Markets are entering a slower, more selective phase as recent volatility exposes weak conviction. Hedera (HBAR) is slipping toward critical support, while the XRP price continues to defend a level that has defined its structure for years. These contrasting signals are forcing traders to pause, reassess risk, and question whether recent moves reflect opportunity or exhaustion across major assets and speculative sectors alike right now.

At the same time, attention is drifting away from short-lived breakouts toward how participation is structured. In that shift, Zero Knowledge Proof (ZKP) is being discussed alongside majors as traders debate the top crypto to buy in an environment where transparency and contribution matter more than momentum. This change is reshaping expectations across the market after months of volatility and failed rallies seen recently everywhere.

HBAR Structure Weakens Near Key Support

Recent weakness in Hedera (HBAR) reflects mounting structural stress rather than routine consolidation. Price is down more than 10% on the week, and the chart is pressing into a developing head-and-shoulders formation.

Support between $0.100 and $0.102 now carries outsized importance, as a daily close below this zone would confirm a breakdown and project roughly 20% downside if selling pressure accelerates quickly under broader market weakness conditions seen recently across altcoin markets overall.

Capital flow metrics reinforce the risk. Chaikin Money Flow has slipped decisively below zero, signaling real outflows rather than low-volume drift. Sentiment has also fallen to multi-month lows, historically a warning sign for Hedera (HBAR).

While early dip buying is visible, the structure remains fragile, keeping downside scenarios active for traders assessing the top crypto to buy during periods of elevated uncertainty and volatility that challenge conviction across markets at this stage, now broadly speaking.

XRP Mirrors 2017 Cycle With Extended Consolidation

Unlike weaker setups, the XRP price continues to respect a major long-term trendline. After breaking above the resistance that capped price action for nearly seven years in December 2024, XRP has spent the past year consolidating above that former ceiling, which has now flipped into support.

Multiple pullbacks toward this level have held firmly, signaling acceptance rather than distribution so far despite broader market volatility and sentiment shifts seen across crypto assets recently this cycle clearly.

This behavior mirrors XRP’s 2017 cycle, when a long-term breakout was followed by extended consolidation before continuation. As long as the XRP price remains above this trendline, the structure favors reaccumulation rather than failure.

A decisive breakdown would be needed to invalidate the setup, keeping XRP relevant in the top crypto to buy discussion during periods of uncertainty and rotation, where patience often defines eventual trend resolution for longer-term participants watching closely right now.

Zero Knowledge Proof Brings Participation Back Into Focus

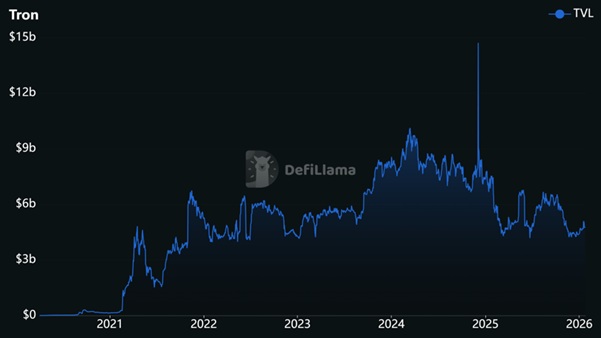

As price-driven narratives lose traction, Zero Knowledge Proof (ZKP) is being evaluated through structure rather than momentum. Its on-chain, presale auction that replaces fixed pricing and private allocations, releases $190M tokens every 24 hours. This model removes timing advantages entirely and emphasizes consistency over speculation during volatile market conditions seen recently across crypto markets.

Beyond distribution, ZKP is built around verifiable contributions. The network uses zero-knowledge proofs to validate off-chain computation, enabling privacy-preserving AI workloads without exposing underlying data. This technological focus positions ZKP as infrastructure, designed to operate independently of market cycles and short-term sentiment shifts.

Proof Pods anchor this design. These plug-and-play units perform validated compute tasks and generate zero-knowledge proofs, tying rewards directly to measurable work. As more Proof Pods come online, network capacity expands alongside participation, creating alignment between contributors and the protocol rather than passive holders alone. This mechanism supports long-term scalability without relying on hype cycles or constant speculative inflows from traders globally.

In parallel, ZKP has introduced a $5 million giveaway, awarding $500,000 worth of tokens to each of ten winners. Participation requires holding ZKP tokens and completing defined steps, reinforcing commitment over casual interest.

For traders comparing other assets, this model reframes how the top crypto to buy is evaluated during periods of heightened uncertainty and market rotation.

Closing Note!

The divergence across assets is becoming clearer. Hedera (HBAR) highlights how quickly downside risk can build when structure weakens, while the XRP price demonstrates what trend acceptance looks like through repeated support tests.

These differences are reshaping how traders frame risk and opportunity in a market defined by uncertainty rather than straightforward momentum trades that dominated earlier cycles during expansive market phases now fading away.

Against this backdrop, ZKP offers an alternative lens. By combining transparent distribution, working technology, and contribution-based rewards, it shifts attention toward sustainability. As traders reassess the top crypto to buy, systems built to function through volatility may matter more than short-term price moves in an increasingly selective market environment where patience and structure are rewarded over speed and speculation during uncertain cycles ahead.

Explore Zero Knowledge Proof:

Website: https://zkp.com/

Buy: buy.zkp.com

Telegram: https://t.me/ZKPofficial