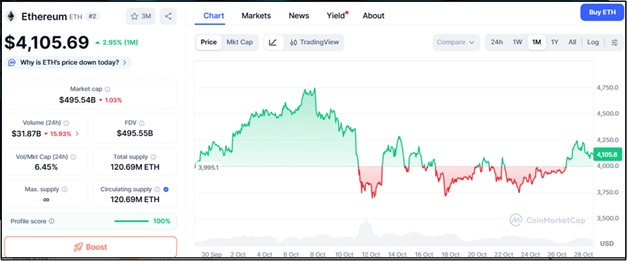

Crypto bull markets don’t just reward those who buy strong assets—they reward those who identify breakout tokens before the peak hits. As momentum builds heading into the next explosive phase, smart investors are watching key assets that combine strong narratives, technical strength, and early-stage potential.

Pepe, Ethereum, and Ozak AI are three tokens currently drawing significant attention from both retail traders and whales. Each comes from a different segment of the market—meme coins, mounted potential, and early-level innovation—but all present the potential to supply breakout gains earlier than the bull run peaks.

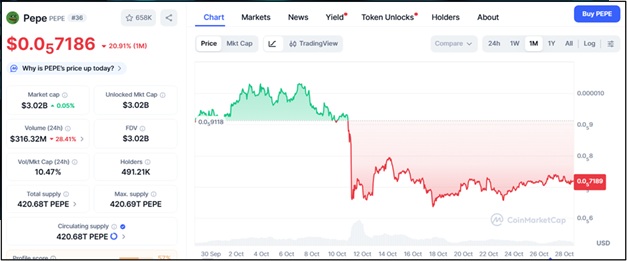

Pepe

Pepe has been step by step hiking, presently trading around $0.000007186. Key resistance levels sit at $0.000007950, $0.000008600, and $0.000009500, while robust assist holds at $0.000006500, $0.000005800, and $0.000005200.

Pepe has speedily grown to be one of the most dominant meme coins available on the market, with an energetic network and high liquidity. Its simple, viral nature makes it a magnet for retail traders looking for rapid-transferring possibilities. As meme narratives warm up in the later tiers of bull cycles, Pepe is properly positioned to ride the retail wave and doubtlessly deliver big short-term profits.

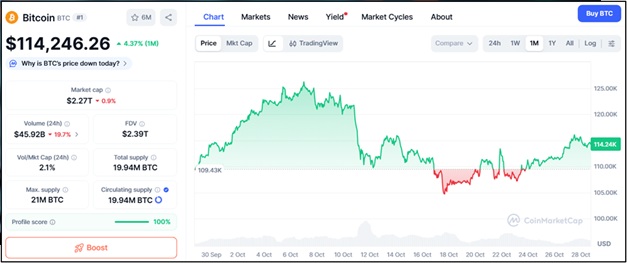

Ethereum (ETH)

Ethereum remains one of the strongest large-cap properties in the market, trading close to $4,100. Resistance tiers are positioned at $4,450, $4,780, and $5,000, while support lies at $3,950, $3,720, and $3,500. Ethereum’s dominance in DeFi, NFTs, and Layer-2 solutions gives it both fundamental energy and long-term growth capability.

Institutional demand continues to grow, and as capital rotates from Bitcoin to top altcoins, ETH is often the first to benefit. Many analysts expect Ethereum to set new all-time highs before the bull run peaks, making it a core asset for both conservative and aggressive investors.

Ozak AI Emerges as a High-Upside Project

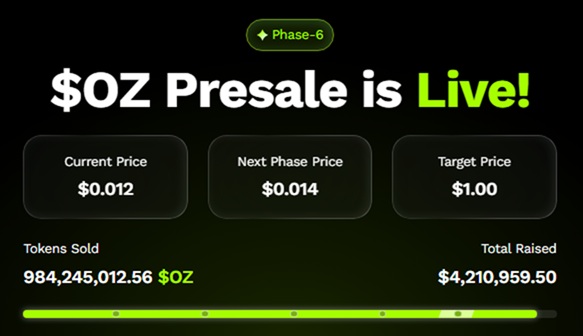

While Pepe and Ethereum bring strong narratives from opposite ends of the market, Ozak AI is turning heads as an early-stage project with explosive upside potential. Currently in its 6th OZ presale stage at $0.012, Ozak AI has raised over $4.2 million and sold more than 980 million tokens—a sign of growing investor confidence.

Unlike meme tokens, Ozak AI’s foundation lies in its AI-powered prediction agents that deliver real-time trading signals, intelligent market insights, and automation tools. This combination of AI and blockchain is one of the most powerful narratives heading into the next bull run.

A key reason Ozak AI stands out is its strategic partnerships with Perceptron Network, HIVE, and SINT. These collaborations enhance its technological capabilities, predictive accuracy, and integration into broader blockchain ecosystems. For whales and early investors, this isn’t just another presale hype—it’s a project with utility, vision, and momentum.

Pepe, Ethereum, and Ozak AI: Three Projects, One Goal—Breakout Gains

As the bull run accelerates, Pepe could ride the meme coin wave, Ethereum may solidify its blue-chip dominance, and Ozak AI could become the standout early-stage rocket.

Together, these three tokens cover retail frenzy, institutional trust, and innovation—all key narratives that tend to thrive before a cycle peaks. Investors positioning early in breakout assets like these could be the ones who capture some of the largest returns before the next market top.

About Ozak AI

Ozak AI is a blockchain-based crypto project that offers a technology platform that specializes in predictive AI and advanced facts analytics for financial markets. Through machine learning algorithms and decentralized community technology, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the precise decisions.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi