Tunde, a taxi driver in Ibadan, starts his morning with his favourite radio station. As he navigates the bustling streets, he listens intently to a lively talk show on current affairs. But just as he gets deeply engaged, an ad break interrupts the flow. Instinctively, he reaches for the tuner, searching for another station with a more engaging conversation or perhaps a hit song to liven up the ride. Within minutes, he has switched stations multiple times, a habit he barely notices but one that deeply affects the dynamics of radio broadcasting in Ibadan.

This common phenomenon is known as audience floating, where listeners frequently switch between stations rather than remaining loyal to one. In a city like Ibadan, where numerous radio stations operate within close frequency ranges, competition for listeners is intense. But why does this happen, and how does the frequency spacing of radio stations contribute to this trend?

The Magnetic Pull of Nearby Stations

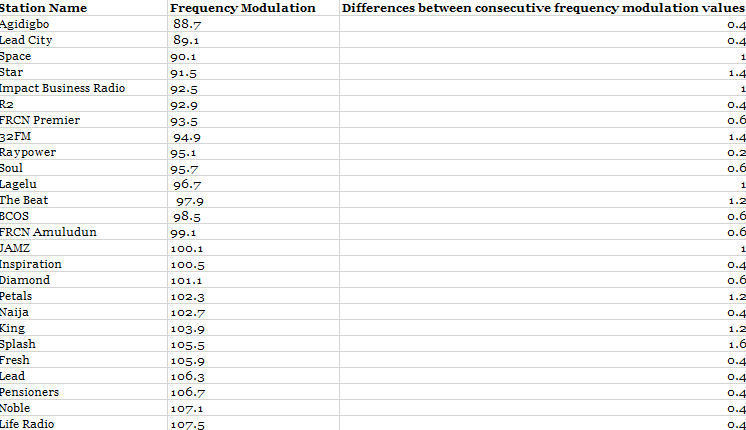

In Ibadan, FM radio stations are packed closely together on the frequency spectrum. Some are separated by as little as 0.4 MHz, a minuscule gap that makes it incredibly easy for listeners to drift from one station to another. Unlike television, where channels are deliberately spaced apart and require more effort to switch, radio listeners can change stations almost effortlessly with a simple turn of the dial.

For example, if Tunde finds himself bored with a political discussion on 100.1 FM, he may scan upwards and land on 100.5 FM, where an Afrobeats playlist is playing. If that station enters a long commercial break, a quick adjustment brings him to 101.1 FM, which features a comedy skit. Without any strong loyalty to a single station, he floats through the available options, finding entertainment in snippets rather than committing to one station for an extended period.

Exhibit 1: Stations and their differential frequency range

The Battle of Content and Listener Preferences

One of the reasons audience floating is so prevalent in Ibadan is the similarity in programming across many radio stations. Several stations feature morning talk shows, news discussions, and popular music segments, making it difficult for any broadcaster to hold onto an audience for too long. If a listener hears a familiar discussion on multiple channels, they are more likely to jump between them to find a different perspective or a more engaging host.

Moreover, advertising plays a major role in audience floating. Long ad breaks often drive listeners away, as soon as a station cuts to a commercial, the temptation to switch becomes almost irresistible. Radio stations that heavily depend on advertising revenue must strike a delicate balance between monetization and keeping their audience engaged.

The Role of Signal Strength and Interference

Another overlooked factor in audience floating is signal strength. In certain parts of Ibadan, some stations broadcast with lower transmission power, leading to weak reception or interference from nearby stations. For example, if Tunde drives into an area where his favorite station’s signal starts to fade, he may instinctively switch to a clearer frequency, even if the content isn’t exactly what he was looking for. In cases of overlapping frequencies, two stations may even bleed into each other, creating a frustrating experience for the listener and increasing the likelihood of floating.

The Impact on Radio Stations

For broadcasters, audience floating presents a significant challenge. Listener loyalty is crucial for sustaining advertising revenue, as advertisers prefer stations with consistent and engaged audiences. If a station struggles with high audience turnover, it may find it difficult to attract premium advertisers. Additionally, floating behavior makes accurate audience measurement more complicated. Traditional methods of tracking listenership rely on surveys and listener diaries, but when people switch frequently, it becomes harder to gauge a station’s true reach and influence.

Strategies to Keep Listeners Hooked

To combat audience floating, radio stations in Ibadan must be strategic in their programming and delivery. Our analyst notes that stations that offer unique programming, such as investigative journalism, niche music genres, or interactive listener-driven segments, are more likely to retain audiences. It is also important that managers of these stations stagger popular programmes so that competing stations aren’t airing similar content simultaneously. This will help in retaining listeners.

Shorter, more spaced-out ad breaks, or integrating ads seamlessly into content, can keep audiences engaged longer. Investing in better transmission technology ensures that listeners don’t leave due to poor reception. Call-ins, social media polls, and listener participation would create a sense of belonging. This will make audiences feel more connected to a station.