Stellar (XLM) is at a critical point, with the chance of either a dramatic 70% rise or a worrying 20% drop due to an impending “Death Cross.” In contrast, Avalanche (AVAX) is drawing positive focus, with Standard Chartered’s optimistic long-term forecast predicting significant growth.

Amidst these varied forecasts, BlockDAG (BDAG) is rapidly advancing towards its mainnet debut, showing remarkable readiness. The latest Keynote 3 has confirmed the shipping of its X30 and X100 miners, with 10,000 units ready for delivery before the mainnet goes live. This distribution will provide the necessary infrastructure for BlockDAG to handle increased transaction demands as its adoption grows.

Stellar Price Analysis: Upcoming Breakout or 20% Drop?

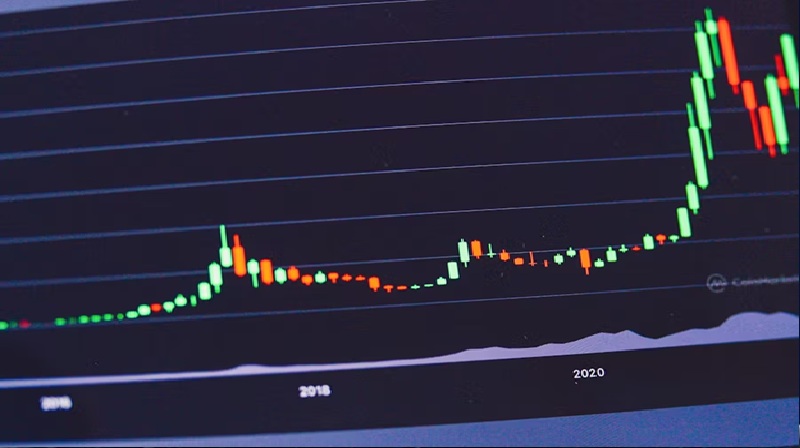

Stellar (XLM) is positioned near a critical resistance level, indicating a potential sharp movement soon. After rising from $0.25 on March 31, it is currently priced at around $0.267, showing a pattern of higher highs and lows. This Stellar price analysis indicates a possible breakout, with bullish targets in the range of $0.40 to $0.46—a rise of up to 70%.

However, another aspect of Stellar price analysis points to a bearish scenario. A “Death Cross,” where the 50-day moving average falls below the 200-day, could lead to a 20% decrease to the $0.19-$0.21 range. Overall, this Stellar price analysis suggests critical upcoming days for XLM’s trajectory.

Latest Avalanche Price Forecast

Standard Chartered’s Geoff Kendrick has forecasted that Avalanche (AVAX) could reach $55 by 2025 and ascend to $250 by 2029—a potential 10x increase from its current price of $18.51. This Avalanche price forecast is supported by the platform’s interesting subnet scaling approach and the recent Etna upgrade, which has enhanced efficiency and reduced costs.

This Avalanche price forecast is reinforced by the platform’s expanding adoption and technological progress. As these improvements proceed, AVAX’s potential for substantial growth looks very promising, contributing to a bright outlook for its future value.

BlockDAG Sets to Ship 10,000 Miners as Mainnet Approaches

BlockDAG’s Keynote 3 video recently unveiled a significant step forward as CEO Antony Turner announced the imminent shipment of the X30 and X100 miners. With the beta testnet now available to the public, BlockDAG is on track to distribute 10,000 miners before the mainnet launch, aiming to ensure robust transaction processing and a solid ecosystem foundation.

This deployment of mining hardware is pivotal for BlockDAG, setting the stage for a robust infrastructure from the start. With 10,000 units lined up for delivery prior to the mainnet, these rigs will serve as a key element of the BDAG ecosystem, embodying CEO Turner’s vision that, “These miners will form the backbone of our decentralized consensus mechanism.”

The extensive rollout of BlockDAG’s mining equipment demonstrates the project’s ambition and readiness. The dispatch of almost 10,000 units solidifies the infrastructure needed for supporting BlockDAG’s high transaction throughput.

Additionally, BlockDAG’s expansion is accelerating, as evidenced by the sale of over 16,822 miners, which has generated more than $6.83 million in revenue. This success reflects strong market interest and confidence in BDAG’s future potential.

The proactive shipment of these mining rigs responds to the growing demand and expanding user base of BlockDAG. This initiative is further enhanced by BlockDAG’s impressive crypto presale results, having raised over $212.5 million with more than 19.1 billion BDAG coins sold, marking a substantial 2380% increase in value.

This strategic and timely rollout of hardware drives significant momentum towards the mainnet goals, positioning BlockDAG as a leading project actively developing its decentralized framework and establishing itself as the best crypto to mine and buy currently.

Future Outlook

Stellar (XLM) faces a critical decision point, with its future potentially swinging between a 70% increase or a 20% decline, underlining the uncertain trajectory ahead. In contrast, Avalanche (AVAX) is gaining traction, buoyed by Standard Chartered’s optimistic forecast, which sees substantial growth ahead thanks to its subnet scaling approach and recent enhancements.

Meanwhile, BlockDAG is capturing significant attention as it gears up for its mainnet debut, supported by a substantial hardware rollout and robust presale achievements. With over 16,802 miners sold and 19.1 billion coins distributed, raising $212.5 million, BDAG emerges as a leading choice as the best crypto to mine and buy, especially with the upcoming mainnet launch promising significant prospects.

Presale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu