Analytical opinions about Solana price predictions in April 2025 focus on whether the blockchain giant can bounce from its recent minimum yearly levels.

Solana looks to have kick-started its comeback during a period of market instability which has resulted from macroeconomic factors such as tariff wars combined with regulatory challenges.

Institutional investors who have offered bullish Solana price predictions are now also betting on a new Defi coin that is creating opportunities for new cross-border solutions to grow. Researchers observe SOL’s ability to maintain its market momentum while studying if this new Defi project will become the most profitable crypto asset of 2025.

Solana Price Predictions: Can SOL Break $160 Again?

Solana price prediction for April suggests the asset can experience a relief rally following its recent bounce from $95 to $111. Analysts highlight the bullish divergence on Solana’s daily chart as the big indication of the move to the upside.

This divergence, characterized by lower lows in price and higher lows in RSI-14, has prompted traders to go long on SOL despite expectations of further downside volatility in the coming weeks.

Popular Elliot Wave commentators believe Solana is now beginning its “B” move—a corrective rally in the A-B-C pattern—that could push prices to $160–$200 before the asset resumes its broader downtrend.

For this uptrend to materialize, though, Solana must breach critical resistance levels at $120 and $140. Falling below these levels instead could send SOL retouching support at $95 or even falling as low as $90 in the worst-case scenario.

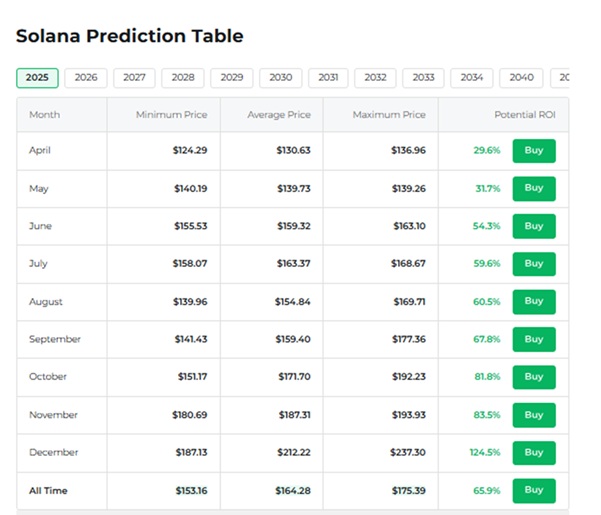

Long-term Solana price predictions remain split, with some analysts predicting an average price of $237 by the end of 2025, while others warn of potential dips due to macroeconomic pressures.

Remittix Presale Achievement Fosters Optimism Amid Regulatory Frenzy

Remittix presale has been among 2025’s highest-profile crypto events, with RTX tokens consistently selling out at each stage of its top ICO. This blazingly quick fundraising feat has seen 527 million tokens sold, amounting to over $14.4 million.

The presale success is driven by a series of innovative features that distinguish Remittix from the rest. Among them, Its Payfi tech featuring near zero-fee microtransactions is optimized for unbanked clients.

This allows transfers under $5 and head-to-head competition with established providers like Wise. Consequently, many investors are foreseeing potential 50x returns on RTX listing on top exchanges like Binance and Coinbase.

The intersection of path-breaking technical expertise, strong presale performance and competitive staking incentives is an indicator of the project’s potential to gain ground with entrenched market leaders like Ripple in the race for financial inclusion.

While regulatory obstacles persist for coins like Ripple, Remittix’s partnership progress with local Remittance systems across over 40 countries has brought rest of mind to its stakeholders.

With robust up-front support and transparent use-case advantages, Remittix is in a good position to leverage the growing demand for secure, low-cost and convenient financial services in a more globalized world.

Why Remittix Is Perfect For The Future

In the long term, analysts are sure Remittix can translate its presale popularity into sustainable operational growth. The coming months will be crucial as the Defi company works towards securing strategic partnerships and finalizing its mainnet launch.

Remittix will be successful in addressing regulatory concerns and has demonstrated strong commitment to reaching its development milestones. Analysts say with this momentum, Remittix will not only disrupt traditional financial models but also redefine digital payments across the world. Join now and don’t get left out!

Discover the future of PayFi with Remittix by checking out their presale here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix