Solana’s trajectory toward a $1,000 valuation is, without question, one of the most ambitious goals in the current crypto cycle. It has already demonstrated incredible resilience in 2025 by climbing to $147, bolstered by ultra-fast speeds, microtransaction-level fees, and a growing foothold in the institutional DeFi and NFT sectors. But despite the excitement, Solana’s climb—while admirable—may ultimately offer more of a steady marathon than a thrilling sprint.

That’s where Ripple (XRP) and Little Pepe (LILPEPE) change the game. Both projects are generating explosive momentum, driven not just by hype but by smart fundamentals, unique positioning, and actual catalysts for market-shaking growth. Unlike SOL, which is starting to show signs of saturation, XRP and LILPEPE are poised for asymmetric upside that even Solana may struggle to replicate in the short to medium term.

Solana’s Strength—and Its Ceiling

There’s no denying Solana has had a remarkable run. Its transaction speeds are blistering, its fees are negligible, and its infrastructure is increasingly being adopted by developers and institutional DeFi players. The path to $1,000? Not impossible—especially with institutional adoption and the maturation of its ecosystem.

But therein lies the limitation.

Solana is no longer the scrappy underdog. It’s a semi-mature, relatively stable Layer 1 with a large market cap. That kind of scale brings predictability. For short-term speculators or investors seeking 10x or more returns, predictability can be boring. The very strength of Solana’s network is what caps its explosive potential.

Solana might be a great hold. But it’s no longer a great story.

XRP: The Institutional Sleeper Waking Up

Ripple’s XRP, on the other hand, is in the middle of a powerful resurgence. Trading around $2.30 and flirting with key resistance levels, XRP has not only rebounded from bearish sentiment—it’s beginning to retake territory most analysts thought was lost to history.

Recent developments are helping to turn that optimism into action:

- Near-certain approval (98%) of a spot XRP ETF

- Inclusion in the NASDAQ Crypto Index

- CME futures launch, boosting its legitimacy among institutions

- Guardian Arch strategy analysts targeting $20–$27 in the medium term

Ripple Guardian Arch Strategy

What makes XRP different from Solana is the degree of untapped speculative and institutional capital waiting on the sidelines. This isn’t just about use case anymore—it’s about the long-overdue unlocking of value that regulatory clarity and major integrations can catalyze. Unlike SOL, XRP still has a narrative: the comeback. And investors love a comeback.

Little Pepe (LILPEPE): The Meme Coin With Utility and Velocity

If XRP is the comeback king, then Little Pepe (LILPEPE) is the wild card nobody saw coming—but everyone’s watching.

On the surface, it may be just another meme coin. But dig deeper, and you’ll find that LILPEPE is anything but ordinary. It’s a Layer-2 blockchain, not just a token, and it brings actual infrastructure to the meme space, pairing lightning-fast transactions with zero tax and a strong decentralization ethos. Think of it as the Pepified version of Arbitrum or Optimism—only with a massive culture engine and a personality.

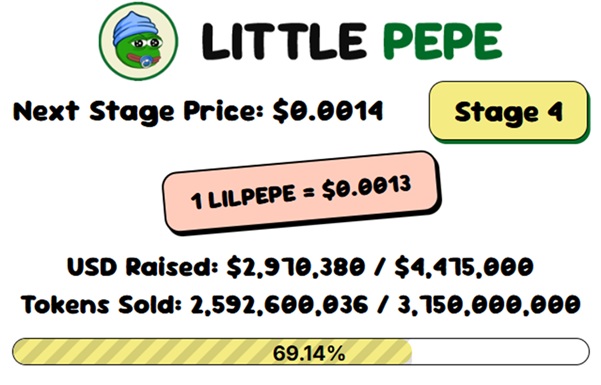

What’s more compelling is its presale momentum, with $2.9 million already raised of a $4.47 million goal, and deep into Stage 4, where each token is priced at $0.0013. Investors are snapping up their share of the 3.75 billion tokens allocated to early adopters, and with a total supply of just 100 billion, scarcity is baked in.

And if that weren’t enough, a $777,000 giveaway is currently underway—ten winners will each receive $77,000 worth of LILPEPE, incentivizing both presale participation and viral community engagement. LILPEPE isn’t just aiming to become a meme—it’s building a chain. A proper Layer 2, with real utility and community fuel behind it. That’s a level of ambition not even Dogecoin or Shiba Inu ever dared to reach.

The Verdict: Solana Grows, But XRP and LILPEPE Explode

Solana’s march to $1,000 may well happen. But it will be measured, institutionally driven, and ultimately constrained by its maturity and scale. It’s an asset for those who want exposure to stability rather than seeking a specific upside.

In contrast, XRP and LILPEPE represent a new generation of asymmetric plays. XRP is rediscovering bullish momentum with regulatory tailwinds and mass-scale integrations. LILPEPE is carving out a new category entirely: the memechain—a hybrid of culture and infrastructure.

If Solana is climbing a mountain, XRP and LILPEPE are strapping on jetpacks.

And in a market that rewards speed, narrative, and timing, jetpacks almost always win.

Ready to Leap?

With LILPEPE’s presale in full swing and over 2.2 billion tokens already sold, time is running out to grab this meme-layer opportunity before it lists. Visit the official website to join the presale and enter the $777K giveaway. Minimum contribution: $100. Maximum vibes: unlimited. Because in 2025, the best gains aren’t found in old empires—they’re minted in the memes.

For more information about Little Pepe (LILPEPE) visit the links below:

Website: https://littlepepe.com

Whitepaper: https://littlepepe.com/whitepaper.pdf

Telegram: https://t.me/littlepepetoken

Twitter/X: https://x.com/littlepepetoken