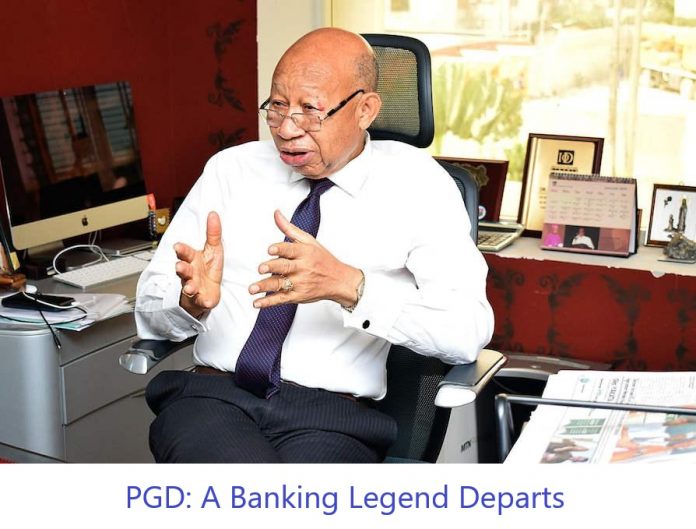

A legend departs from the solid bounds of the earth to the ecclesiastical heaven where cymbals, tapestries and flutes, with cherubic melodies welcome a man who raised a generation of young people, pushing them into the path of prosperity and abundance.

In November 2023, a phone rang, and I picked it. And from the other side, an unmistakable voice said, ‘Prof Ekekwe, I am PGD, your colleague in Diamond Bank”. I jumped and shouted “Ifeoma [my wife], come over here because a Legend is on the line”. Yes, a banking legend, Pascal Dozie, Founder of Diamond Bank, called one of his boys.

I was to be hired for the Owerri branch of the bank, but during the final level interview, the leadership decided to post me to the headquarters. And in just three years, I experienced transformation, turning a village boy-FUTO-educated engineer into a top-grade professional. While in the bank, they paid for my two master’s degrees and a correspondence doctoral degree in banking and finance.

As we spoke, I thanked our Chairman for his grace, kindness and generosity, reciting Diamond Bank’s mission and vision statements which I memorized while in the training school. Great leaders inspire generations and PGD served.

Chairman remembers everything. Many years ago, on a January morning, I came to the bank to drop my resignation letter; I was to fly into New York that day. Hours before, the bank had paid my upfront, a big chunk of my yearly salary. I quickly updated the letter, and asked the bank to reverse the entry as I was leaving the country and would not be around to earn the money. To cut the story short, our Chairman later approved for me to keep the money, covering it for the Bank.

In the world of African banking, PGD was peerless on innovation. He pioneered the integrated banking system (DIBS) which used technology to link branches together, making operations of accounts agnostic of location. In short, during the research of my undergraduate final year seminar in FUTO, I came into contact with DIBS and the Valucard system, and decided that it would be fun to work in Diamond Bank. I got in and right in the training school, I received a message that I needed to visit Schlumberger in PHC, to decline a job, because then it was a heritage in FUTO that best graduating engineering students were given multiple job offers. I flew the first time to decline that, because I wanted to work in Diamond Bank.

Chairman ascended to heaven today, aged 85, leaving behind a generation of men and women he inspired. An icon of African business, innovator personalized, THANK YOU for all you did for a village boy to understand the physics of finance.