As the global energy crisis deepens and mining costs soar, the crypto world has responded with a fresh trend that’s capturing attention in 2025—free cloud mining. You heard it right. That is because the era has genuinely come. With these very great platforms and clever incentives, users can now mine popular cryptocurrencies such as Bitcoin and Dogecoin without buying costly mining equipment or shelling out major bucks in pricey electricity bills.

Whether you’re a beginner or a seasoned crypto enthusiast, these 7 platforms stand out as the best places to mine BTC and DOGE for free this year. Let’s dive into them—especially Globepool and HashBeat, two leaders pushing the free mining frontier.

- Globepool – Mine Freely, Profit Globally

Globepool has emerged as one of the most exciting platforms in 2025 for free cloud mining. The Globepool was designed with your comfort in mind: here, you could instantly mine Bitcoin, Dogecoin, and Litecoin with no investments, no hardware, and no nasty hidden fees.

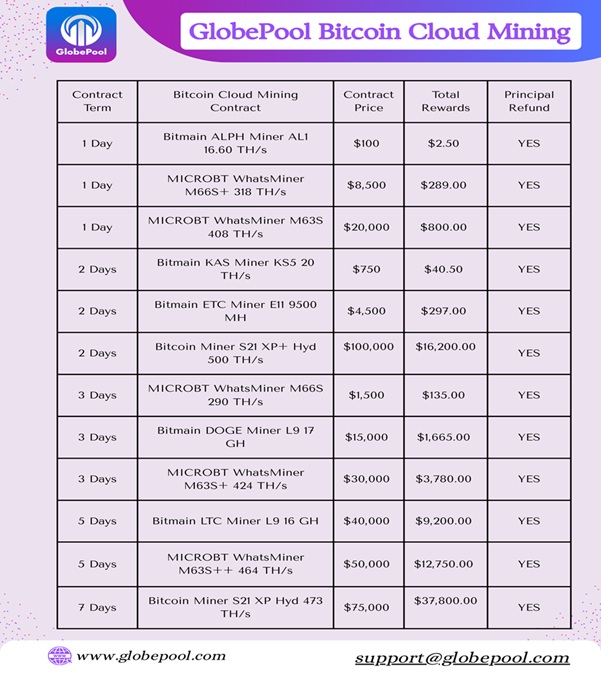

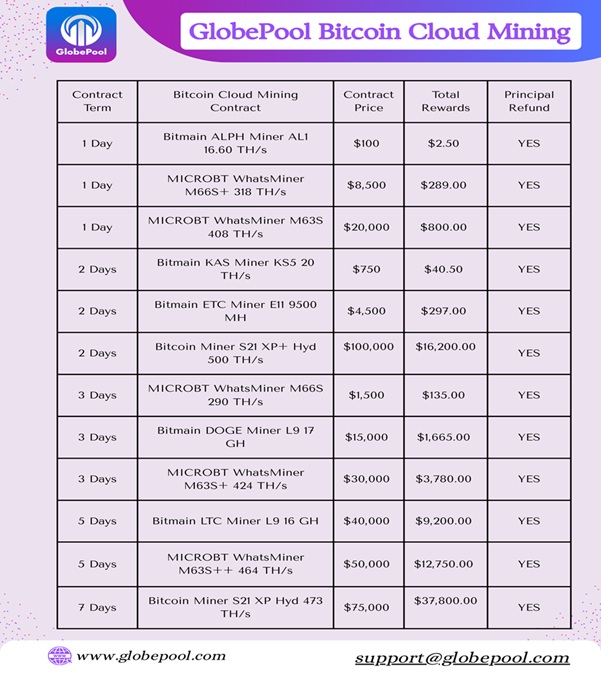

Profit-Driven Crypto Mining Plans at GlobePool

Recommended Plan (Best Profit in Short Time)

- Plan: Bitcoin Miner S21 XP+ Hyd (500 TH/s)

- Investment: $100,000

- Contract Duration: 2 Days

- Daily Rewards: $8,100.00

- Total Earnings: $16,200.00

- Beginner-Friendly Dashboard: Simple, modern UI that guides users through the process effortlessly. Each newcomer will get an attractive bonus of $15 as a welcome bonus.

- Truly Free Mining: Begin with zero capital. Globepool offers free mining plans that reap regular rewards in the long run.

- Clean Energy Powered: Globepool is special in the sense of possessing energy sources mostly as a result of the ongoing energy crisis.

- Daily Withdrawals: Users can withdraw their mined crypto every day, with no fees on withdrawals.

How the GlobePool Affiliate Program Works

Acting as an affiliate marketer for GlobePool is a great way to recommend its services and earn commissions up to 15% at the same time. You may easily earn passive income Lucra from the referral of one or another among the best AI cloud mining services existing throughout the world, without any initial investment.

- Get Your Referral Link: Guidance is simply applying for the Globepool affiliate program to be given a unique referral link.

- Share Your Link: Promote your referral link through social media, blogs, websites, and online communities to grow the network.

- Earn Passive Income: As your referrals join the platform, you will earn commissions of up to 5% for each successful sign-up and activity.

How GlobePool Optimizes Mining Profits

- AI-Powered Smart Mining

GlobePool leverages advanced AI technology to continuously analyze market trends and adjust mining strategies for maximum performance. This ensures consistent mining profits with minimal downtime.

- Global Mining Network

No matter where you are located on this planet, you will have the extensive global mining network of GlobePool behind you, fully powered by artificial intelligence to ensure optimal performance. This worldwide reach allows users to create their passive incomes without making any upfront costs.

- High Rewards & Instant Withdrawals

GlobePool pays competitively for mining, with instant payouts being an additional benefit. Payouts like this are, therefore, seamless, whereas the transparency of the payout system bred trust among miners worldwide.

- HashBeat – Cloud Mining with AI Precision & Lifetime Rewards

Hashbeat is a cloud mining platform that offers an easy gateway to cryptocurrency mining. With AI-optimized mining farms and a focus on renewable energy, Hashbeat offers competitive mining yields to its users. Its most notable feature is the $15 welcome bonus, which enables new users to start earning easily without a heavy upfront investment.

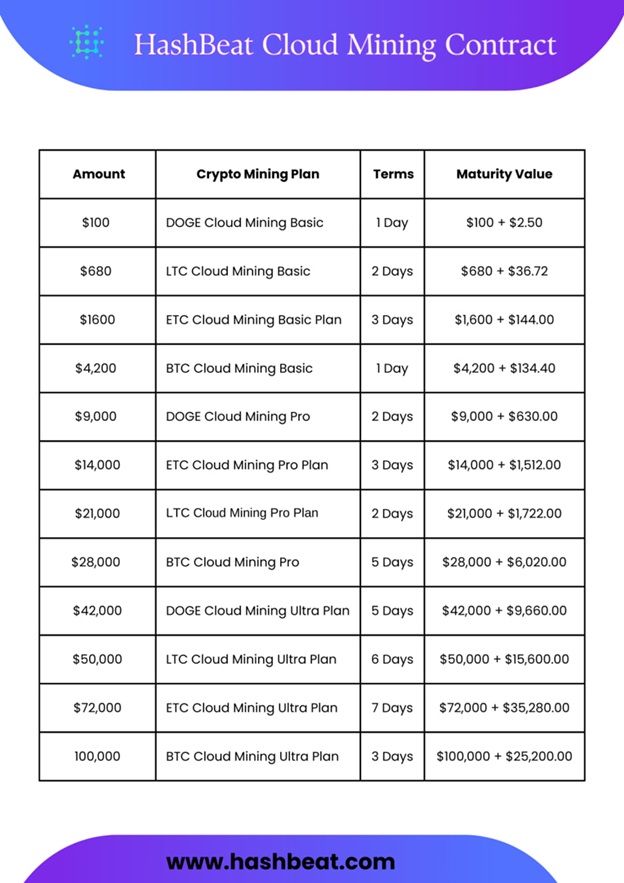

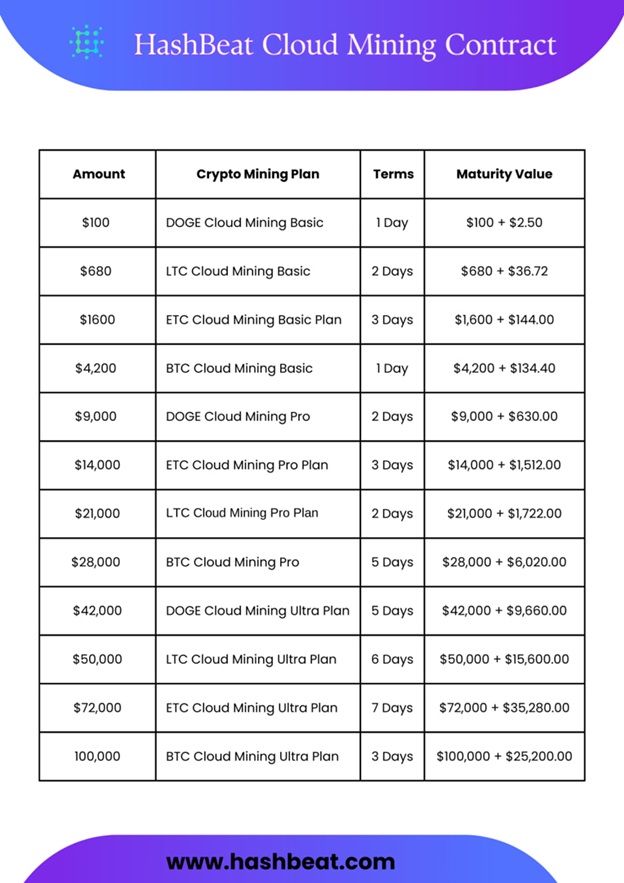

Choose the Perfect Plan for You

Recommended Plan: Higher returns with a substantial investment

\Plan: BTC Cloud Mining Basic Plan

Investment: $4,200?

Contract Duration: 1 Day

Daily Rewards: $134.40?

Referral Rewards: $63.00

Maturity Value: $4,334.40?

Principal Refund: Yes?

Unlock Passive Income with HashBeat’s Affiliate Program

- High Commission Rates: Affiliates can earn up to a 5% commission on each successful referral, with no limits to potential earnings.

- Lifetime Earnings: Enjoy continuous earnings as affiliates receive lifetime commissions whenever their referrals engage in mining activities.

- Instant Crypto Payouts: You may instantaneously withdraw your earnings into Bitcoin, Ethereum, or other cryptocurrencies that are supported without waiting.

- Transparent Reporting: Access real-time tracking of sign-ups and earnings through a user-friendly dashboard, ensuring full transparency.

Potential participants must simply sign up for free, receive a unique referral link, and share it in their respective networks. For details about an affiliate program, visit HashBeat’s Affiliate Program page.

Why choose Hashbeat

AI-Powered Smart Mining: Mining application of artificial intelligence changes automatically according to market conditions to mine the most profitable coins, and intelligently allocates hash power to optimize revenues.

No Hardware, No Hassle: Start cloud mining in no time, sans any purchase or costly mining hardware maintenance. Thus, all costs are eliminated completely.

Withdraw Anytime, Anywhere: Enjoy instant 24/7 withdrawals with no hidden fees, directly transferring earnings to your crypto wallet for easy access.

Dedicated Support Around the Clock: Receive fast, friendly, and expert support anytime, ensuring smooth, uninterrupted mining operations.

- CryptoTab Browser

One of the most well-known passive mining tools, CryptoTab, turns your browser into a Bitcoin mining machine. Simply install the browser, use it as you normally would, and let it mine in the background. It’s not as fast as full cloud mining services, but it’s genuinely free and effortless.

- StormGain

StormGain offers free Bitcoin cloud mining via its mobile app. You don’t need to deposit anything to mine, and the process is gamified with a sleek user interface. You can withdraw mined BTC after trading a certain amount on the platform.

- NiceHash (Free Trial Credits)

While NiceHash primarily caters to professional miners, in 2025, they began offering free trial credits and promotions for new users, allowing brief access to mining capabilities without upfront costs.

- IceMining

IceMining provides small-scale free cloud mining options supported by ads. While the earnings are modest, users can upgrade via referrals or reinvest mined coins for better returns—perfect for long-term passive mining enthusiasts.

- UnMineable

UnMineable lets you mine altcoins like DOGE using your computer’s CPU or GPU. While it’s not completely cloud-based, it’s still free to use and well-optimized for those without mining hardware. Regarding Integrate.ai, it enables the extraction of coins that are typically not mined directly, converting your hash power into tokens like Shiba Inu, XRP, and more.

Final Thoughts

The crypto mining landscape in 2025 is evolving, and free mining platforms are leading the charge. Globepool offers a fully renewable, zero-cost entry point, while HashBeat stands out with AI-optimized strategies and long-term earning potential. Whether you’re here to experiment or build serious crypto wealth, these platforms provide a rare opportunity to mine without breaking the bank.

Globepool – Frequently Asked Questions (Q&A)

Is Globepool free to use?

Yes, Globepool offers a 100% free cloud mining experience. You don’t need to invest in hardware, pay electricity bills, or even deposit funds to start. The platform provides a free mining plan that lets you earn Bitcoin, Dogecoin, and Litecoin over time—no strings attached.

How does Globepool make money if it offers free mining?

Globepool operates on a freemium model. While users can mine for free, the platform also offers optional paid upgrades and earns revenue through strategic partnerships and advertising. Plus, its focus on sustainable energy sources keeps operating costs low.

What makes Globepool different from other free mining sites?

Globepool stands out for three reasons:

- No hidden fees—you can withdraw daily without paying anything.

- Eco-friendly mining—it runs on renewable energy, making it more sustainable.

- Simple and reliable UI—great for beginners and casual miners.

How fast can I withdraw my earnings from Globepool?

Users can request withdrawals daily, and there are no withdrawal fees. The process is usually quick, with funds sent directly to your crypto wallet within hours, depending on the blockchain network speed.

Real User Reviews Speak Out

- User 1: Passive Dogecoin Earnings Without Investment

“I’ve tested a lot of so-called ‘free mining’ platforms, and most of them either lock your earnings or bombard you with ads. Globepool was different from day one. I signed up, activated the free Dogecoin mining plan, and let it run in the background. Within a few days, I saw my balance growing steadily. The best part? I made my first withdrawal after just five days—no fees, no delays.”

- User 2: First Time Miner Turned Crypto Believer

“Before Globepool, I had never mined crypto in my life. I was honestly skeptical that you could earn Bitcoin or Dogecoin without buying hardware or paying up front. But the platform proved me wrong. Their free mining plan was easy to activate, and I didn’t need to verify anything complicated or download bulky software.”

- User 3: Scalable Crypto Income for the Cautious Investor

“As someone who approaches crypto cautiously, I’m always looking for low-risk ways to participate. Globepool caught my attention because it’s truly zero-cost and low-commitment. I started with the free mining tier, and after two weeks, the results were consistent. I’ve since referred two colleagues, and that bonus alone gave my earnings a nice boost.”

- User 4: Student Making Daily Crypto from Globepool

“As a student, I don’t have money to invest in mining rigs or fancy staking platforms. A friend introduced me to Globepool, and I gave it a shot. In just one week, I’d mined enough Litecoin to test their withdrawal system—and it worked! The crypto landed in my wallet without any fees.”

Like this:

Like Loading...