Every market cycle, traders and investors set out to identify the top crypto to watch for maximum gains and 2025 is no exception. While different projects compete for this top spot, RCO Finance (RCOF) is already setting the pace after the project secured a groundbreaking $7.5 million venture capital funding.

This level of investment signals more than just hype; it clearly indicates that something big is brewing beneath the surface. In this article, we dive into the top crypto to watch in 2025, with the spotlight on RCOF, which just secured a multi-million-dollar VC deal.

We’ll explore what makes this project stand out, the technology behind it, and why institutional investors like venture capitalists are betting big. Whether you’re a seasoned trader or just crypto-curious, this information is needed to stay ahead of the curve.

Why The $7.5 Million VC Backing For RCO Finance?

While many projects are positioning for the top crypto to watch in 2025, a globally renowned Venture Capital firm just pumped $7.5 million into RCO Finance. This move has reverberated across the crypto community, with market experts and analysts citing RCOF’s high-profit potential as the driving factor for the VC backing.

Venture Capital always flows to projects with strong potential for significant growth and profitability. If VCs are investing big in RCO Finance (RCOF), it only means that they have done their due diligence and concluded that RCOF is the top crypto to watch in 2025 with massive upside potential.

The project is already in its sixth presale stage, with the token priced at %0.13, a 919% growth from the first presale price of $0.01275. Right from the first presale stage, the token price has followed an upward trajectory, and top market experts strongly believe the token will achieve historic growth of over 39,680% post-launch.

VCs and institutional investors are seeing the potential and are flocking in. Don’t sit on the sidelines while others make life-changing returns from the RCOF presale. RCOF is not just the top crypto to watch in 2025 due to the $7.5 million VC backing; the team has been working round the clock, launching a series of innovative products.

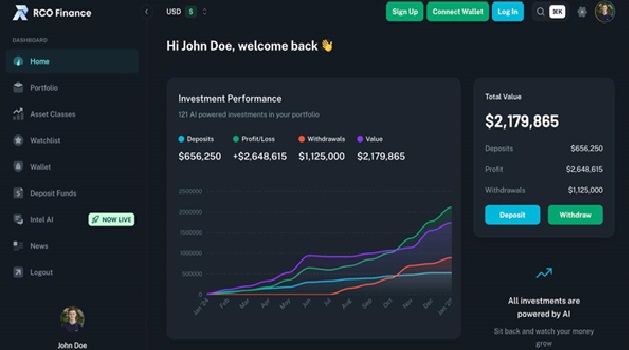

Over the past 4 months, the team has launched an AI-powered dashboard, Smart Portfolio Management, Multi-Asset Class Support, Wallet Management, AI Investment Advisor, Custom Watchlist, and Demo Trading Environment.

Why RCO Finance Is the Top Crypto To Watch

With the DeFi market worth over $450 billion, RCO Finance (RCOF) is rapidly carving out a significant share with its breakthrough AI Robo Advisor. This intelligent tool scans the market in real-time, identifying high-potential trades before they become mainstream headlines.

For instance, while many traders missed the HEGIC token’s explosive 78% surge within a single day, RCOF users would have received early alerts, positioning them to take action before the crowd.

Similarly, when the ZEREBRO token plummeted by over 27%, the Robo Advisor’s risk-detection capabilities could have helped users avoid costly losses. This real-time market foresight empowers RCOF traders to make data-driven moves rather than relying on guesswork or luck.

But RCOF’s innovation doesn’t stop there. The platform boasts access to a vast catalog of over 120,000 assets, with data sourced from reputable outlets like Bloomberg and Reuters. With unique features like fractional ownership and no-KYC trading, RCOF blends accessibility with advanced security, creating an inclusive space for all.

Despite being an emerging project, RCOF has already delivered a robust suite of tools, including immersive demo trading environments and AI-powered market insights. Plus, entry into exclusive Private Syndicate ETF Funds, that were previously exclusive for institutional investors.

Add in its automated market maker (AMM) functionality for earning passive income, and it’s clear why many analysts consider RCOF as the top crypto to watch in 2025.

RCOF’s Groundbreaking Beta Platform

RCO Finance (RCOF) is breaking new ground in the DeFi space by launching its Beta Platform during its presale phase, something few projects have dared to attempt. In just a matter of days, over 10,000 users signed up, and that number has surged past 285,000 within weeks.

This early momentum highlights the massive interest and growing trust in what RCOF is building. The Beta platform’s unique value proposition and fully functional AI-driven features stood out.

Traders gained early access to over 100,000 global assets, paired with smart tools like the Robo Advisor for real-time strategy and insights. This hands-on rollout allowed the team to gather critical user feedback fine-tuning performance, and user experience (UX) well before the official launch.

With real-world usage already proving its value, many crypto experts now view RCOF as the top crypto to watch in 2025 for historic gains.

Upcoming Features That Further Consolidate RCOF’s Position As the Top Crypto To Watch

According to the RCOF team, they have lined up a series of groundbreaking new products for the second quarter of 2025. In Q2 2025, they will launch AI-powered simulated trading to enable users to compare manual trades and AI-executed trades before going live.

There will also be a Demo trading leaderboard that allows 50 demo traders to be ranked in real-time based on their profit growth. The In-Depth Trade Performance Analytics will empower users to optimize their strategies using hard data.

In May 2025, three new products will go live, including CRM Sync and User Behaviour tracking, Calendar-Based Profit and Loss Tracking, and Crypto-Funded Demo Trading. The mobile number collection feature will also go live, allowing users to receive SMS alerts.

The AI-trading indicator will be launched in June 2025, with expansion to stocks, bonds, FX, and commodities scheduled to go live by August 2025. Top analysts strongly believe these new products will help consolidate RCOF’s grip as the top crypto in 2025.

Join the RCOF Presale For Massive Gains

RCO Finance (RCOF) is currently in Stage 6 of its presale, and interest is accelerating rapidly. More than 16.8 million tokens have already been sold, amounting to over 40% of the allocation, and investors are buying into the vision. So far, the presale has brought in over $17 million, signaling strong market confidence.

At just $0.13 per token, RCOF is still accessible, but that price won’t hold for long. Once the next phase hits, the cost rises to $0.15. Analysts are forecasting a staggering potential increase of over 39,680%, meaning a $1,000 investment today could balloon to $396,800 by Q3 2025.

Beyond its impressive presale success and low entry price, the project has passed a rigorous audit by SolidProof, adding another layer of credibility. Early investor incentives are also heating up, with news of a $100,000 giveaway once the next milestone is unlocked.

With powerful built-in leverage features, a $7.5 million injection from a venture capital firm, and a roadmap already delivering results, RCOF is more than just the top crypto to watch in 2025; it’s a serious contender in the altcoin space.

With momentum building and supply shrinking, you could miss out entirely if you wait too long. If you want to get in before the next surge, now’s the moment to move. Join the RCOF presale and position your portfolio for massive gains.

For more information about the RCO Finance (RCOF) Presale:

Visit RCO Finance Presale