Tesla’s China-produced electric vehicle deliveries showed modest resilience in January 2026, rising 9% year-on-year to 69,129 units from 63,238 in January 2025, according to data published by the China Passenger Car Association (CPCA) on Wednesday.

The figures, which reflect shipments from Tesla’s Shanghai Gigafactory for both domestic sales and exports, placed Tesla third among major Chinese EV makers, behind BYD’s 205,518 units and Geely’s 124,252 vehicles.

While the increase marks a positive contrast to the broader market’s slowdown, analysts caution that the numbers primarily reflect production and export dynamics rather than a clear resurgence in domestic demand. Tesla’s Shanghai plant produces the Model 3 and Model Y for the Chinese market as well as for export to Europe, Asia-Pacific, and other regions.

New registrations—a closer proxy for actual sales—showed only slight growth in Europe in January, per Reuters tracking, with no clear domestic uptick reported. The performance comes against a backdrop of intensifying challenges in China’s EV market. New energy vehicle (NEV) sales, including battery-electric and plug-in hybrid models, grew just 1% year-on-year in January—the fourth consecutive month of decelerating growth, according to CPCA data.

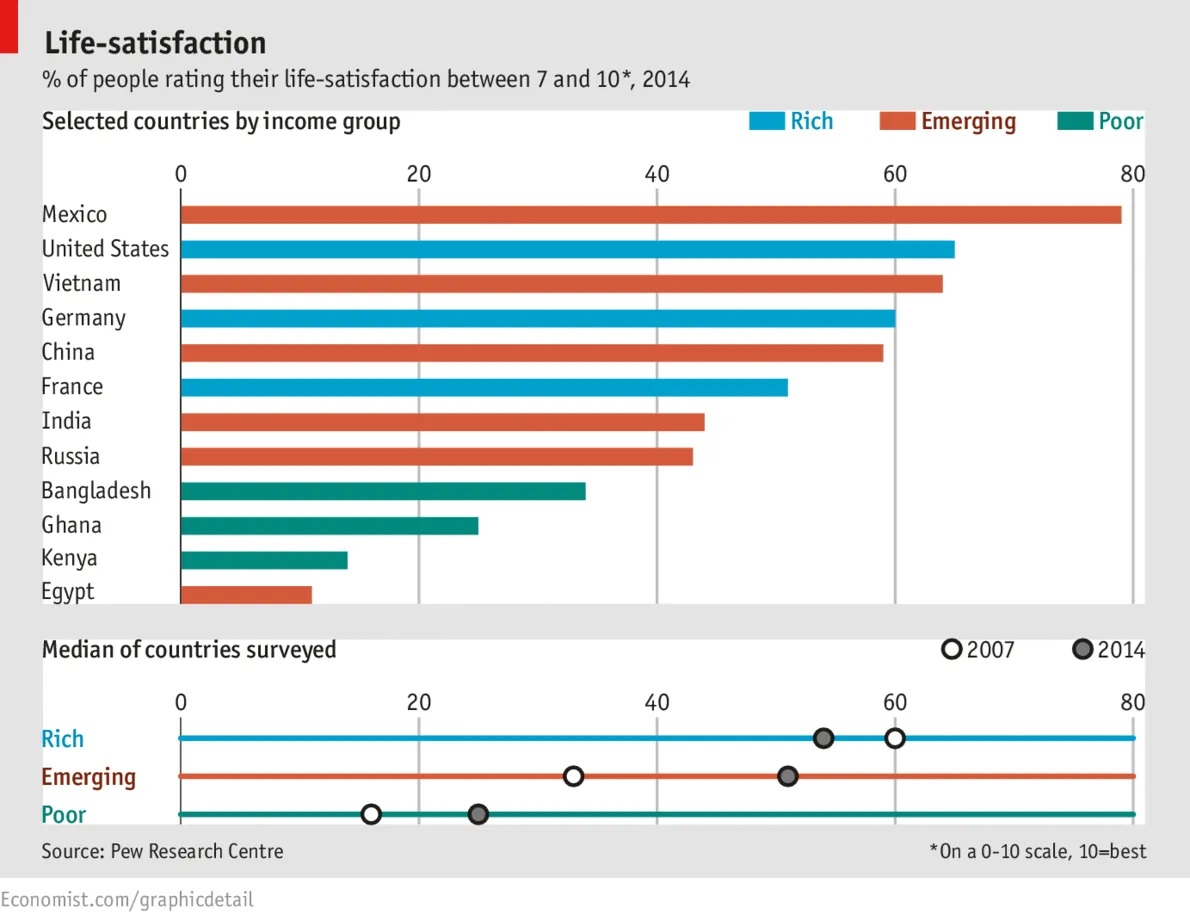

The slowdown reflects a combination of policy shifts, economic pressures, and fierce domestic competition. A key policy change took effect on January 1, 2026, when China reinstated a 5% purchase tax on NEVs after more than a decade of full exemption from the 10% vehicle purchase tax. This reversal has prompted some consumers to delay purchases, with analysts expecting further moderation in early 2026 demand.

“We see increasing pressure on China’s auto market in 2026, driven by a combination of policy and competitive factors,” Helen Liu, partner at Bain & Company, noted.

Tu Le, founder of Sino Auto Insights, said: “We know [EV sales will] slow, we just don’t know by how much. We’ll know much better after the first quarter is over.”

Tesla has faced particularly stiff competition from local rivals offering more affordable models. The base Model 3 sedan starts at around 235,500 yuan ($33,943), nearly three times the price of BYD’s Seal base model at approximately 79,800 yuan. To counter this, Tesla has introduced aggressive incentives on its Chinese website, including five-year 0% interest loans and seven-year ultra-low interest rate loans for orders placed before February 28, 2026.

The price war has squeezed margins across the industry, with Abby Tu, principal research analyst at S&P Global Mobility, noting: “We have [had] really intense price wars that have gone on, although the government and industry have called on automakers to not engage with aggressive pricing strategies.”

Despite these efforts, Tesla’s full-year 2025 China-produced EV sales fell 4.8%, one of only two major manufacturers to report an annual decline.

Regulatory changes add further complexity. On Monday, February 2, 2026, China’s Ministry of Industry and Information Technology (MIIT) announced that, effective January 1, 2027, all vehicles sold in China must feature interior and exterior mechanical door releases. The rule follows high-profile incidents in the U.S. and China where EV occupants could not escape burning vehicles due to power failures in electronic door-locking systems.

Flush, concealed door handles—popularized by Tesla as a signature design element—will need modification or replacement. Tu Le described the regulation as a “decent sized headache” for Tesla, given the brand’s reliance on minimalist, flush-handle designs. However, he noted that most Chinese automakers are unlikely to be caught off guard.

“When regulators were drafting the new regulations, they consulted OEMs and industry experts intensively,” he said.

Tesla will have a runway to adapt, but the change could require design adjustments and additional costs. Despite these headwinds, Tesla’s Shanghai Gigafactory continues to serve as a major export hub, supporting deliveries to Europe and other markets. The modest January growth may partly reflect export demand and production scheduling rather than pure domestic recovery.

Geely, which climbed to second place in China’s NEV market, reported strong performance across its Galaxy and Zeekr brands, while Aito (Huawei-backed), Leapmotor, and Nio posted year-on-year delivery gains. Broader economic pressures, including a prolonged real estate slump and weak consumer confidence, continue to weigh on discretionary spending.

The auto sector, supporting over 30 million jobs, remains a critical economic pillar. Fitch Ratings economist Alex Muscatelli noted that while autos represent only 3.7% of fixed asset investment (versus real estate’s 23%), further deterioration could prompt Beijing to reinstate subsidies if Q1 data confirms a deeper slowdown.

China’s top leaders will release 2026 policy targets at the annual parliamentary meeting in March. With the Lunar New Year holiday contributing to volatile early-year figures, the full impact of the tax reinstatement and competitive pressures will become clearer later in the year.