for loyalty.

The rise of Justrite and Jendol shows that indigenous retailers can grow steadily when they focus on proximity, affordability, and relevance. FoodCo demonstrates that regional strength can be maintained but may not be enough for national leadership. Bokku Mart shows that disruptive marketing and rapid expansion can win attention quickly but that sustainability is what ultimately matters.

The lesson for Nigerian retail is that consumer attention is shifting from spectacle to service. Nigerians no longer view shopping as a rare weekend event at a large mall. They want convenience, trust, and everyday accessibility. Public search interest is more than a measure of curiosity. It is a signal of where loyalty is likely to grow and where disappointment is beginning to show.

The post-Shoprite era is one where no brand can afford complacency. The winners will be those that understand local realities and combine expansion with reliability. Public data shows us that the age of monopoly has given way to a battle for trust and relevance in one of Africa’s most dynamic retail markets.