Online casinos offer excitement and the chance to win big, but success requires more than luck. Smart strategies and disciplined habits significantly increase the odds of walking away with a profit. By focusing on proven methods, players can elevate their game and make every session count. This piece delineates four actionable pointers to amplify your returns, steering players toward sharper calls and improved outcomes within the dynamic realm of online wagering.

Master the Games You Play

Familiarity is the engine of triumph in the digital gaming sphere. Before committing chips, gamblers should deeply comprehend the regulations and workings of their preferred diversions. Be it twenty-one, hold’em, or reel-spinning contraptions; each pastime necessitates specialized methodologies. Take twenty-one, for instance: absorbing fundamental strategy blueprints shrinks the house advantage to minuscule levels. Gamblers who delve into instructional materials, observe seasoned pros, or hone skills in no-cost formats gain a distinct edge. This preparation transforms conjecture into calculated plays, bolstering assurance and prospective rewards.

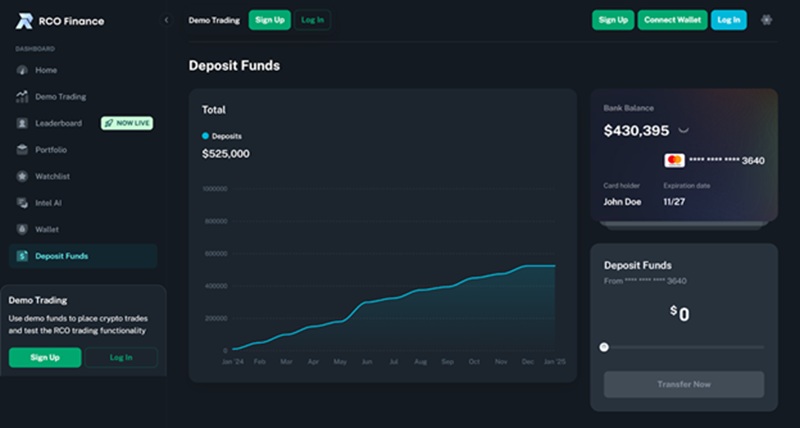

Practicing hones proficiencies even further. Numerous platforms present test iterations where players assess schemes sans risking capital. These exercises unveil patterns, such as the activation of reel-spinner bounties or advantageous fold opportunities in hold’em. Devoting time to sharpening skills cultivates familiarity, which translates into superior judgment during genuine stakes. Instead of plunging into high-roller games blindly, players who first master their craft position themselves for dependable victories over time.

Manage Your Bankroll Wisely

A well-managed bankroll keeps players engaged and safeguards against catastrophic debacles. Establish a definitive ceiling before commencing, and adhere to it with unyielding discipline. For example, resolve to expend no more than a hundred notes per session and never tap into auxiliary reserves. This modus operandi ensures gaming remains recreational without escalating into pecuniary duress. Apportioning the budget into modest bets, such as a fiver per hand, extends playtime and augments prospects of landing a hot streak.

Monitoring wins and losses preserves command. Employ a simple ledger or application to chronicle each session’s consequences. This custom highlights spending patterns and signals the opportune moment to withdraw. Eschew chasing after losses – doubling down to recoup is rarely efficacious and frequently digs a deeper abyss. Sharp players appreciate that disciplined bankroll management, teamed with platforms like SureWin Casino, crafts a bedrock for enduring accomplishment and sustains the thrill.

Leverage Bonuses and Promotions

Web-based gambling establishments deluge players with perks, and resourceful ones convert these offerings into profits. Welcome gifts, bonus spins, and allegiance schemes contribute surplus funds or opportunities to participate. However, scrutinizing the small print is crucial. Wagering prerequisites frequently dictate the frequency a perk must be wagered before withdrawing winnings. Selecting promotions with sensible conditions, such as a 20x play-through, simplifies cashing out and maximizes value.

Timing supercharges the reverberations of perks. Many venues roll out exclusive incentives during festivities or weekends. Enrolling in newsletters or tracking casino social media outlets keeps players informed. Claiming these deals at the appropriate juncture stretches the bankroll. By thoughtfully accepting perks and aligning them with robust gameplay, players tip the balance in their favor and boost their earning potential.

Stay Focused and Avoid Distractions

Concentration distinguishes victors from occasional dabblers. Internet casinos, with their shimmering illuminations and inexhaustible alternatives, can overwhelm. Establish a distraction-free perimeter before participating – silence notifications, close extraneous tabs, and zero in solely on the diversion. This clarity hones decision-making, particularly in swift-moving games like hold’em, where a single misstep forfeits the kitty. A focused mind discerns opportunities and dodges costly blunders.

Emotional command is intertwined with focus. Winning sprees ignite euphoria, while setbacks breed vexation, yet both can obfuscate judgment. Set temporal limits for engagements, like thirty minutes, to preclude exhaustion or impulsive bets. Pauses rejuvenate perspective, permitting players to return with a lucid mentality. By sustaining self-discipline and presence, players make astute choices, transforming close shaves into triumphs and preserving their capital intact.

Conclusion

Boosting winnings at online casinos blends strategy, discipline, and focus. Mastering games builds a strong foundation, while wise bankroll management ensures longevity. Leveraging bonuses adds extra firepower, and staying focused keeps decisions sharp. Collectively, these suggestions metamorphose casual engagement into a measured quest for revenue. Players who embrace these habits not only relish the excitement but also stack the likelihood in their corner for grander, more predictable wins.