The world of cryptocurrency never stands still, and today we see the rise of a project that many call the best crypto to buy and the new DeFi project. Dogecoin and Shiba Inu, two famous meme coins, have made many millionaires since 2020.

Now a new player is showing signs that it could create even more wealth. It is a new DeFi project with a real-world use case, and many experts already call it the best crypto to buy for its potential to fix cross-border payments.

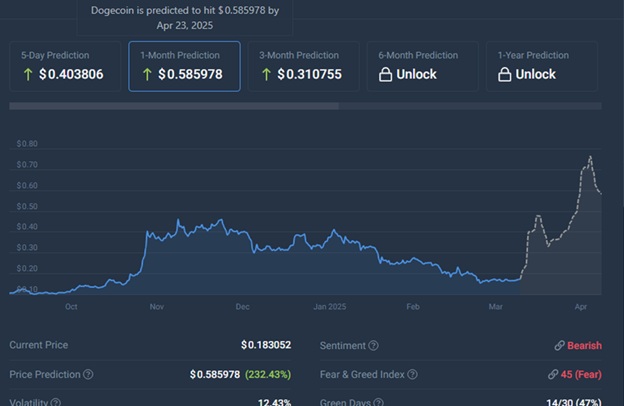

Dogecoin: Recent Update, Technical Analysis, and Price Prediction

Dogecoin started as a joke but is now a full-fledged cryptocurrency with a huge following. Dogecoin has just seen a small price boom; its price rose by 6% in the last 24 hours to about $0.1830. The majority of traders put the boom down to strong social media trends and statements by Elon Musk.

Technical charts project Dogecoin with robust support at $0.10 and resistance at $0.15. Moving averages project a robust positive trend if the upside pressure continues. Dogecoin will rise by 232.43% and reach $0.585978 by April 23.

It is considered by some investors to be among the best crypto to invest in for short-term gains based on its momentum. However, its price is still dependent on social media frenzy and sentiment.

Dogecoin’s price action is often following investor sentiment, and some negative tweets can make its price drop immediately unlike Remittix that is shining through its immense utility.

Shiba Inu: Current News, Technical View, and Price Forecast

Shiba Inu had once promised to be the next meme coin phenomenon. Its price has seen a decline over the past month, falling by approximately 11% to trade at about $0.00001346. This decline has been disappointing to the majority of its holders.

Analysts point to fewer new features and warning hype as main causes of the decline. The technical charts show that Shiba Inu has failed to hold onto its previous support levels. Its 50-day moving average is below its 200-day moving average, a sign that the downtrend will continue unless something happens.

It is the belief of some analysts that Shiba Inu could not regain the glory of yesteryear without a powerful upgrade or some new utility. Shiba Inu price will go down by 2.07% and reach $0.00001286 on April 23.

Technical analysis says that Shiba Inu will recover if there is a sudden surge in community activity or the team makes some drastic changes. Until then, its future remains bearish.

Remittix: Solving Real-Life Payment Problems and Encouraging Adoption

Remittix is a new DeFi project attempting to tackle one of the biggest problems in the digital payments market: sluggish, expensive cross-border payments. Traditional banking infrastructure has a tendency to complicate it for people living in rural communities or developing countries to get access to fairly priced financial services.

Over 1.4 billion people in the world do not have a bank account. The same people can most likely obtain a mobile wallet and send cryptocurrency. Remittix offers a solution that bridges the divide between digital economy and conventional finance.

Remittix enables one to send cryptocurrency directly to a bank account for local currency. It becomes easier for an individual in a developing country to receive money without having to go through complex crypto exchanges.

For instance, a foreign worker may send money from a crypto wallet to an agency such as Western Union, and the recipient receives money in their native currency. This approach preserves the core principles of cryptography – anonymity and control over one’s money – but in the context of today’s finance.

The Remittix platform has already sold over 521 million tokens in the initial coin offering. The low entry cost of $0.0734 and clear use case have been able to command strong support from institutional and retail investors. To many, RTX is one of the best cryptocurrency to invest in as it solves a problem that has been a thorn in the flesh of the global payments system for decades.

Discover the future of PayFi with Remittix by checking out their presale here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix