The story of Peller, a TikTok creator who recently revealed that the Lagos State Internal Revenue Service (LIRS) demanded N36 million in income tax from him, shines a spotlight on a growing debate in Nigeria. In this piece, our analyst asks how should digital earners be taxed, and under what framework can such taxation be seen as fair? His outcry reflects more than personal frustration. It exposes the tensions between platform owners, self-made digital entrepreneurs, and a government aggressiveness for revenue.

Peller insists he has not earned directly from Nigeria, that his income flows from social media platforms, and that his infamous interview where he claimed to earn huge sums was mere “packaging.” Yet LIRS claims he owes millions in taxes, most likely based on estimates of his digital success and lifestyle visibility. The clash is emblematic of a larger issue because the Nigerian state applying a traditional revenue model to a new digital economy. In many ways, this story is less about one creator and more about how Nigeria chooses to adapt to the realities of digital work.

Platform Owners and the Gatekeeping of Earnings

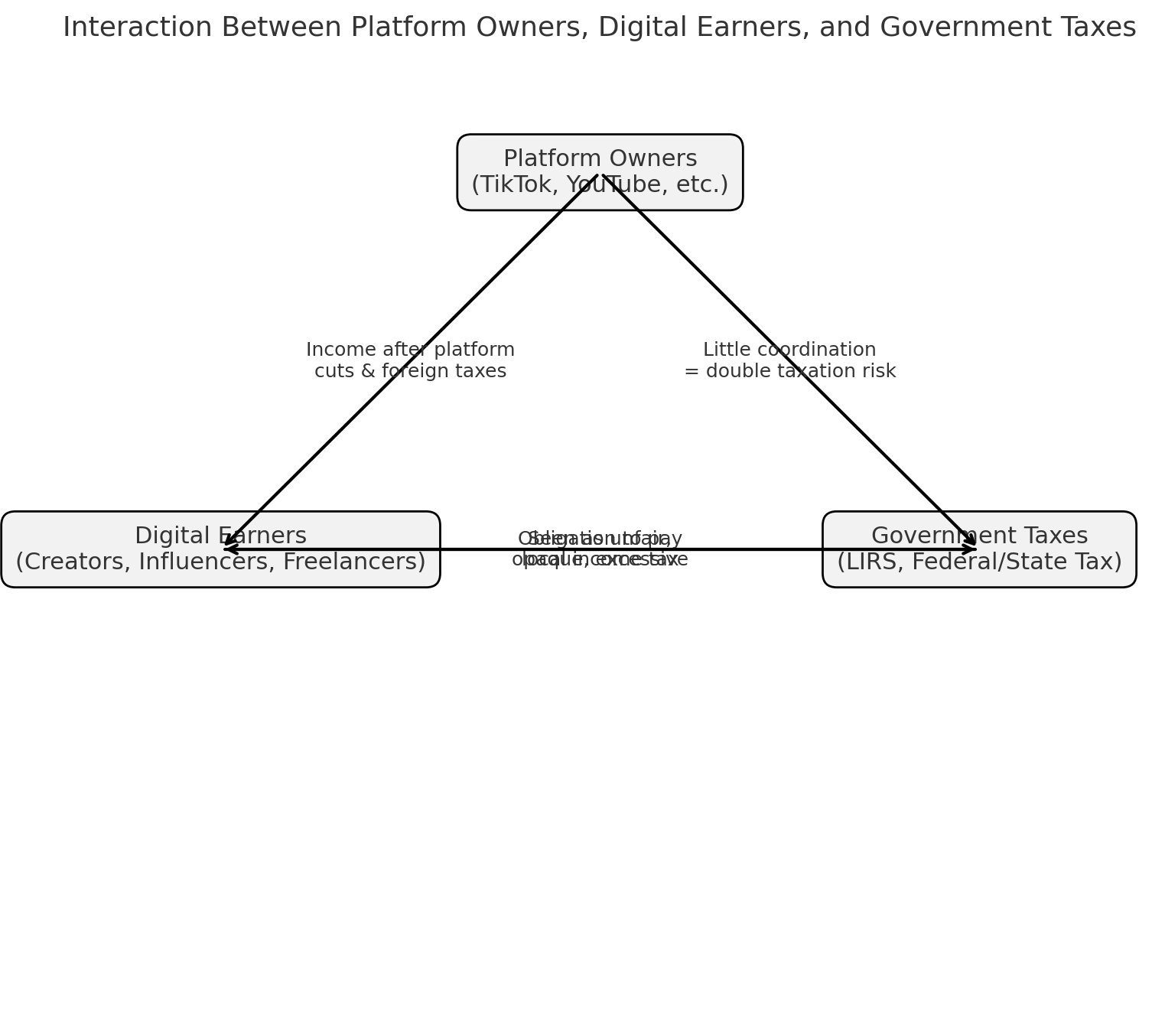

Digital platforms like TikTok, YouTube, and Instagram already deduct taxes in their home jurisdictions. Creators are often taxed at source before receiving their income, which means that by the time revenue reaches them, it has already been trimmed. This places creators in a difficult position, squeezed between platform cuts and government demands. Without coordination between platform taxation systems and local tax regimes, digital earners face the threat of double taxation. What governments see as untapped revenue streams, creators often see as unfair duplication.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

The challenge is also structural. These global platforms are not primarily accountable to Nigeria. They collect revenue in dollars or other currencies, apply their own deductions, and remit payments across borders. A Nigerian creator like Peller is therefore taxed first by a foreign jurisdiction and then expected to comply with local rules that take little account of the deductions already made. Without an international framework or bilateral agreements that protect digital workers, local tax authorities will continue to estimate aggressively, creating resentment and confusion.

The Vulnerability of Digital Earners

Creators like Peller represent a new economic class. They are self-made, often without formal employment, thriving on digital skills, charisma, and community. Their incomes are inconsistent. A viral video may bring windfalls one month while another may yield nothing. Yet traditional tax models treat them like salaried employees with predictable incomes. This mismatch fuels the perception that government taxes are blunt instruments, unable to capture the realities of creative digital work.

For many digital earners, taxation feels less like civic duty and more like punishment for visibility. Government attention rarely arrives when creators are struggling, but the moment success is flaunted, tax authorities appear. Peller’s admission that his claims of high income on television were “packaging” underscores how dangerous visibility can be. In a society where legitimacy is tied to lifestyle displays, creators are often judged on appearances, and tax assessments follow accordingly.

This raises deeper questions about fairness. Should taxation be based on evidence of actual income or on estimates driven by visibility? If creators are to be integrated into the tax system, then transparency, dialogue, and accurate assessment are essential. Otherwise, digital earners will remain wary, seeing taxation as arbitrary extraction rather than a shared responsibility.

Government Taxes and the Trust Deficit

Taxation, at its core, is a social contract. Citizens give up a portion of their earnings in exchange for infrastructure, healthcare, security, and social safety nets. In Nigeria, this contract is deeply frayed. Citizens face poor roads, unreliable electricity, and underfunded hospitals, even as billions are collected in revenue. In this environment, a ?36 million tax bill looks less like civic responsibility and more like predation. The trust deficit makes compliance difficult because taxpayers doubt that their contributions will be put to collective use.

The politics of visibility also plays into this. By boasting of large earnings, Peller drew the gaze of the taxman. Many other creators, freelancers, and influencers earn without scrutiny, but the moment income is flaunted, tax authorities move in aggressively. This inconsistency undermines the legitimacy of the system. Taxation is indeed mandatory by law, but compliance depends on fairness, transparency, and credibility.

If Nigeria wishes to tax its digital earners fairly while also expanding its revenue base, three shifts are necessary. First, Lagos and the federal government must engage global platforms to design systems that recognize taxes already paid at source, reducing double taxation risks. Second, taxation models must reflect the volatile nature of digital earnings. Flat or estimated figures are inappropriate, and flexible, transparent assessments are needed. Third, citizens must see tangible benefits from taxes. Roads, healthcare, power, and social services should visibly improve if government expects compliance from digital workers.

The demand placed on Peller is not just about one TikTok star. It is also about how Nigeria integrates the digital economy into its tax framework. To tax without trust is to fuel resentment. To tax without coordination is to risk suffocating a growing industry.