Canadian quantum computing firm Xanadu Quantum Technologies is set to go public through a merger with Crane Harbor Acquisition Corp in a deal valuing the company at $3.6 billion, the firms announced on Monday.

The merger, which will list Xanadu’s shares on the Nasdaq, is expected to generate nearly $500 million in proceeds, including a $275 million private investment in public equity (PIPE).

The move marks a major milestone for the Toronto-based startup, positioning it among the growing list of quantum computing companies seeking to tap public markets through special-purpose acquisition companies (SPACs) rather than traditional IPOs.

Xanadu’s CEO, Christian Weedbrook, told Reuters that the decision was driven by growing investor enthusiasm for quantum computing stocks.

“We were really keeping a close eye on what was happening in the public markets,” Weedbrook said. “The capital available in the public markets was too enticing to ignore.”

Quantum computing, long considered a futuristic technology, has begun moving from theoretical research into practical applications and commercial development. These machines use qubits—the quantum equivalent of classical bits—to perform complex calculations far beyond the capacity of conventional computers. In theory, quantum computers can simulate chemical reactions involving trillions of atoms in minutes, a feat that would take classical supercomputers thousands of years.

This leap in computational power has far-reaching implications for fields such as drug discovery, materials science, cryptography, and artificial intelligence. But Qubits are notoriously unstable, often collapsing under minimal interference, which can cause computational errors that overwhelm useful results. As a result, the industry continues to debate how soon truly error-corrected quantum computers will become commercially viable.

Still, investor optimism in the sector has surged in 2025, fueled by breakthroughs from major players and growing adoption among corporate giants. IBM, Microsoft, and Google have all accelerated their quantum research, with Google announcing a breakthrough algorithm last month that it claims could significantly improve quantum processing efficiency.

Meanwhile, JPMorgan Chase has outlined plans to integrate quantum computing into its long-term digital transformation strategy, as part of a broader $1.5 trillion innovation initiative announced in October. The financial sector’s growing interest in quantum applications—particularly for risk modeling and cybersecurity—has further validated the technology’s commercial potential.

The timing of Xanadu’s public debut comes amid renewed investor appetite for quantum firms. In September, U.S.-based Infleqtion (formerly ColdQuanta) struck a $1.8 billion SPAC deal with a blank-check company led by veteran Wall Street dealmaker Michael Klein, underscoring the sector’s momentum despite a challenging IPO climate.

Quantum computing companies have increasingly turned to SPAC mergers to expedite their market entries and access capital. The route allows startups to bypass the long regulatory scrutiny and pricing uncertainties of a traditional initial public offering.

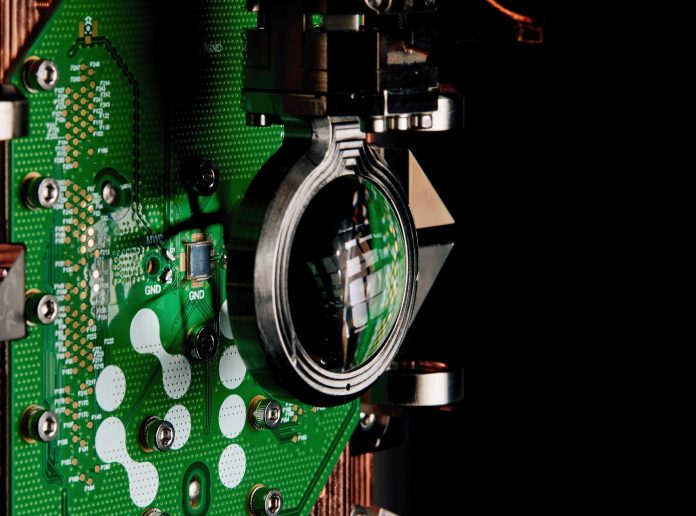

For Xanadu, which specializes in photonic quantum computing—a system that uses light particles instead of electrical circuits—the influx of capital from the merger is expected to fund the expansion of its commercial roadmap and accelerate research into scalable quantum architectures.

Analysts say that as public and private investment floods into the quantum computing ecosystem, the industry is approaching a turning point. The industry is believed to be building viable systems and software that can solve real-world problems.

If the merger closes as planned, Xanadu will join a small but growing cohort of publicly traded quantum computing firms, giving investors new access to a technology that many believe will define the next era of computational power.